One of the most worthwhile tokens to stock up on for the long term is TRX

Every time the market fluctuates, waves of lively narratives are staged in the cryptocurrency circle, and the projects that can really cross the bull and bear are finally returned to quiet data. That's exactly what TRON is. From 2018 to the present, TRON has firmly established itself on the most basic and realistic application scenario: the world's largest stablecoin payment network.

Tens of billions of dollars of funds are settled through TRON every day, and on-chain fees and financial service income continue to accumulate, constituting TRON's stable underlying cash flow. This confidence comes from the real use of users around the world, laying the foundation for expanding from stablecoins to DeFi and RWA.

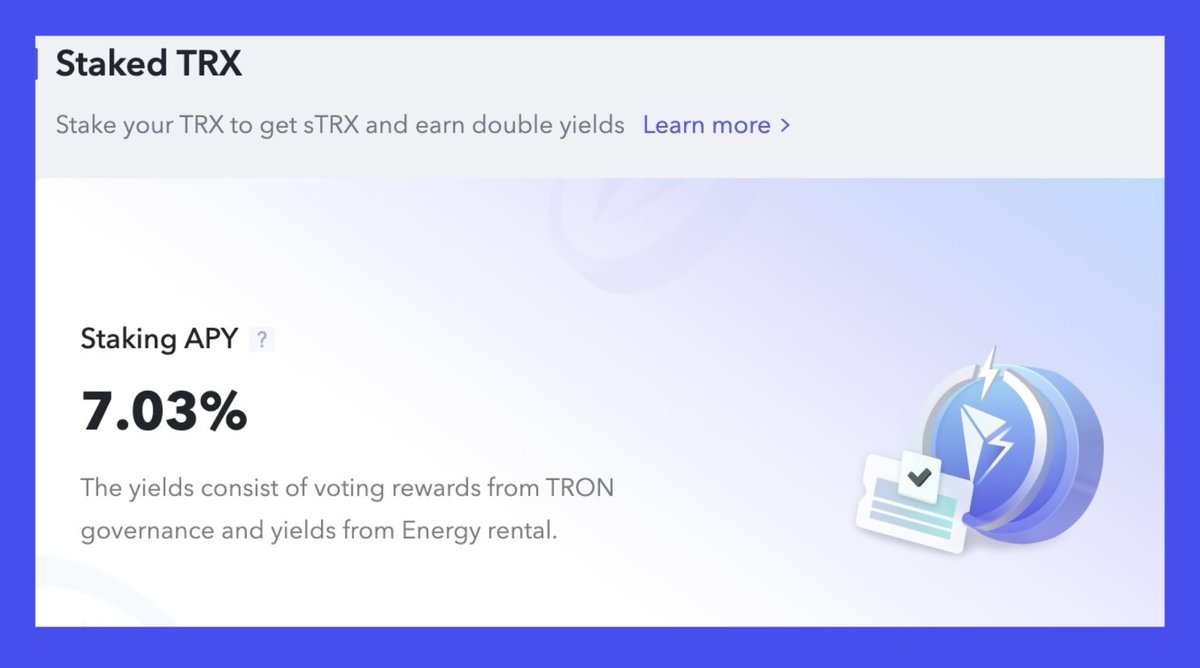

The high APY of sTRX makes holding TRX more deterministic for the long term

The core of on-chain finance will always be the rate of return. However, high yields are easy, but high yields and steady sustainability are not easy to achieve. Instead of creating or subsidizing TRON out of thin air, TRON annualized sTRX rewards on-chain revenue and fees to staking users.

For those who are optimistic about TRX for a long time, simply hoarding coins is just a price game, while sTRX staking can not only obtain stable APY, but also form a positive cycle of token holding and income in the continuous growth of the TRON ecosystem. To some extent, sTRX has become an important plus point for TRX's long-term allocation, allowing funds to not only stay on the chain, but also continue to generate income.

Ecological transition: from the payment chain to the closed loop of capital flow

In the past, when it came to TRON, the first reaction of most people was the stablecoin transfer chain. But in the past two years, TRON's role has been quietly changing. The rollout of a series of on-chain financial infrastructures such as JustLend, Sun io, and Smart Allocator has actually built TRON into a self-contained closed loop of capital flows.

TRON is no longer just a simple USDT transfer tool, but a network that can support multiple financial scenarios such as on-chain lending, wealth management, and asset scheduling. Combined with the introduction of decentralized USDD and RWA assets, this network has even begun to map to the real asset world. Real asset returns and on-chain fund interoperability have begun to appear a clear interaction path.

Brother Sun's strategic layout: All in USA, no longer just a hot chase

Brother Sun's changes this year are visible to the naked eye: from frequent hot spots in the past to a low-key and pragmatic layout of the US market, the strategic focus has been completely shifted.

He has invested heavily in WLFI projects, personally serving as an advisor, strategically investing resources and actively engaging with the mainstream U.S. financial narrative. Behind this is his judgment of the trend: the future of the chain cannot exist separately from the real financial system, and the compliance tracks of RWA, stablecoin compliance and ETF are the real important battlefields in the next cycle.

This pragmatic layout is not a change in Brother Sun's style, but the essence of long-termism that he has always been clear: landing first, then layout, and never making a pavilion in the air.

It's no accident that TRON has come to where it is today.

It has chosen a less sexy, but more long-term and pragmatic path.

@justinsuntron @trondaoCN #TRONEcoStar

Show original

13.47K

37

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.