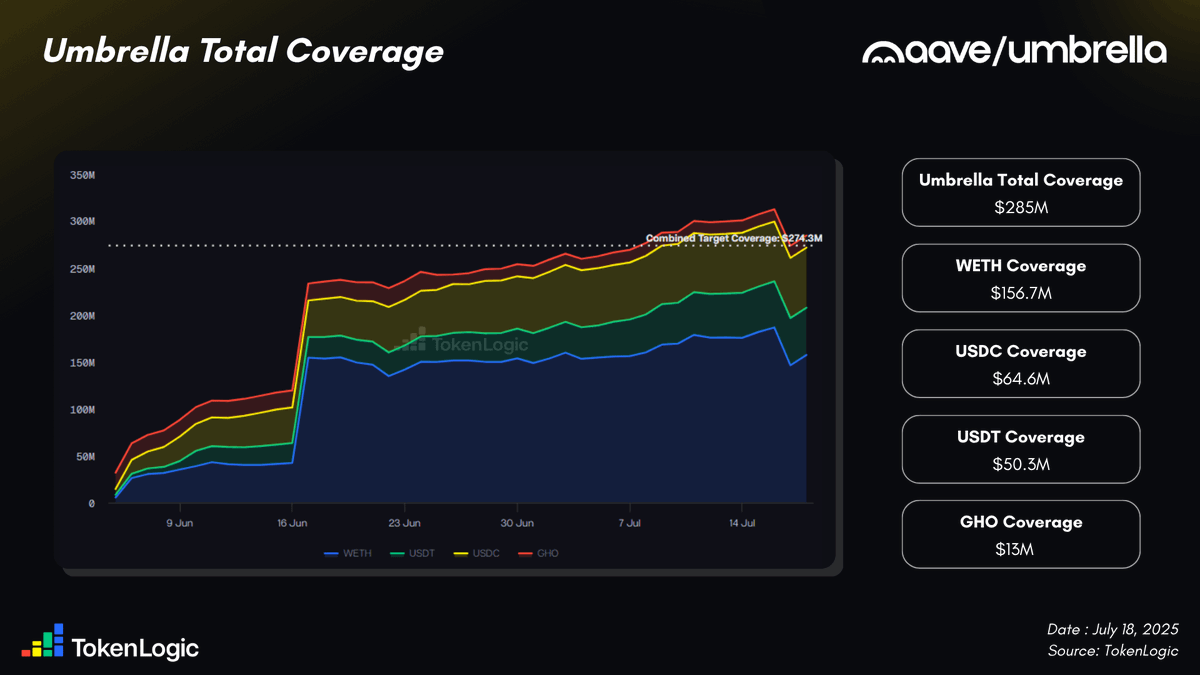

With over $285M in coverage, Aave is by far the most secure lending protocol in DeFi.

Umbrella shields the protocol in real time from bad debt on $ETH, $USDC, $USDT, and $GHO.

Together, $ETH, $USDC, and $USDT represent 87% of total borrowings on the Core instance, which is why they were selected for Umbrella coverage.

Bad debt is one of the biggest threats for any lending protocol.

Without proper protection, it can completely collapse and never recover, as this kind of failure breaks trust and damages the platform’s reputation.

Aave and Gearbox are the only protocols that have funds allocate for protecting users, with Umbrella being the first fully automate system built by @bgdlabs.

Its coverage is 2.5x larger than the combined treasuries of Morpho and Euler.

No other protocol comes close to this level of protection.

And the best part? It is fully funded by over $100M in real, organic protocol revenue, with an annual budget of $9.1M.

In return, users who deposit earn juicy yields. For example, stkaUSDT is currently yielding 9.9%.

18.46K

58

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.