1/ Today, we’re introducing key features to Earn Vaults

Designed to provide deeper insight into vault performance and curator activity, directly from the Earn UI

Kamino Earn is evolving🧵

2/ Before we dive into the new features, we need to explain why these features matter, contextualizing them within Kamino Earn as a product

Earn Vaults aggregate funds across various lending markets, actively rebalancing deposits across a defined set of risk parameters to ensure yields are optimized, while operating within a certain risk profile

In practice, this means each Earn Vault operates as an on-chain Managed Fund, with full transparency on where funds are allocated. A key difference being, your funds always remain in your native asset, and they are only ever allocated into Kamino Lend, and only into markets that fit the risk profile—therefore not introducing unknowns or unforeseen trust assumptions

A vault manager (the Kamino Earn equivalent of a fund manager) specifies the vault profile, from conservative, to balanced, to aggressive, and users can deploy into whichever vault profile their risk appetite dictates

Conservative vaults typically deploy into only the most liquid markets, where yields tend to be lower, but liquidity and insolvency risk are lower accordingly—and Aggressive vaults could deploy across a set of parameters and markets that emphasize yield first and foremost

Each Earn Vault adheres to such a set of parameters, as specified by the manager, and these can span from specific percentage allocations to different markets, to utilization caps, and much more

Given the nature of these vaults as onchain equivalents of managed funds, the need for quantifiable performance data and transparent strategy tracking becomes clear

3/ We've added four new metrics to analyze vault performance & curator activity:

• Vault Share Price

• Interest Generated

• Reallocation Volume

• Reallocation Transactions

Let’s dive in⤵️

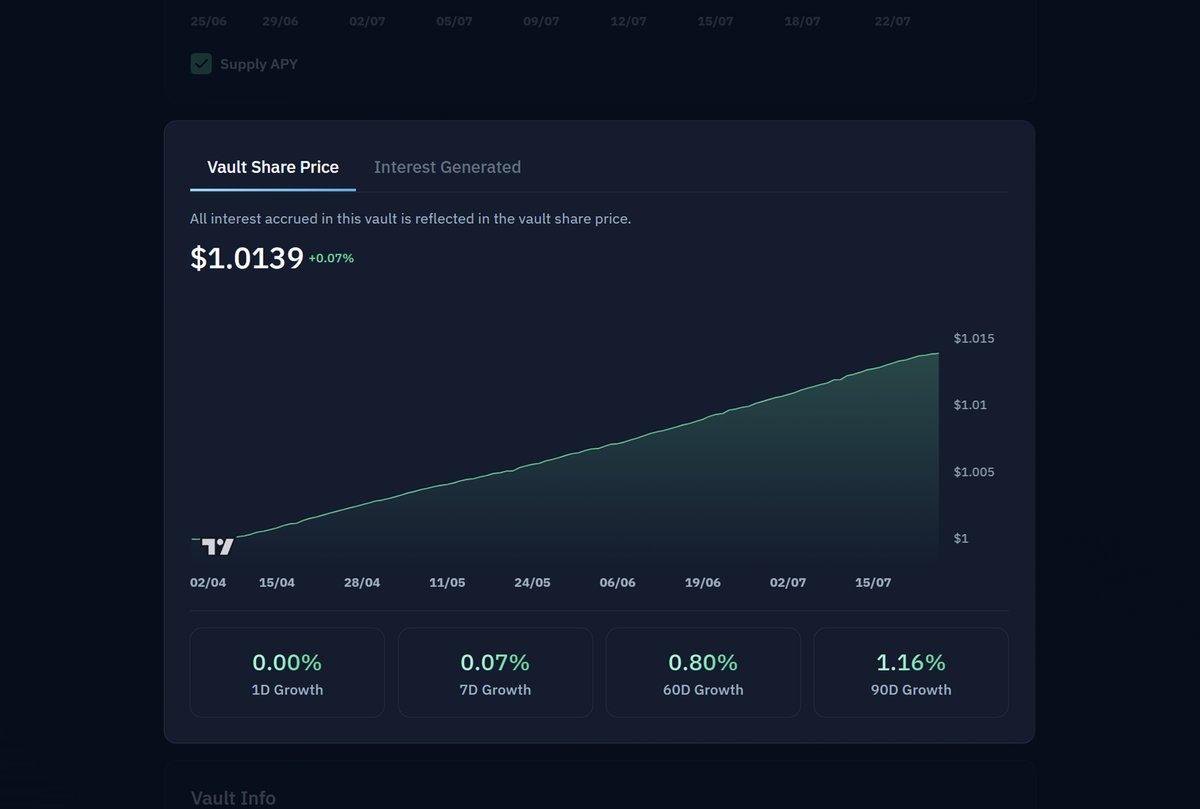

4/ Vault Share Price

Similar to NAV (Net Asset Value) in traditional managed funds, Vault Share Price reflects the performance of a vault over time

It starts at $1.00 and increases as interest accrues—offering a transparent view of how strategy performance evolves over time

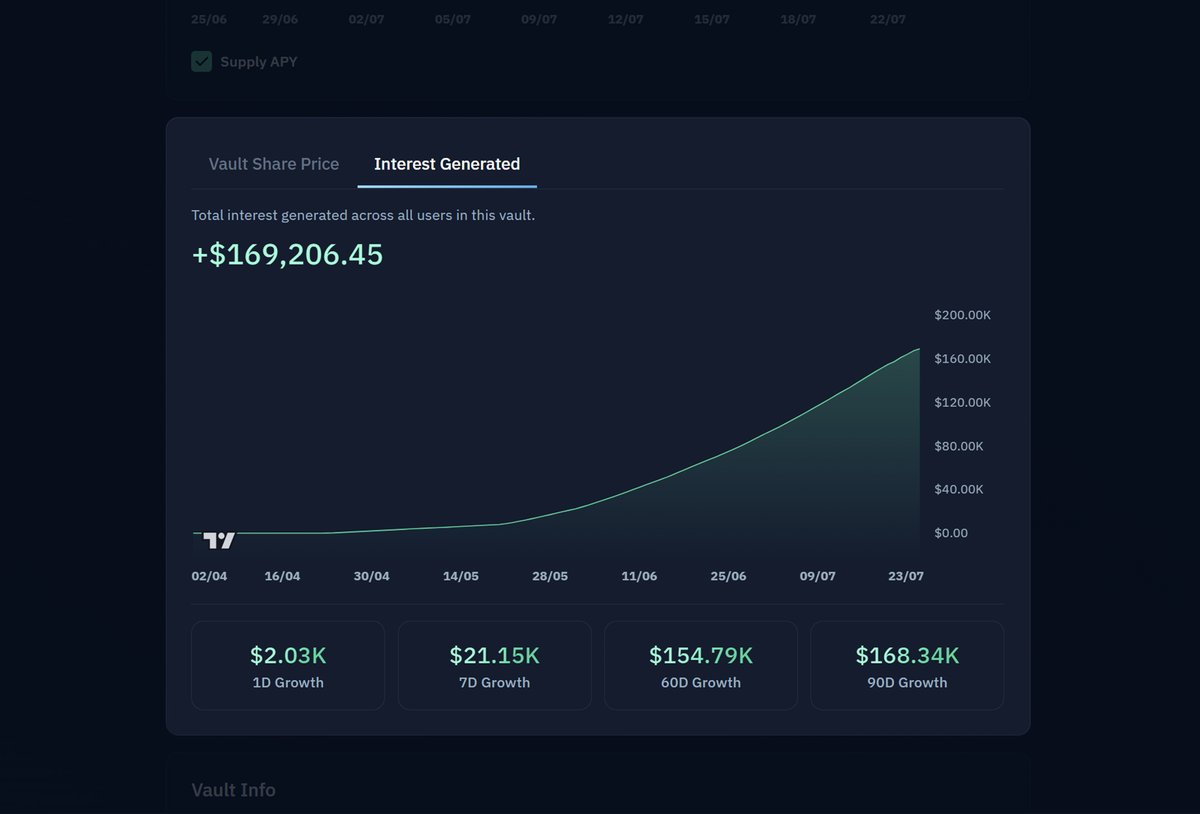

5/ Interest Generated

Each Earn Vault tracks the cumulative interest earned across all users in the vault, offering a clear view of realized performance

USDC Prime by @SteakhouseFi, for example, has generated over $169K since its launch in May

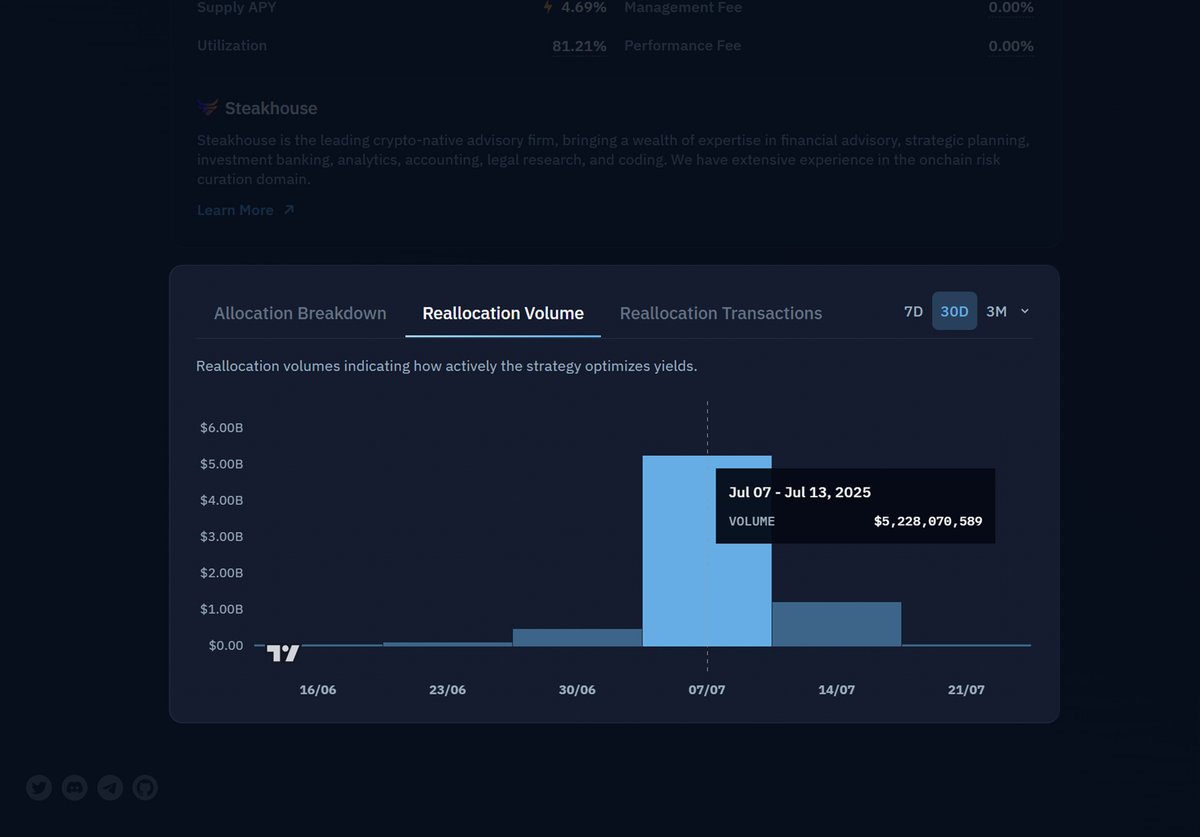

6/ Reallocation Volume

A quantifiable way of measuring strategy activity. This tracks how much funds a vault strategy moves across markets, automatically optimizing risk-adjusted yields

USDC Prime saw over $5B rebalanced in one week, a sign of consistent optimization

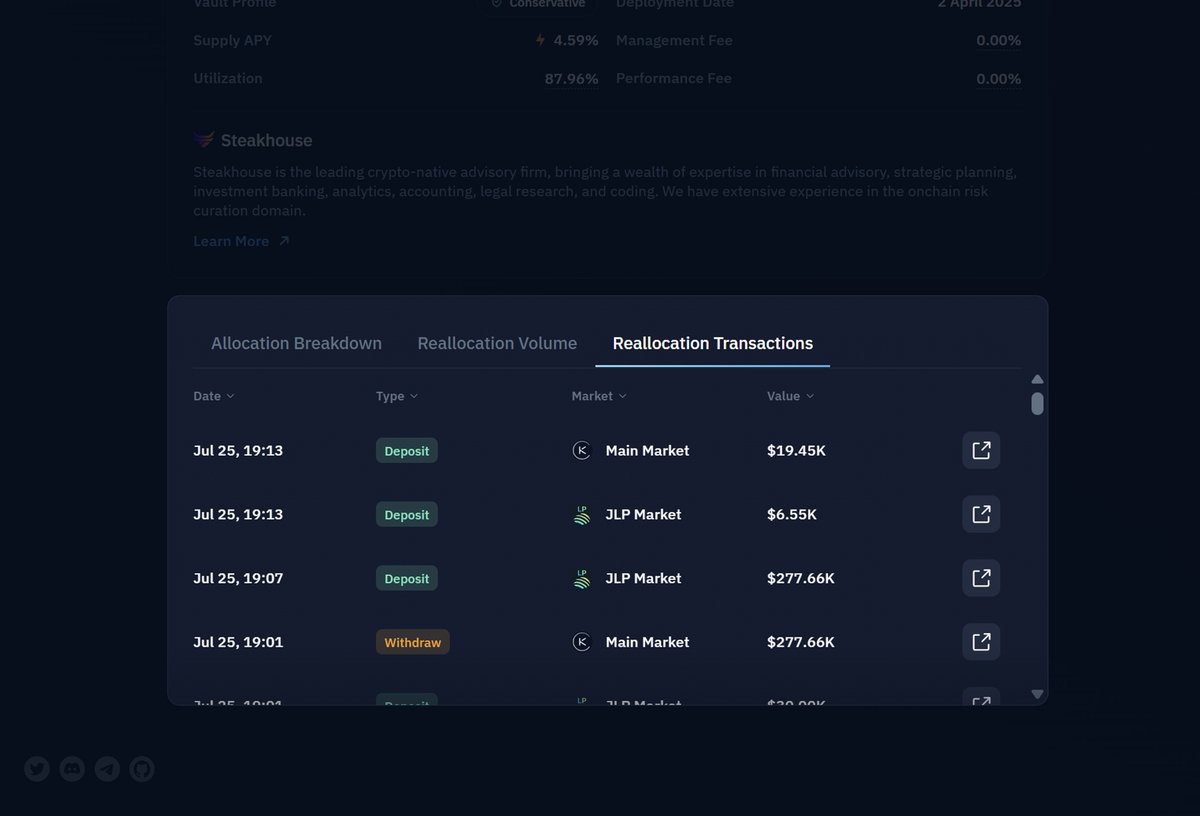

7/ Reallocation Transactions

This shows every reallocation transaction made in the vault

With each transaction, funds are moved between lending markets, reacting to changing rates, liquidity, or utilization caps

Every transaction is recorded and now visible in the Vault UI

8/ With over $80M deposits and $600K interest generated, Kamino Earn has become the largest lending yield product on Solana

We believe this update is a huge step towards growing Earn Vaults into mature, data-driven yield vehicles

Discover Earn:

4.45K

26

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.