By 2025, 96% of USDT holders will be newly added on TRON.

If we consider stablecoins as the cash flow of the crypto world, then TRON is undoubtedly the widest and deepest river of this cash flow.

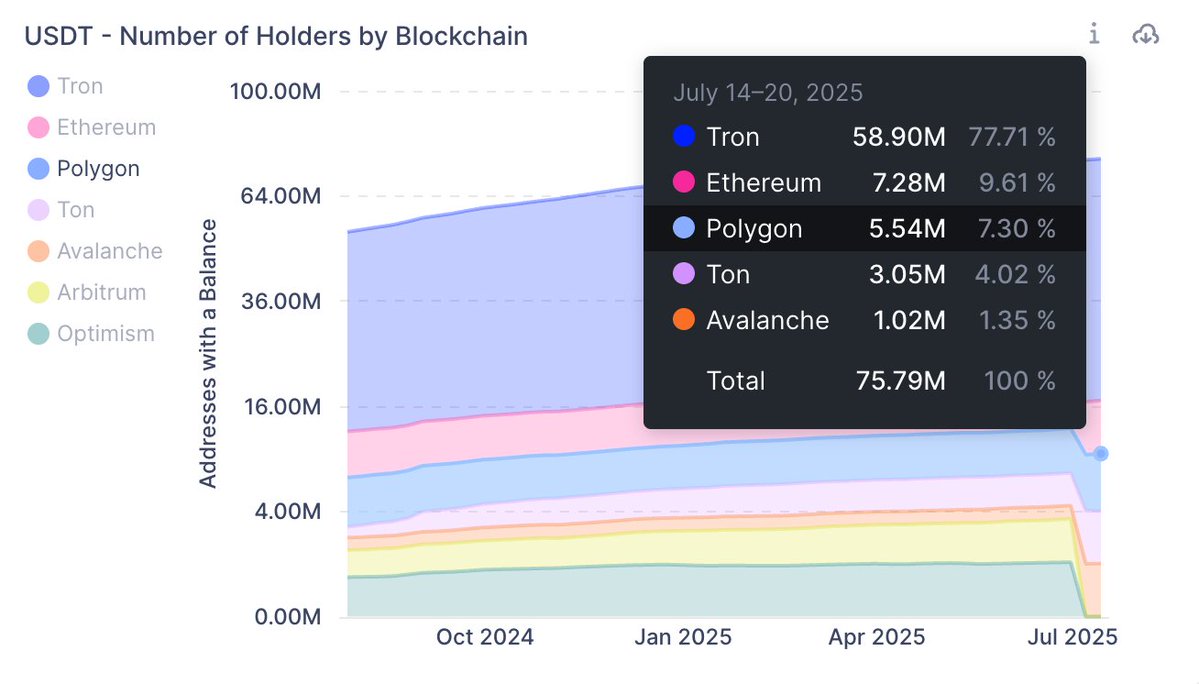

From January to July of this year, among several mainstream public chains that have been statistically analyzed, the total number of USDT holding addresses increased by 8.2 million, with about 96% of the new addresses flowing to TRON.

The data tells us this:

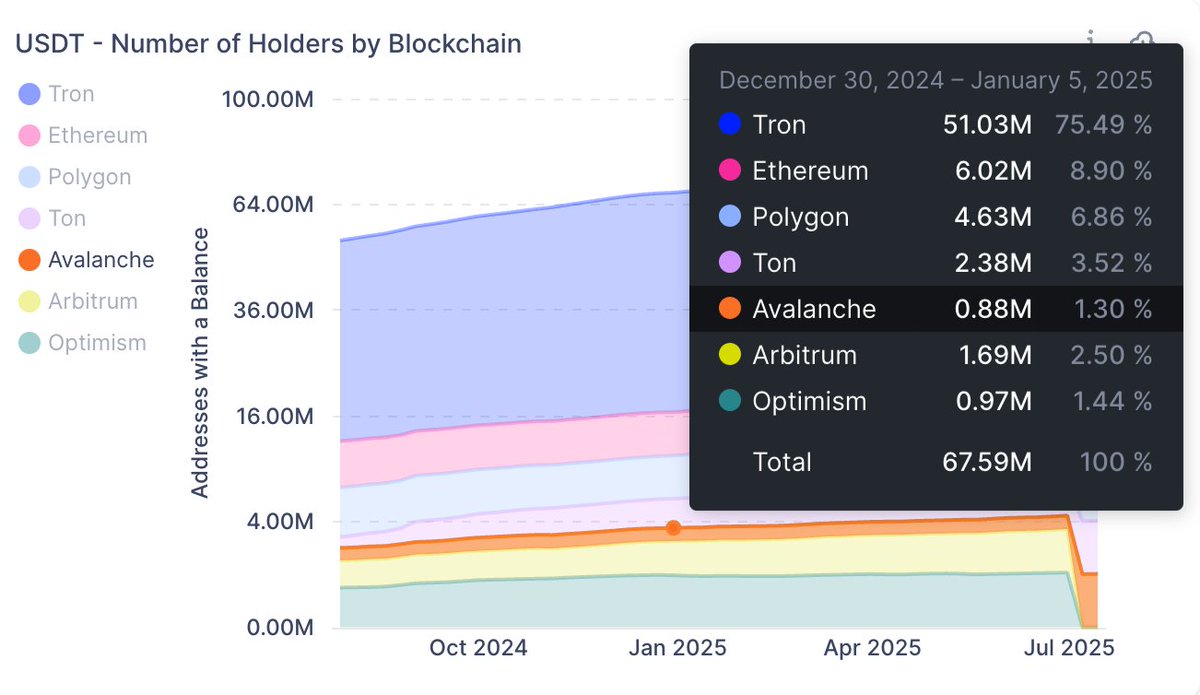

At the beginning of 2025, the number of USDT addresses on TRON was approximately 51 million, accounting for 75.49% of the total.

In just seven months, this number rapidly surged to 59 million, further expanding its share to 77.71%.

During the same period, while the number of addresses on competing chains like Ethereum and Polygon also grew, it can only be considered moderate compared to TRON.

Why are users willing to hold USDT on TRON?

The answer is not difficult: it is convenient enough, fast enough, and secure enough. Especially for ordinary users who use stablecoins daily, there is almost no reason to torture themselves with slower and more congested chains.

It seems that TRON is like a spacious and comfortable highway, smoothly transporting a continuous flow of stablecoin traffic. Other chains appear increasingly congested in comparison to this road.

Of course, the market is never static, but at least for now, TRON has firmly occupied the top position in the stablecoin ecosystem, and is even continuously widening its lead and enhancing its own value.

So, in the short term, if you ask which chain controls the lifeblood of stablecoins?

The data has long provided the answer: it is TRON, no one else.

@justinsuntron @sunyuchentron #TRONEcoStar

Show original

32.93K

17

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.