1/ July was a strong month for @solana, with onchain activity showing resilience across various fronts:

- Real Economic Value: $87M, +38% MoM

- App Revenue: $161M, +50% MoM

- DEX Volumes: $115B, +42% MoM

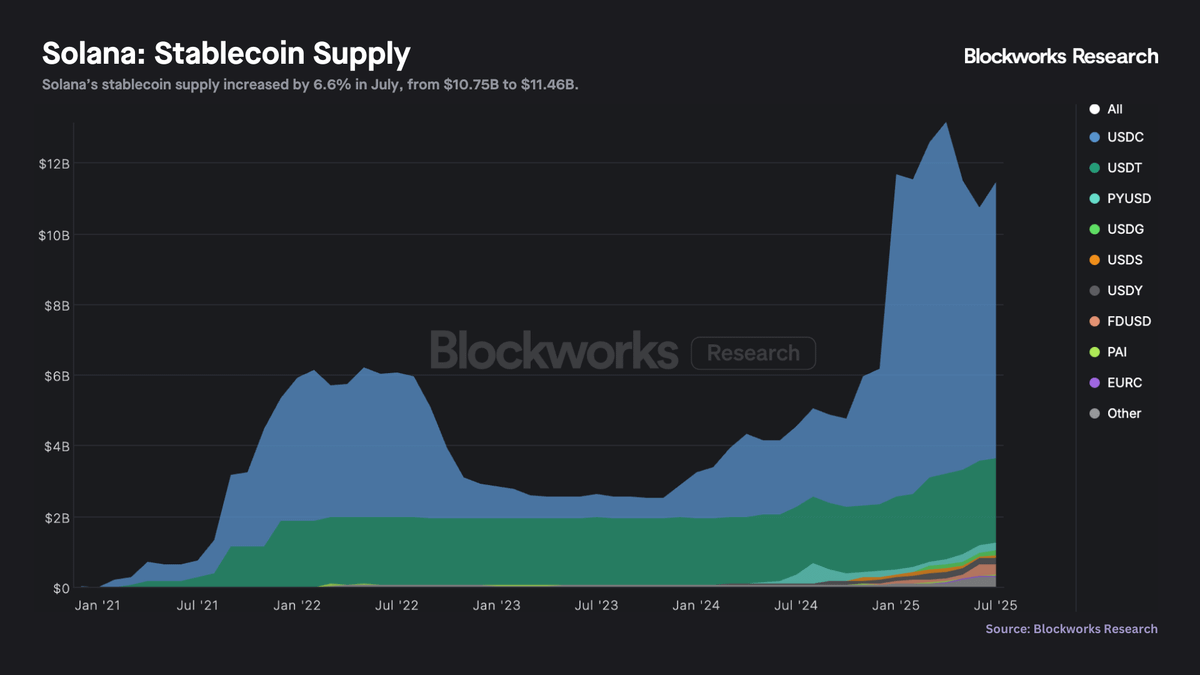

- Stablecoin Supply: $11.46B, +6.6% MoM

Let's dive into the data 👇

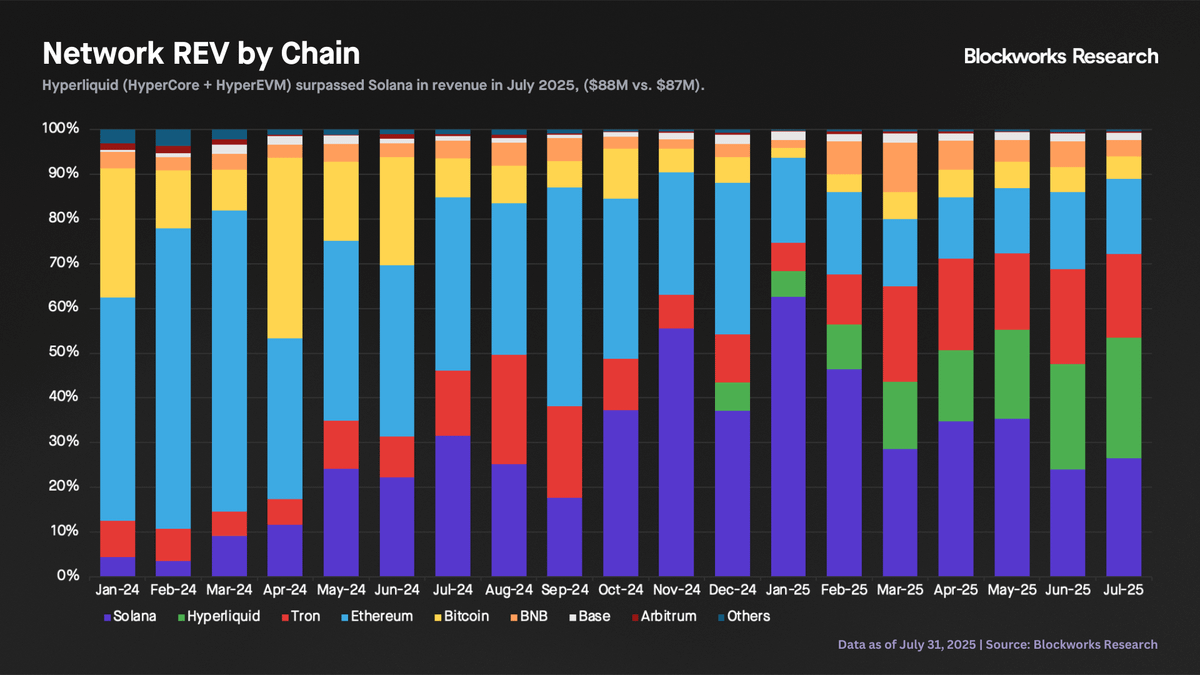

2/ Solana's REV hit $87M in July, up 38% MoM.

For the first time ever, Hyperliquid (HyperCore + HyperEVM) surpassed Solana in monthly revenue ($88M vs. $87M).

July's market share snapshot:

- Hyperliquid: 26.9%

- Solana: 26.5%

- Tron: 18.7%

- Ethereum: 16.8%

- Others: 11.1%

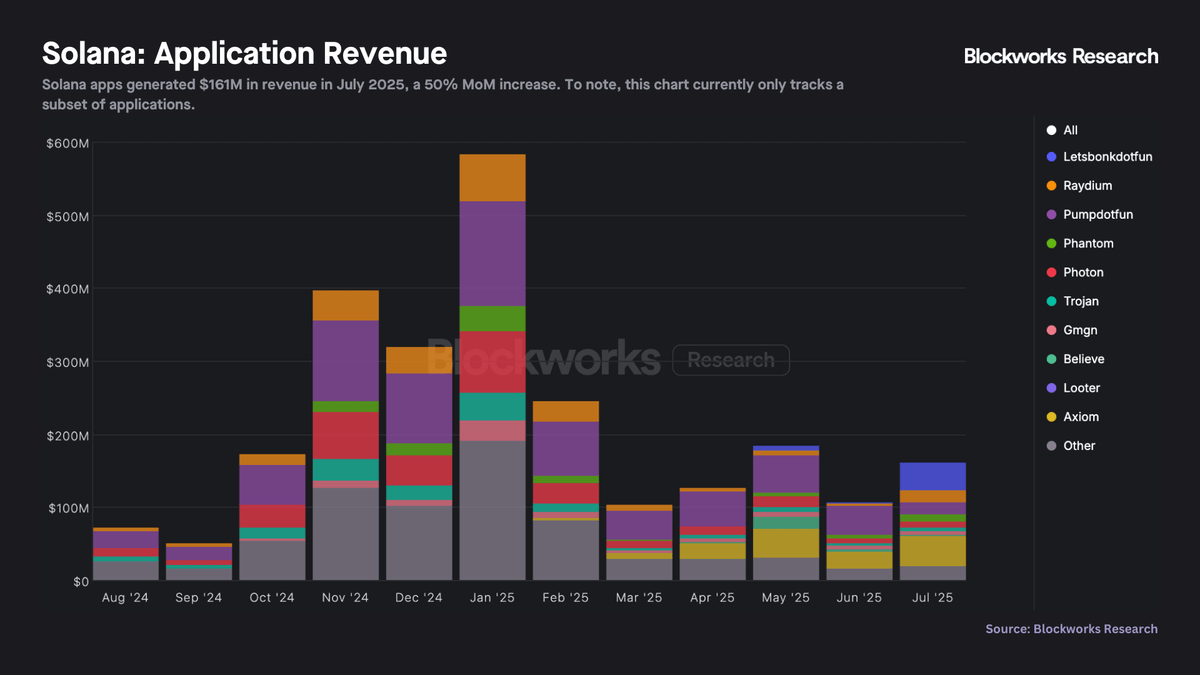

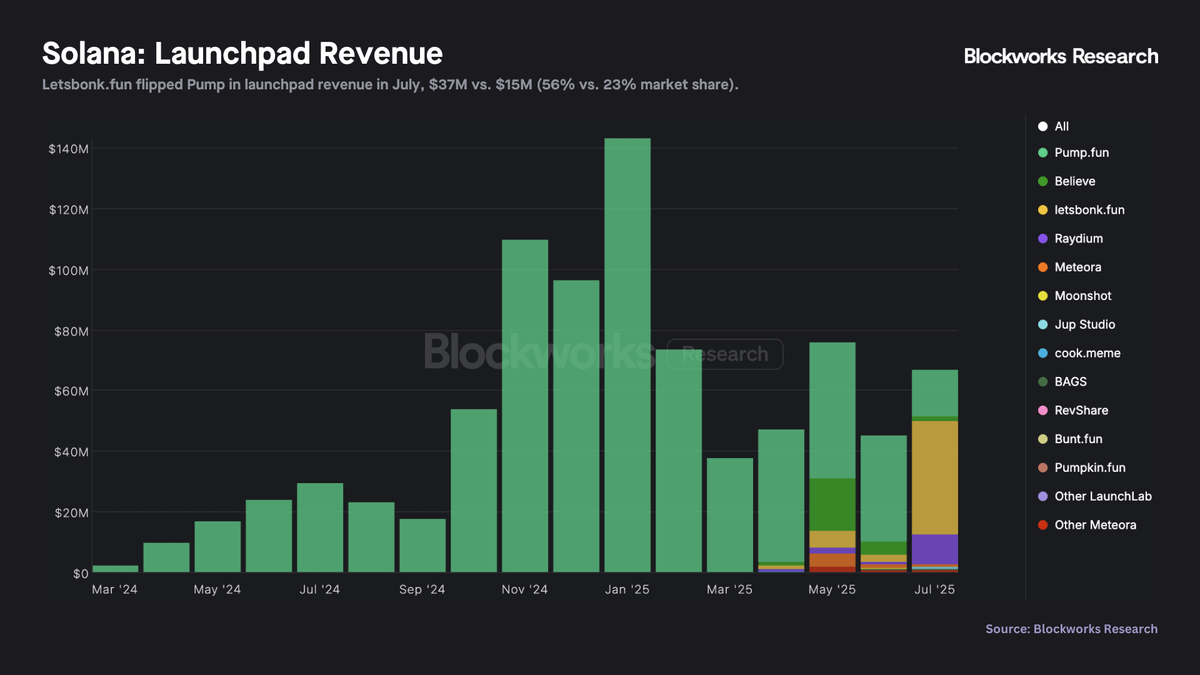

3/ Solana apps generated ~$161M in revenue in July, up 50% MoM.

Top apps by revenue:

- Axiom: $41M (26%)

- Letsbonkfun: $37M (23%)

- Pump: $17M (11%)

- Raydium: $16M (10%)

Note that we are tracking a subset of apps, so actual revenue may be higher.

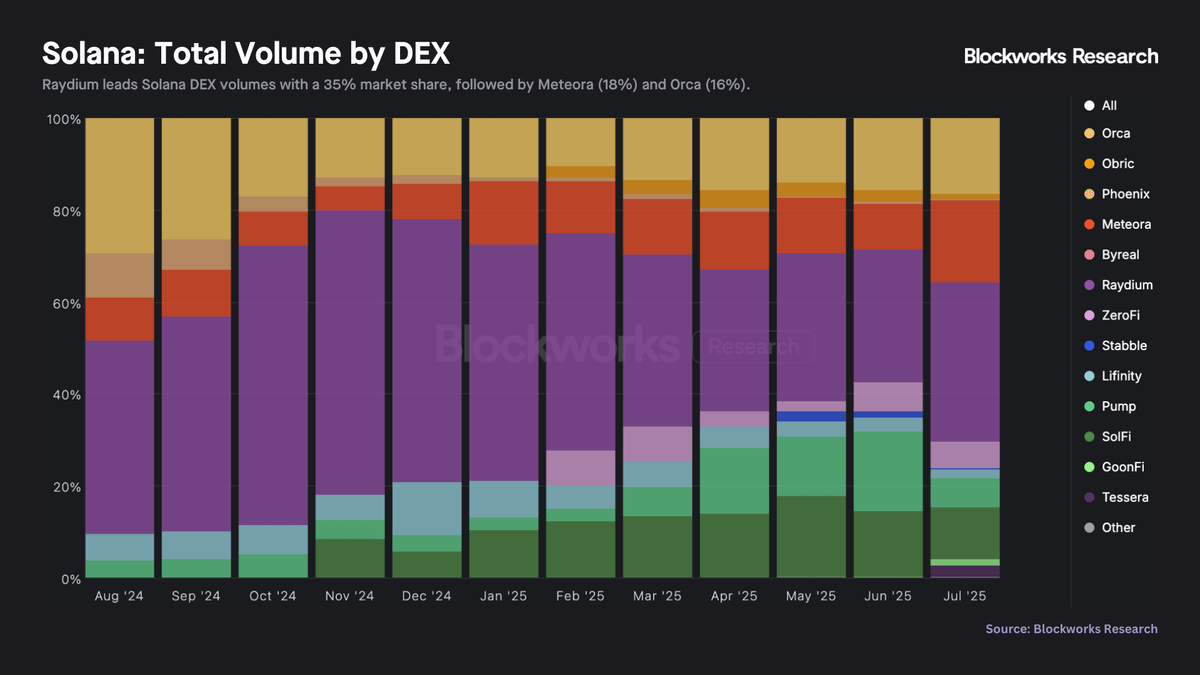

5/ Regarding DEX dominance, Raydium leads overall volumes with 35% market share.

Meteora's trading volume surged 150% MoM, reaching $20B in July, positioning it the second-leading DEX on the chain with 18% market share.

6/ Solana's stablecoin supply increased by 6.6% MoM, closing July at $11.46B.

USDC circulating supply on Solana increased by about $650M in the past month. Meanwhile, USDG supply grew by 44% to $148M.

7/ Launchpad revenue on the network amounted to $68.4M in July, a 50% MoM increase.

Letsbonkfun accounted for 55% of this figure ($37M), with Pump trailing at 22% ($15M).

8/ To stay updated on Solana's monthly developments, including in-depth discussions about the latest Solana Improvement Documents (SIMDs), onchain financials, DeFi activity, and more, subscribe to @blockworksres and check out my latest report.

14.42K

22

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.