We're in an InfoFi x TGE season.

@cookiedotfun → @Almanak__.

@KaitoAI → @TheoriqAI and @EspressoSys

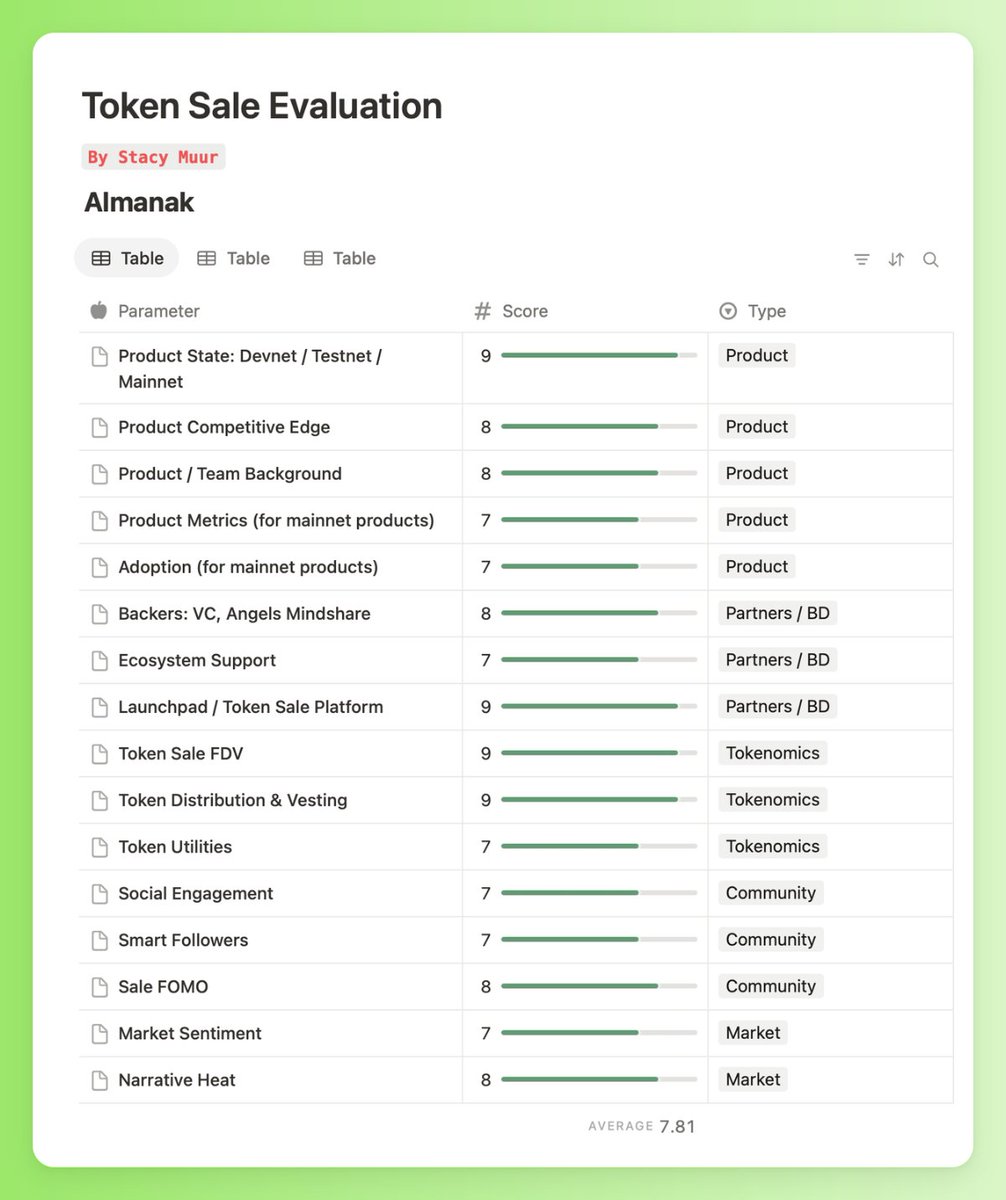

Here's everything you need to know about Almanak's ACM.

While InfoFi campaigns were built to reward visibility, in practice, they rewarded volume regardless of intent.

• AI-generated threads dominated timelines.

• Token allocations flowed to large accounts, not active users.

• Airdrop recipients sold on unlock, often having never used the product.

The mechanism was frictionless... too frictionless. No stake, no skin, no signal.

ACM introduces a constraint: attention must be paired with capital to matter.

SNAPS and cSNAPS

ACM tracks participation in two layers:

• SNAPS reward posts.

• cSNAPS reward posts plus usage or capital commitment.

Tweeting gets you in the game. But investing or interacting moves you up the board and when rewards are distributed:

• 80% goes to the cSNAPS leaderboard

• 20% to the SNAPS leaderboard

This filters out passive farming and favors users with skin in the game those willing to bet, not just talk.

How is this Different from Kaito?

Kaito’s Espresso raise was highly criticised for delayed liquidity:

• $400M FDV

• 0% at TGE

• 12-month cliff + 12-month vesting

Even for believers, the breakeven math looked bleak.

@Almanak__ skips that entirely:

• 100% unlocked at TGE

• No cliff

• Lower FDV for top participants

Other recent launches (e.g., EigenLayer ) leaned on lockups, long vesting, or whitelists shaped by follower count but ACM proposes something different:

• CT clout won’t cut it.

• Being early won’t either.

• Show up, show work, show skin.

The behavioral logic underneath

Two effects explain why ACM might produce better outcomes:

• Endowment Effect: people value tokens more when they’ve paid for them.

• Loss Aversion: when you have real money at stake, you think twice before dumping.

While InfoFi didn’t trigger either, ACM forces both into the design. This doesn't guarantee success, but it reduces the mismatch between who promotes and who stays.

The Bigger Shift

Token sales don’t just raise funds, they reveal how a project thinks. Almanak’s decision to launch via ACM suggests it wants a cap table that mirrors usage.

Almanak isn’t just testing a new fundraising model. It’s testing whether launches can be designed to filter for conviction not just capture attention.

No format is perfect.

But ACM makes one thing clear: If you’re going to post, you should know what you’re backing and if you’re going to back something, it should be visible on-chain.

That feedback loop; between usage, capital, and visibility is what InfoFi lacked.

Whether ACM scales or not, it raises the bar for what a “community raise” actually means. The blueprint is different and for now, that's the more interesting signal.

8.87K

126

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.