What could the market cap of $CAMP be?

💠 First, let's take a look at similar projects like Story.

Currently, the FDV of $IP is 6.41B, with a circulating market cap of 1.88B.

@StoryProtocol raised $134.3M, which means the FDV increased by 48 times from the funding to FDV, and the circulating market cap increased by 14 times.

Previously, it was noted that $ACH reached a circulating market cap 40 times its funding amount at its peak in 2021. $ACH had no significant narrative heat in 2021. The circulating market cap of $SOL reached 200 times its funding amount in 2021.

So, the current FDV of $IP is 48 times its funding amount, and the circulating market cap is 14 times its funding amount, which is not high.

💠 Now, let's compare CAMP.

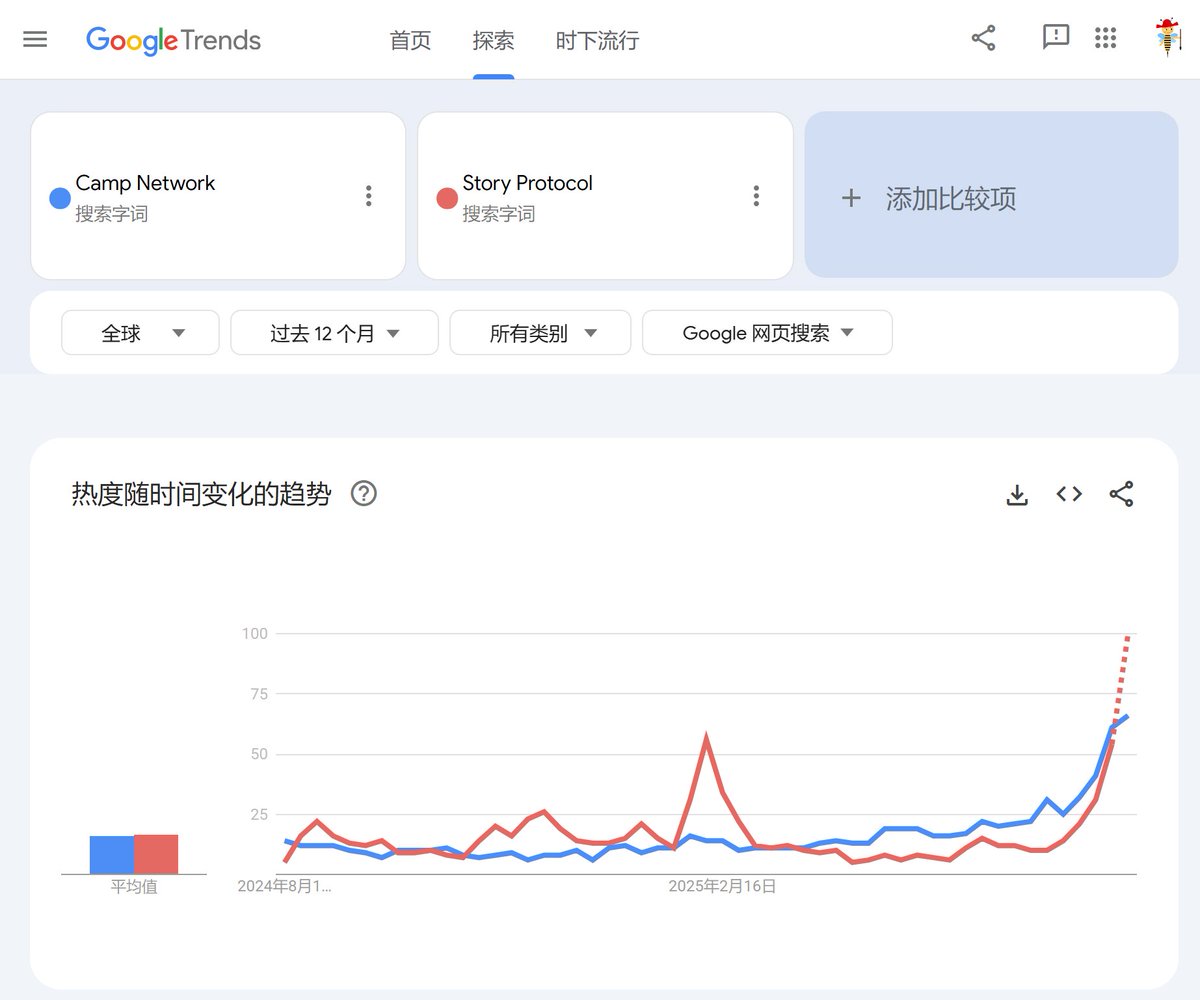

The search interest on Google for both Camp and Story is about the same.

In comparison, Story has a stronger background and more funding. However, @campnetworkxyz operates in a more down-to-earth manner, establishing partnerships with multiple IPs and engaging in various activities aimed at creators, which resonates more with the market.

@BuTongRen6's article also mentioned more features of CAMP.

Therefore, the multiple increase from funding to FDV for $CAMP could potentially be higher, likely between 50 to 100 times.

CAMP raised 29m.

Calculating at 50 times, the FDV of $CAMP would reach 1.45b.

Calculating at 100 times, the FDV of $CAMP would reach 2.9b.

Calculating conservatively at an average of 70 times, the FDV of $CAMP would reach 2b.

Of course, this is a rough estimate based on $IP, and the timing and environment of CAMP's TGE also play a role.

My personal view is that unless the environment is harsh, the FDV of $CAMP should be able to reach 2b.

The FDV of IP has now reached 7B. What will the FDV of @campnetworkxyz be?

There are very few projects in Web3 that are truly building on-chain IP infrastructure. Besides the leading IPs, the only other one is CAMP. Although Camp is also in the IP track, what it does is still different from what Story is doing. The market Camp is targeting includes not only creators but also, boldly imagining, all AI companies that need high-quality data and materials.

Camp is entering a blue ocean with almost no competitors. Its business model naturally connects two high-growth markets: the creator economy + the AI data training market.

- Minted over 1.5 million independent IPs

- 100+ projects launched

- Collaborations with well-known Web2 IP companies

- 6 million+ addresses

Camp will further enhance—providing structured, real-time, scalable usage and tracking mechanisms and profit-sharing for IP, becoming the infrastructure for the next generation of data content economy, not relying on lawsuits and blockades, but making legal use easier than infringement through experience and usability.

LFGGGG CAMPPPPPP

13.87K

43

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.