Have you already secured your profits during this run and are now aiming for double-digit APY on your stablecoins?

Explore @eulerfinance's latest USDAI pool and EulerEarn.

Let's dive in 🧵

...

➠ What’s USD AI?

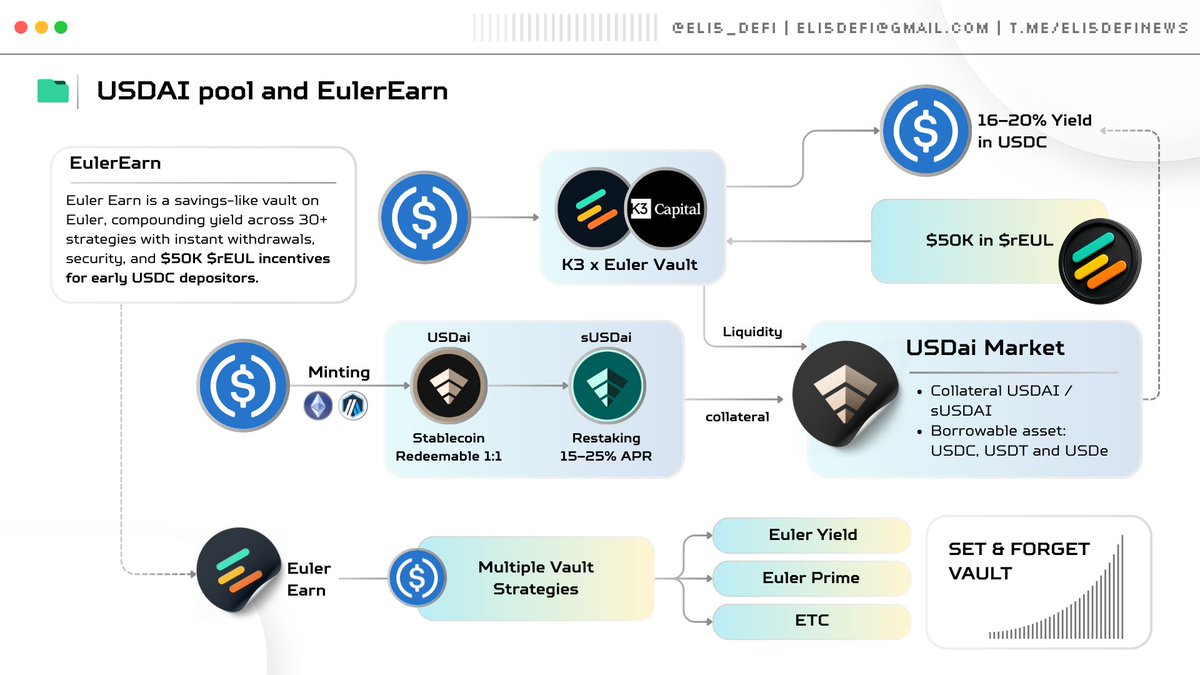

Simply put, @USDai_Official is a decentralized protocol issuing a synthetic dollar backed by U.S. treasuries, AI infra, and DePIN assets. You could say that this is one of a kind stablecoins.

USDAI have 2 main tokens:

❶ USDAI → Stablecoin, redeemable 1:1.

❷ sUSDAI → Staked and yield-bearing version USDAI (15–25% APR) backed by T-Bills + infrastructure loans.

And one of the recently launched vaults on Euler is the USDAI Pool managed by @k3_capital and borrowing pool for USDAI and sUSDAI

➢ Managed Vault → LPs deposit $USDC and earn ~16-20% APY, boosted by $50K incentives.

➢ Your USDC will be used as a liquidity for USDAI and sUSDAI market which the interest become yield from LP

➢ If you want to have more exposure, you can just loop-leverage using Multiply Features.

...

➠ Euler Earn

Euler Earn functions similarly to a bank savings account.

Simply deposit your money, allow the yield to compound, and (literally) forget about it. The vault is optimized to earn across multiple strategies on Euler, up to 30, while ensuring security and instant withdrawal 24/7.

You can start depositing now, with an additional $50,000 worth of $rEUL available for early depositors (applicable to USDC).

12.37K

90

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.