single sequencer so they can control ordering (ie no validator lottery like on the L1)

they have a private mempool (no sniping)

more flexible infra via zkvm & riscvm -> unified margin and better matching logic

Kind of how I am thinking about @bulletxyz_

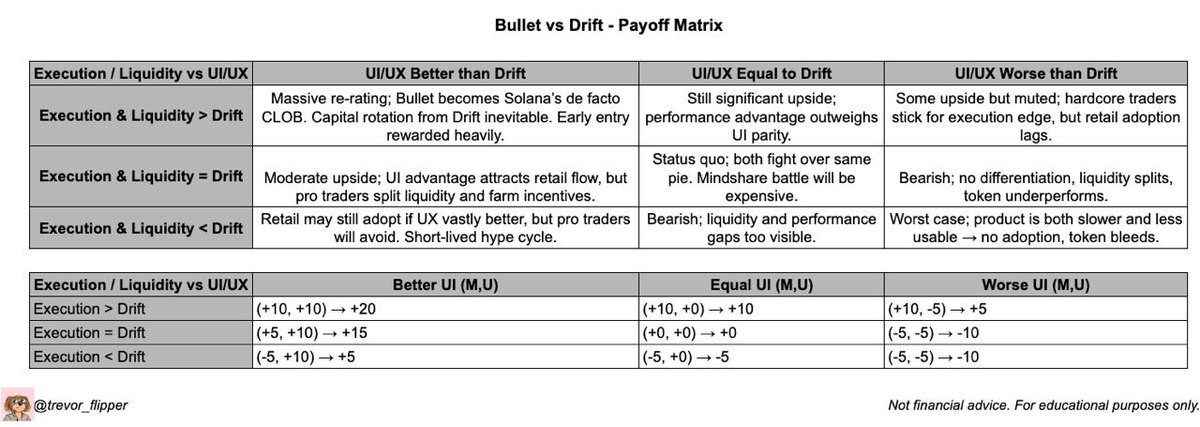

I essentially made a game theory payoff matrix for Bullets potential outcomes vs drift based on two factors

1) Exection & Liquidity - order matching speed, fill quality, depth of book

2) UI/UX - user interface, onboarding, and product experience.

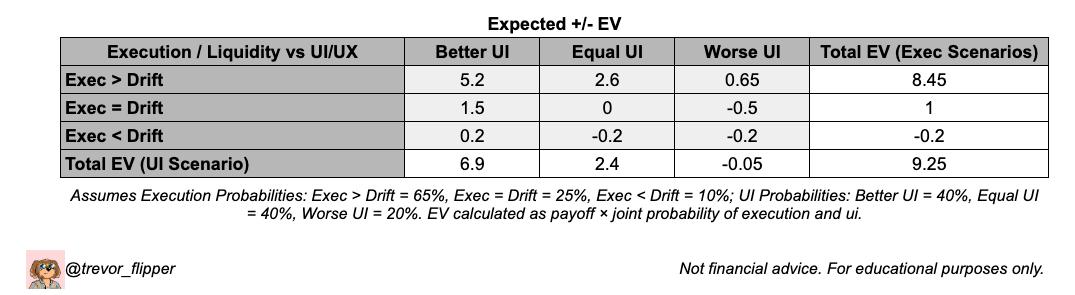

I assign probabilities to each outcome (based on my own judgment) and multiply them by the corresponding payoffs to calculate the Expected Value (EV) in each cell.

Execution is the primary driver

- Execution > Drift accounts for ~91% of total EV (8.45 out of 9.25).

- If Bullet only matches Drift on execution, upside drops sharply to 1.0 EV.

- If execution lags Drift, the model is near breakeven (-0.2 EV total).

Takeaway: This is fundamentally an execution-led bet.

UI is the performance multiplier

- Better UI column = 6.9 EV (~75% of upside).

- Equal UI is still positive (2.4 EV), but Worse UI erodes returns (-0.05 EV).

Takeaway: Better UI amplifies returns but can’t replace execution leadership.

Risk is concentrated in one quadrant

- Most payoff comes from Better Execution + Better UI (5.2 EV) and Better Execution + Equal UI (2.6 EV).

- Miss on either dimension and returns deteriorate quickly.

Positioning View

If Bullet beats Drift on execution, even with equal UI, the thesis holds. If execution is equal or worse, success hinges on UI dominance - harder to achieve and sustain.

The dominant strategy is betting on better execution. Bullet’s single-sequencer architecture gives it control over block ordering, something Drift can’t currently match but is moving toward with BAM. This structural edge could make execution superiority more likely, tilting the EV heavily in Bullet’s favor while keeping downside risk contained.

The obvious counterarguments are that Bullet lacks Solana Foundation backing compared to Drift, or that Hyperliquid - with builder codes and the upcoming HIP-3 - will dominate the market. Those points are valid; Hyperliquid’s moat is real and growing.

But even assuming Bullet never becomes Hyperliquid’s next direct competitor, a ~$20M market cap still feels mispriced given the probability-weighted upside in the EV framework. The bet here isn’t “Bullet beats Hyperliquid,” it’s that Bullet can carve out a profitable niche on Solana if it sustains an execution edge over Drift - helped by a single sequencer (yes, additional risk here) that lets Bullet control block ordering, something Drift can’t yet match (though BAM narrows that gap).

None of this is financial advice.

tbd if market appreciates this but it seems pretty clear to me that this should be the best place to execute perps in "sol" eco

1.05K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.