It's not 1971.

It's 2025.

Stablecoins are the new mechanism to amplify the network effect of the dollar + generate a (decentralized) new global buyer of US debt.

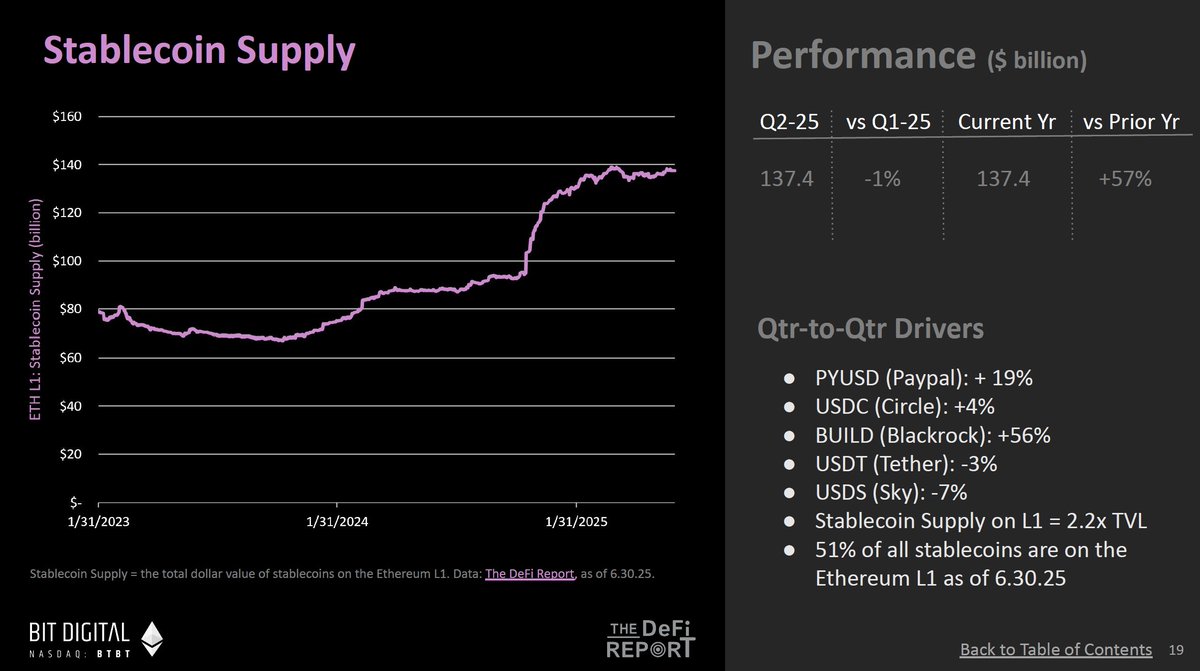

55% of the stablecoins are on the Ethereum Network.

What does it all mean for ETH holders?

Link to the Q2 edition of The ETH Report and supporting @Dune dashboard below 👇

Bessent is Kissinger.

Trump is Nixon.

Stablecoins are the new "petro dollar."

Tether is the new Saudi Arabia.

We just entered a new regime. A new "magic trick" — one designed to amplify the network effect of the dollar and decentralize the holder base of U.S. debt.

It's not a "Mar-a-Lago accord"

It's called the GENIUS Act

---

I wrote about this last week for readers of @the_defi_report

If you'd like to check out the latest research, you can so via the link below 👇

2.99K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.