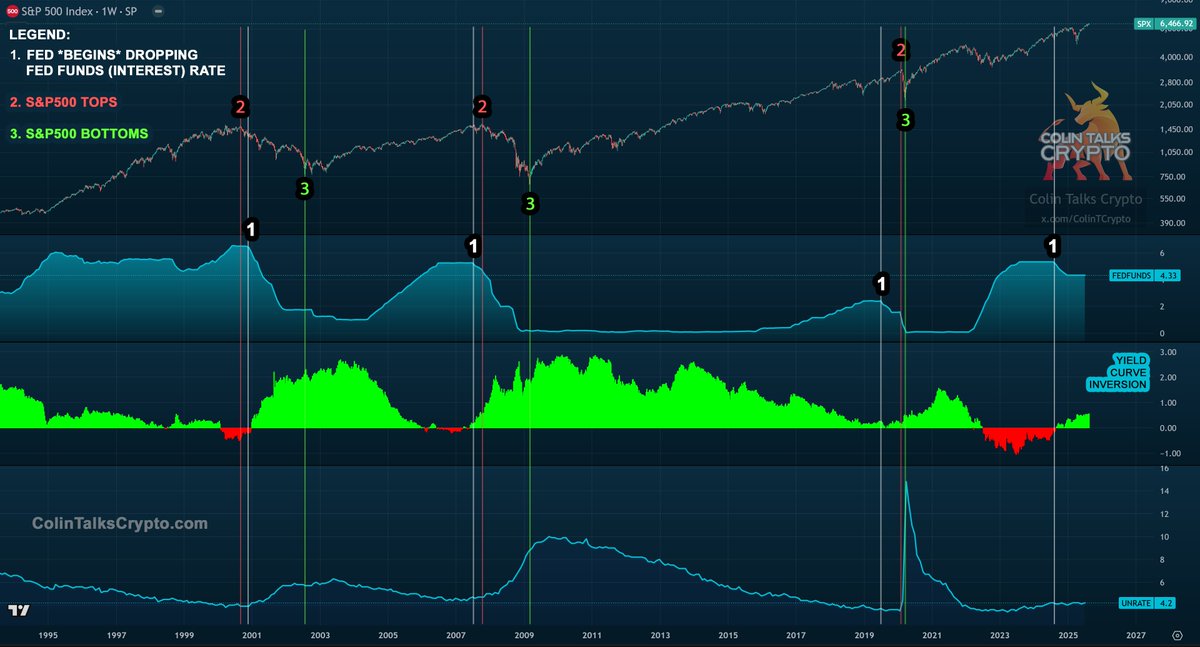

Traditional economic metrics (inverted yield curve, Fed Funds Rate and Unemployment) indicate a stock crash is likely to time approximately (give or take a couple months) with the dropping of the Fed Funds Rate, which is going to begin happening soon. Many indicators are lining up for a bitcoin top in 2-3 months. However, we have no blow-off parabolic rise, but maybe there won’t be one and that’s how everyone gets fooled? There’s so many different ways this cycle could go, but I feel it’s unwise to ignore the underlying economic indicators above which were correct in 2000 and 2008. Recommended to view chart in 4k (on phone, press and hold image and select "view in high resolution") Observations: 🔹 While the Fed made a nominal decrease in interest rates last year, it was not significant and they did not continue dropping it (much like in 2020). 🔹 To those who say "there will be no crash; this time is different", I say: we haven't waited long enough to know. The Fed Funds rate...

64.96K

274

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.