Aave DAO has many lavers protecting users.

- Dual risk teams

- Cold code reviews

- Continuous independent audits

- Umbrella

- Time-locks / Guardian roles

- Track record of paying bad debt

Whilst Morpho has sloppy shoulders making Curators responsible for everything, they are human and can make a mistake:

- Fat finger oracle decimals

- Yes Spot oracles when TGE is happening

- Over allocate from liquidity vaults & become trapped

- Add collateral without time-locks, asset pricing is changed

All of the above has happened on Morpho... When an investment fund is a Curator, they can spend on Risk or generate Quarterly returns.

Claiming to be ready for institutions means nothing without facts to back it up.

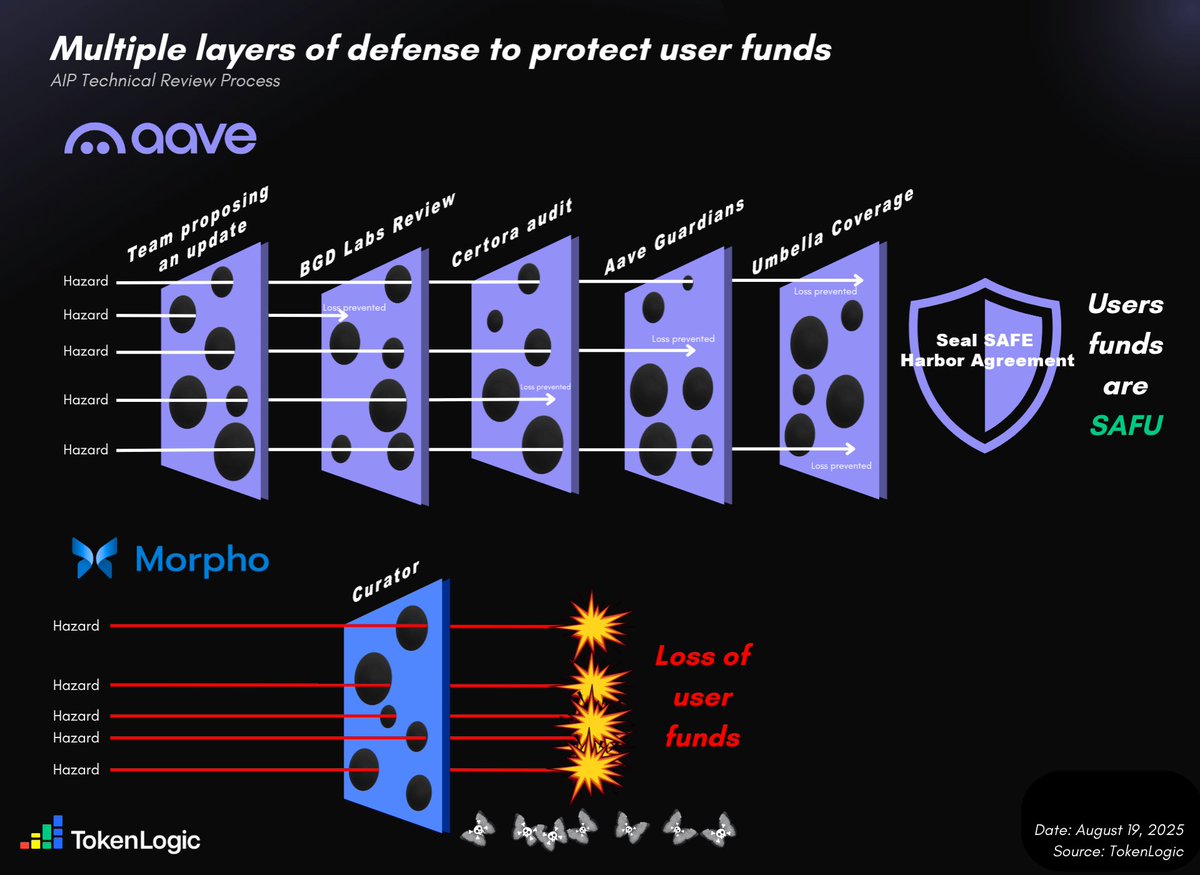

► Aave is secured by 5 independent layers of protection:

1️⃣ @AaveChan / @chaos_labs / Aave Labs the team proposing an update on the governance forum

2️⃣ @bgdlabs to review the code and maintain the protocol infrastructure

3️⃣ @CertoraInc continuous security service for smart contract auditing

4️⃣ Guardian Role: community-elected and able to act quickly if needed, for example by pausing markets, with their mandate renewed periodically through governance.

5️⃣ Umbrella Coverage to automatically protect the protocol against bad debt: unlike others that socialize bad debt among users, Aave has a dedicated module for this, backed by capital from users who accept the risk of being slashed.

On top of that, Aave adopted the SEAL Safe Harbor Agreement, which monitors users' positions and allows whitehats to intervene during active exploits to recover funds, with clear legal protection and a predefined rescue process.

There's also Aave Seatbelt, a tool that forks mainnet to simulate the execution of governance proposals and generates a report with all state changes, triggered events, and a human-readable summary of the impact.

This process ensures that every AIP passes through multiple checkpoints before execution, minimizing the chances of critical failure.

Each layer covers for potential gaps in others, creating a strong and resilient defense that significantly reduces the chances of failure.

This stands in stark contrast to Morpho, which relies on a single layer of protection, risk curators, while Aave is secured by 5 independent layers.

One mistake, and there is nothing left to absorb the impact.

That’s what makes Aave the safest and largest dApp, representing a significant share of all DeFi. It shows an unparalleled and relentless focus on the safety of users' funds.

1.55K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.