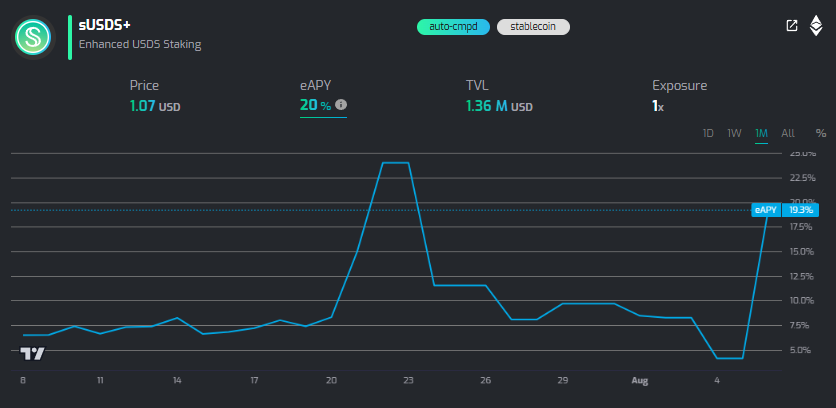

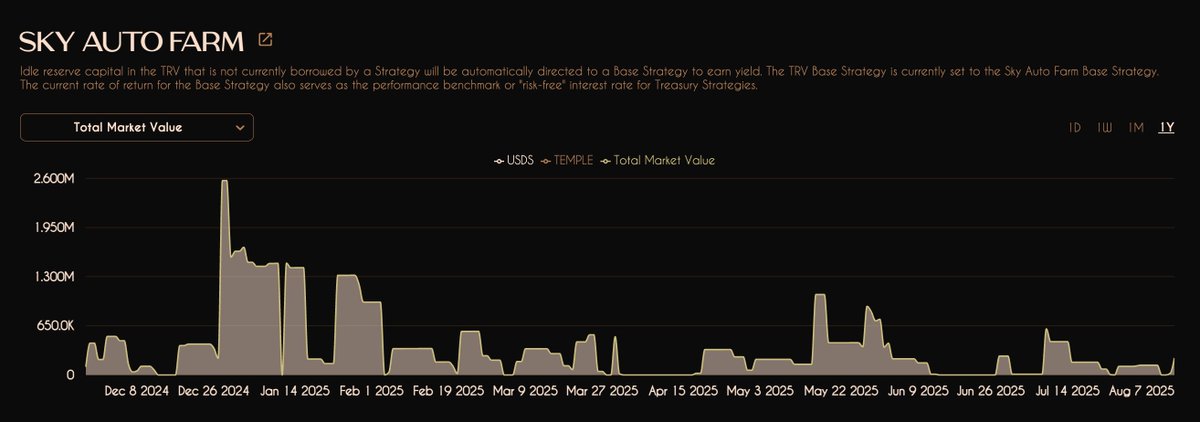

Temple programmatically uses sUSDS+ by @origami_fi for its idle treasury funds.

Why?

1/ Lindy (launched 1y ago)

2/ Efficient (2% yield fee)

3/ Optimised for highest APR

sUSDS+ truly shines as an auto-curated stables vault suitable for capital allocators of any size👇

The operational overhead of active management in a world of fluctuating yields is painful.

sUSDS+ fixes this.

At TempleDAO, idle Treasury funds are algorithmically swept into sUSDS+.

How the vault works👇

sUSDS+ constantly scans the other @SkyEcosystem Liquid Staking yield opportunities (e.g. sUSDS, SPK, or SKY)

It then moves its TVL to the farm with the highest APR with no further user intervention.

Harvested rewards are auto-compounded to USDS reserves.

We !pray for the day when sUSDS+ is enabled for looping on a money market.

9.38K

20

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.