This year's main theme is undoubtedly the great integration, merging CEX and Onchain, as well as TradFi and Onchain.

Coinbase will also allow exchange users to purchase on-chain assets using internal funds through a built-in wallet within the exchange, initially supporting Base and later expanding to Solana, gradually supporting a complete range of on-chain assets. From the description, it seems to be similar to an Alpha product, and we will see how the architecture looks once it goes live.

As a result, Coinbase's on-chain strategy is essentially a dual-track approach with the Base APP and Coinbase Alpha. The former is aimed at distributing to overseas non-KYC users, while the latter allows local KYC users to enter the on-chain space, creating a two-way engagement.

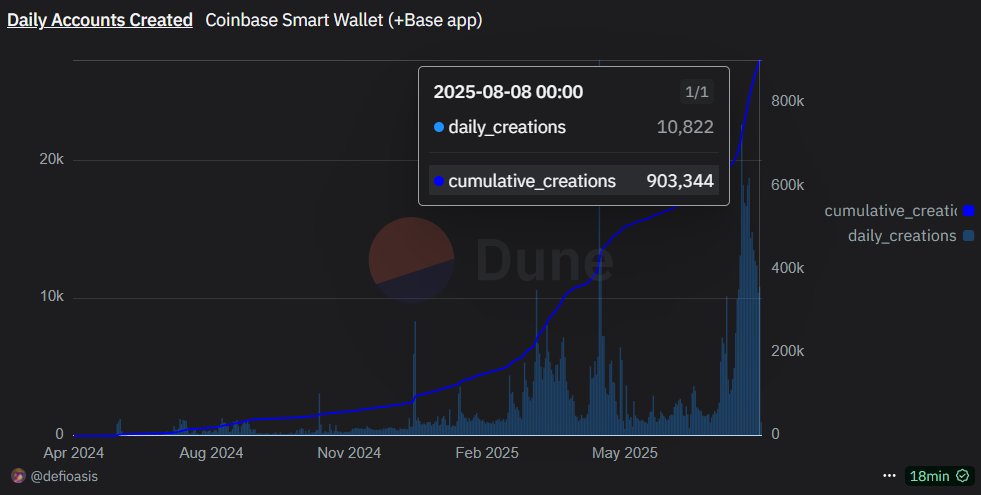

It's worth mentioning that the number of accounts based on the Coinbase Smart Wallet behind the Base APP has surpassed 900,000, nearing the current trading users of Binance Wallet (BSC) (~940,000). Coinabse – Base and Binance – BSC are likely to see some exciting developments ahead, providing opportunities for speculation.

Aside from Coinbase, it feels like the major CEXs have suddenly accelerated their on-chain layouts this week:

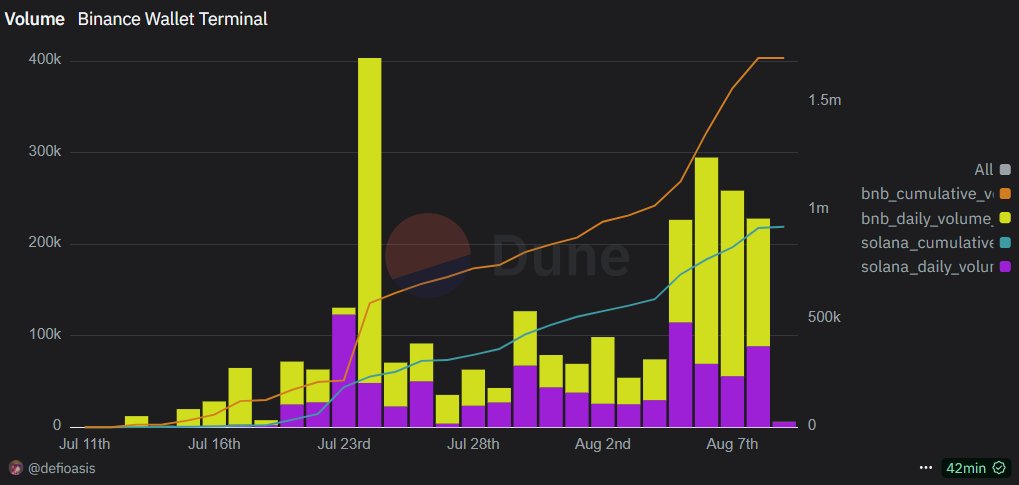

- Binance is promoting its Binance Wallet Terminal to the market, seeking seed users for feedback. Currently, Binance Wallet Terminal supports Solana and BSC, having acquired ~1.2k trading users, with daily trading volume between $250,000 and $300,000. Notably, the recent decline in activity for Binance Alpha seems to show signs of a rebound in daily trading volume and transaction count.

- Bybit has also officially launched a product similar to Alpha, Bybit Web3, which allows users to purchase on-chain assets using exchange funds. Its architecture is similar to Bitget Onchain, managing on-chain assets across multiple wallets, with N addresses being managed, each holding ~3wu. The goal is to prevent slippage and hacks, but it's difficult to track specific data.

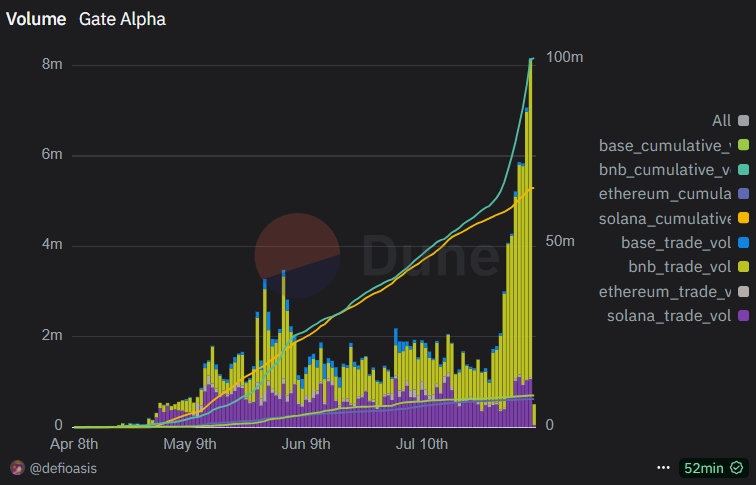

- Gate Alpha has referenced the points and airdrop model of Binance Alpha, with trading volume soaring continuously, recently reaching $8 million, most of which is concentrated on the BSC network.

All exchanges are gradually improving their products, which also means homogenization. Unlike Binance and Coinbase, which have their own public chains as asset backing, other exchanges are essentially competing on operational capabilities.

This CEX and Onchain integration panel should be the most comprehensive view of the on-chain strategies of various exchanges at present, and it will continue to improve. Those interested can pay more attention.

Show original

11.31K

29

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.