Stablecoins are projected to reach $1.4 trillion by 2030.

The important question isn’t how big the market gets.

It’s where it settles.

And increasingly, the answer is Sei: the chain quietly becoming the infrastructure for the next-generation dollar stack.

Let’s delve in: 🧵

● Stablecoins Are the Product. Rails Are the Differentiator.

$USDC, $USDY, $USDT; these are products.

But the railroads that move, mint, redeem, and settle those assets across apps, venues, and jurisdictions?

That’s the dollar stack. And it’s getting rebuilt, chain-first.

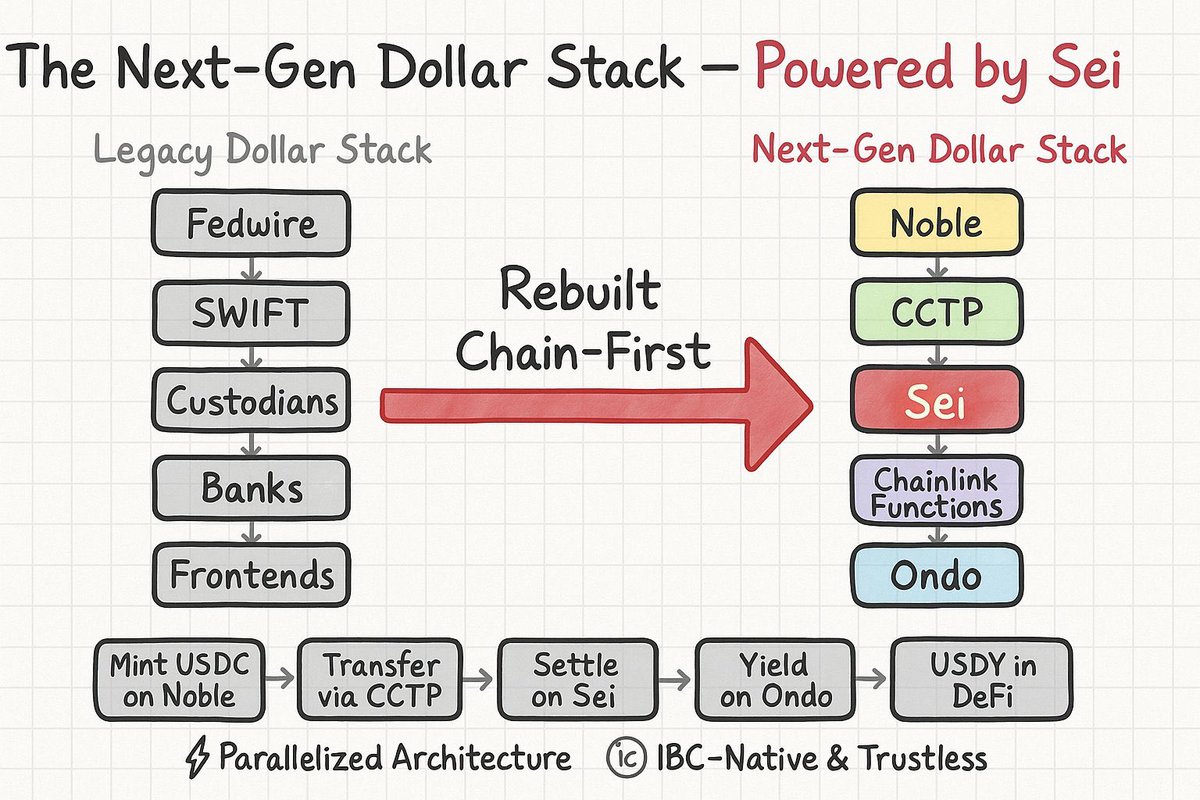

In TradFi, the stack looks like:

Fedwire → SWIFT → Custodians → Banks → Frontends.

In crypto, the new stack is starting to look like:

Noble → CCTP → Sei → Chainlink Functions → Apps like Ondo → Final $USDY/$USDC holders.

● Why SEI Is Becoming the Core Execution Layer

What makes @SeiNetwork uniquely suited to sit at the middle of this stack?

Three reasons:

1️⃣ Performance-optimized for orderflow

Sei’s parallelized architecture is ideal for stablecoin flows that need low-latency, high-throughput settlements especially in use cases like cross-exchange arbitrage, liquid staking, and RWAs.

2️⃣ Finality ≈ 380ms

That’s a gamechanger. Instant finality makes mint/redeem cycles (CCTP) dramatically more reliable and composable in production.

3️⃣ Cosmos-native modularity

Sei integrates natively with Noble (where Circle issues native $USDC) and bridges out to the broader IBC ecosystem without wrapping or bridging risk.

● What Happens When Stablecoins Settle Instantly?

You can think of Sei as the settlement layer for stablecoin-enabled yield infrastructure.

Example flow:

→ $USDC minted via Noble

→ Transferred via CCTP into Sei

→ Swapped or deposited into @OndoFinance vaults for tokenized T-bills ($USDY)

→ Yield-bearing $USDY sent into DeFi apps on Sei or IBC

All of this happens fast, natively, trustlessly with Chainlink validating state and $USDY composability now on the roadmap.

That’s not just a feature.

That’s an alternative money system.

✍️ My Take

Most people are still watching hype.

I’m watching rails.

When stablecoins 5x, they won’t just need liquidity...they’ll need throughput, finality, and native interoperability.

That’s why Sei is becoming the preferred execution layer for the next-gen dollar stack.

And it’s why I'm watching it closely.

19.36K

132

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.