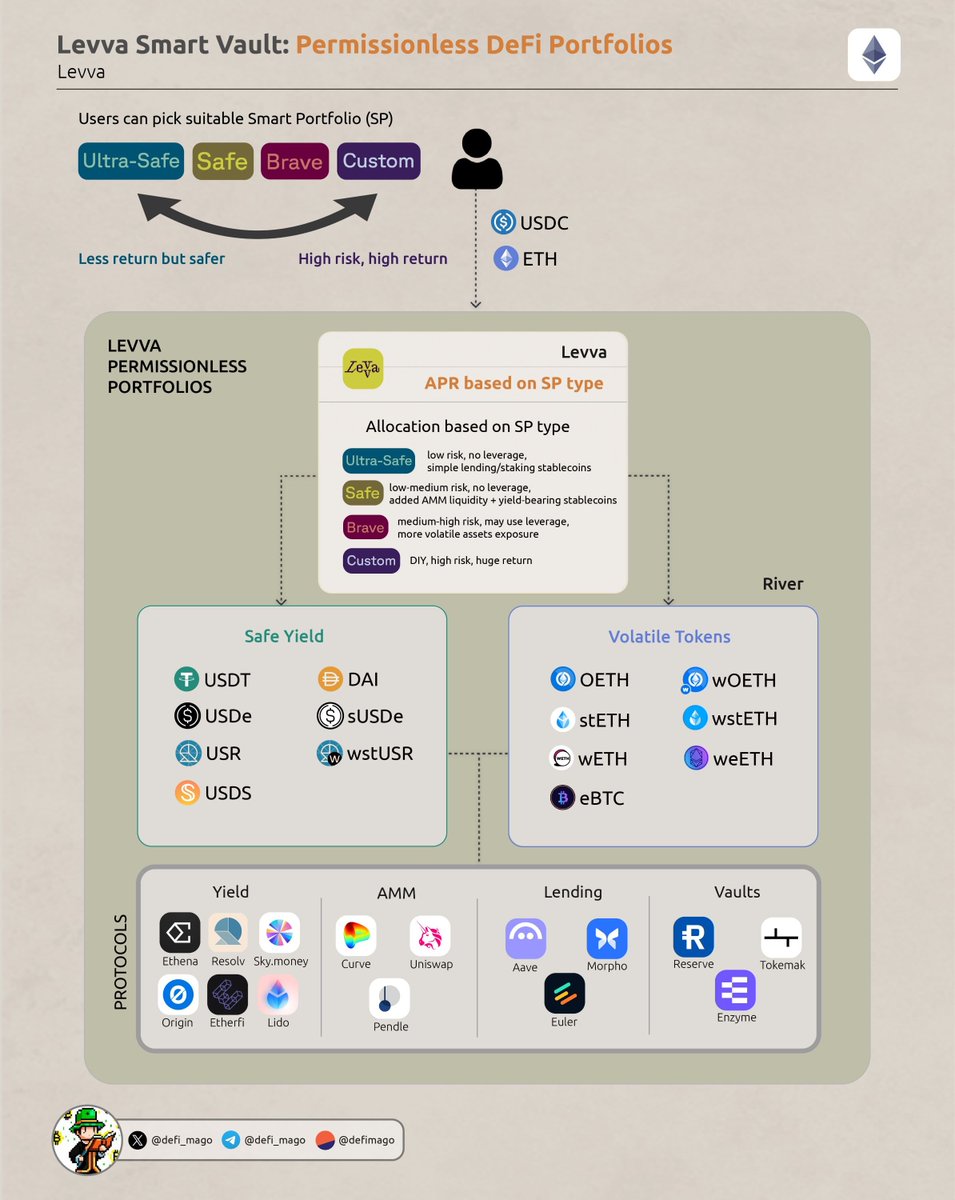

Just found out about @levva_fi’s Smart DeFi portfolios Permissionless vaults that mix volatile assets (ETH, BTC) & safe yield (Aave, Lido, stable AMMs…) with professional portfolio management baked in. Levva is currently offering 10% guaranteed APY in $LVVA token and 12% for top 100 ranked by pts → You can just deposit USDC and/or ETH, pick a Smart Portfolio you vibe with and let Levva do all the DeFi magic automatically. A great opportunity awaits, let's dig into the details 👇 ---- They actually categorize users! • Ultra Safe: Low risk, blue-chip lending/staking only • Safe: Low-medium risk, add AMM liquidity & yield-bearing stablecoins • Brave: Medium-high risk, multi-chain, leverage & RWAs • Degen: High-risk, leverage, perps, meme-sniping → It means there’s something for everyone ---- Their Portfolio Approach: • ETH/BTC = “stocks” • Yield assets = “bonds” Risk Control: • Even ETH be limited in risk-adjusted portfolios • Max Sharpe favors low-volatility assets; Max GM...

23.42K

148

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.