1) In honor of my fellow baldman, @0xMert_ , I'll start with a @solana yield:

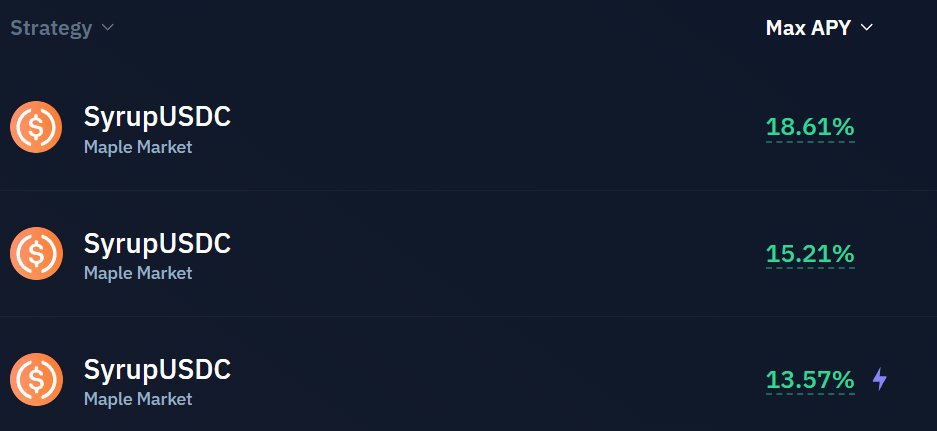

@syrupfi has syrupUSDC, which is redeemable for USDC under different time periods of your choosing.

It averages a 6-8% APR.

You can also loop syrupUSDC on @KaminoFinance for 13% to 18% net APR.

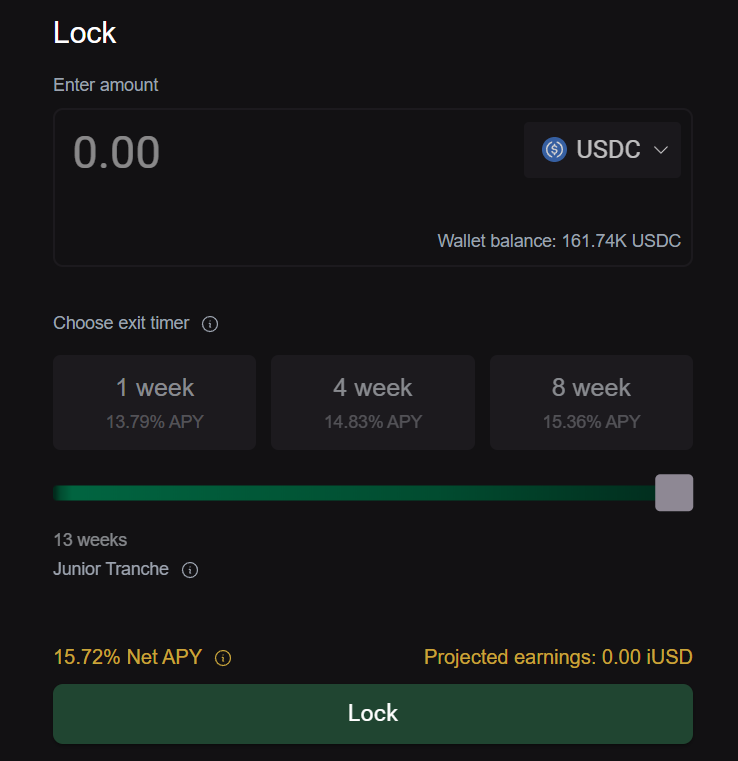

2) @infiniFi_ has one of my favorite USDC denominated yields (one of my largest positions).

iUSD is redeemable & mintable 1:1 with USDC.

You can stake iUSD for 9–16% APR

➢ 9% siUSD, no lock

➢ 14%–16% li-USD, 1–8wk locks

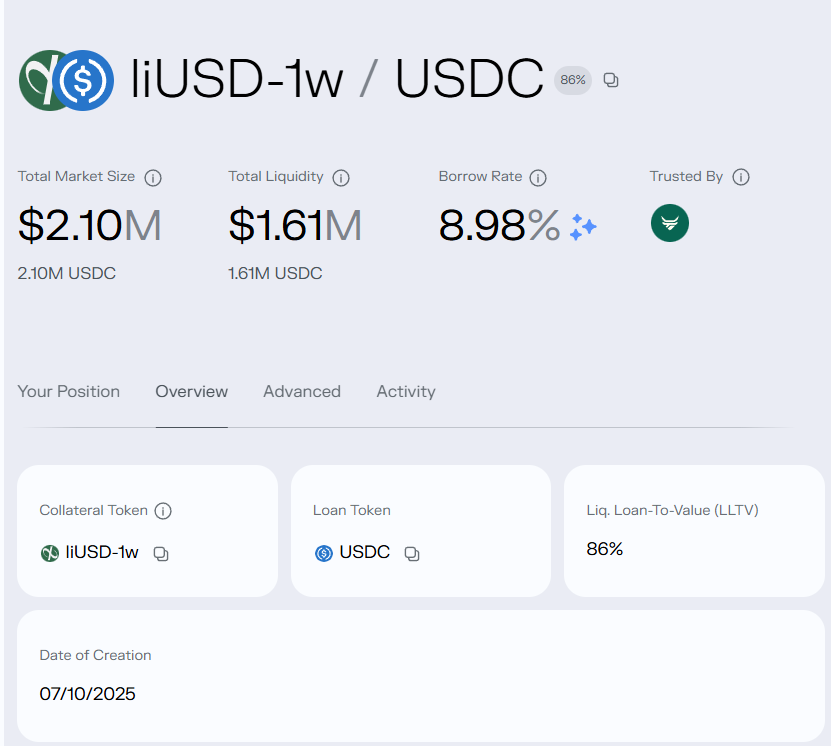

Loopable on Morpho:

⇒ 59% APR on 10x liUSD-1wk

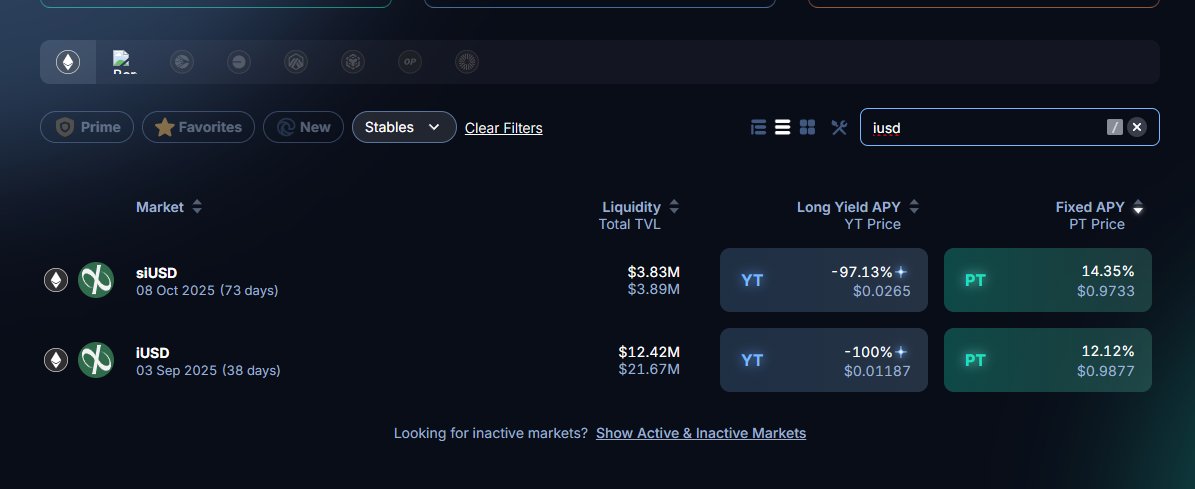

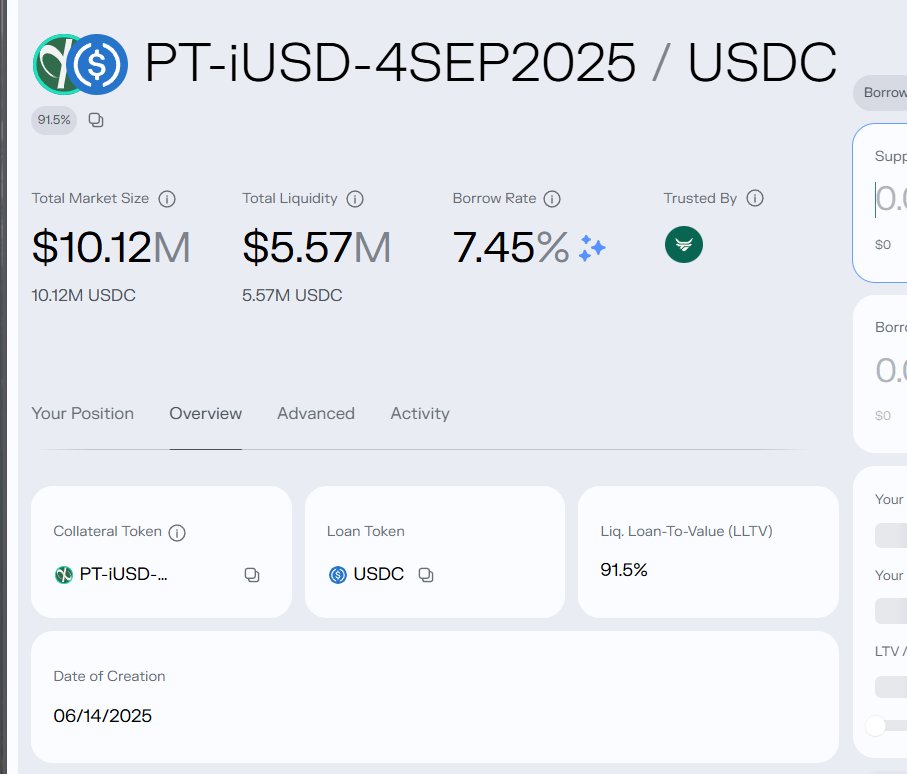

3) @infiniFi_ on Pendle is equally good, if not better

You can also get fixed rate 12–14% on Pendle.

As a reminder, you can redeem these 1:1 for USDC at expiry.

ALSO, these are loopable on Morpho.

⇒ 52.95% APR on 10x leveraged PT-iUSD

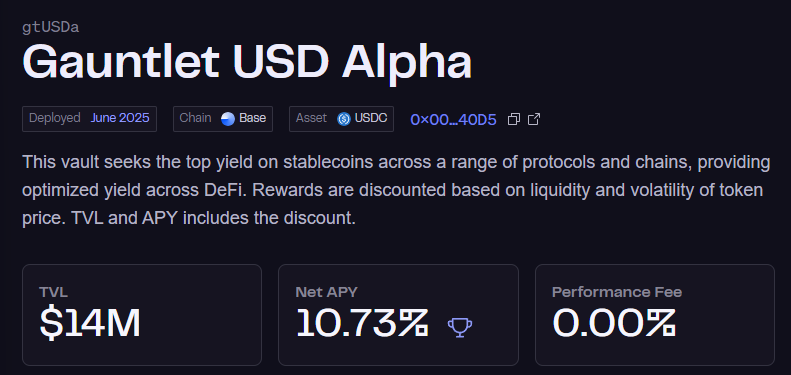

5) The Curator King, @gauntlet_xyz

gtUSDa has 10.73% fully organic USDC yield.

It's not leverageable yet. But I hope it will be.

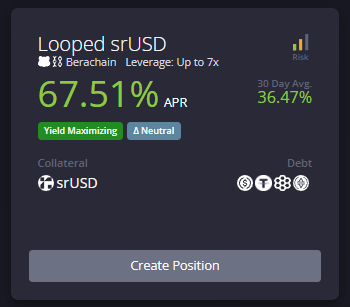

6) @reservoir_xyz has the best base rate on USDC.

wsrUSD has a 13% APY and is 1:1 mint/redeemable for USDC through rUSD.

srUSD can be looped on @Dolomite_io for 65.5% APR

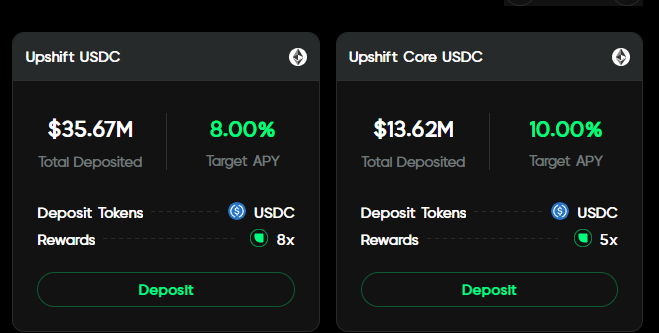

7) @upshift_fi has a vault aggregator...

Upshift Core USDC is at 10% APR with 5x Points

You can also technically leverage upUSDC on Morpho, but there's only 80K to borrow.

@MEVCapital, when more?

8) Everything on @plumenetwork

Many people don't know pUSD is mint and redeemable 1:1 for USDC.

Just lending pUSD on Morpho nets 15-20% APR.

Looping gets wild if you use assets.

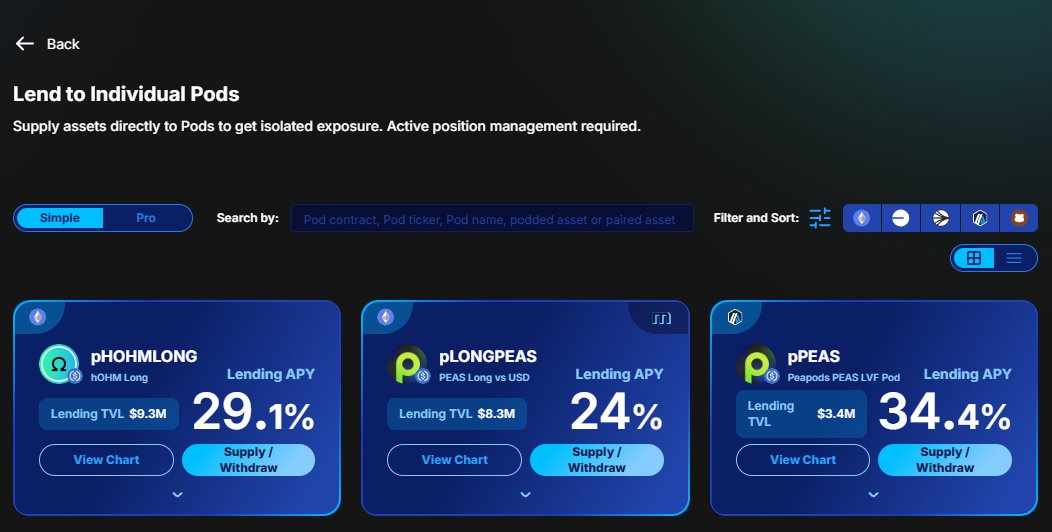

9) Much riskier, but @PeapodsFinance is definitely the highest return for lending.

TL;DR 24-35% APR lending to highly volatile capital.

I would be hesitant to call this battle tested. It's still in Beta, the critical in the audits have been addressed, but there were quite a few.

I don't endorse peapods, but it is a USDC yield, and it's certainly high.

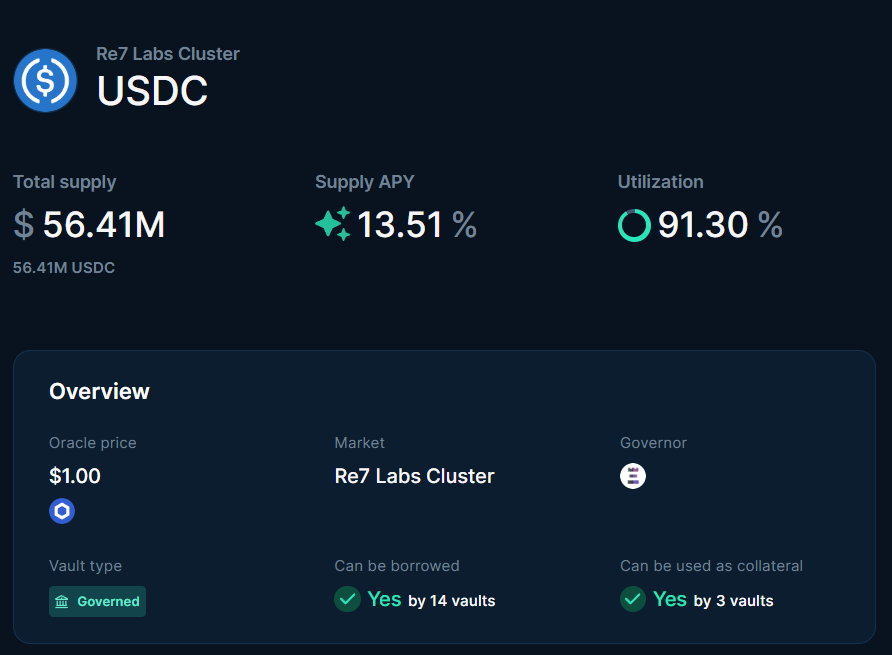

10) @eulerfinance has 87% APR on sUSDC

sUSDC is Spark's USDC.

You can loop it against $3M of USDC collateral.

Note: 4.5% of the rewards are in rEUL, but anyone who's vested their rEUL has been reward greatly so far.

11) You can also just lend USDC on @avax on @eulerfinance for 13%

12) One more @avax yield for the boys.

@BlackholeDex has AXD/USDC at 131% APR (single tick).

But a more reasonable 2-tick range has a 44% APR.

Blackhole is a ve(3,3) dex and it's been growing like wildfire on Avalanche.

That's it!

Thanks for reading. Now go grow your USDC.

Ambassadorships mentioned:

- SummerFi

- Pendle

- Euler

- Avalabs

- Reservoir

- Infinifi

40.39K

233

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.