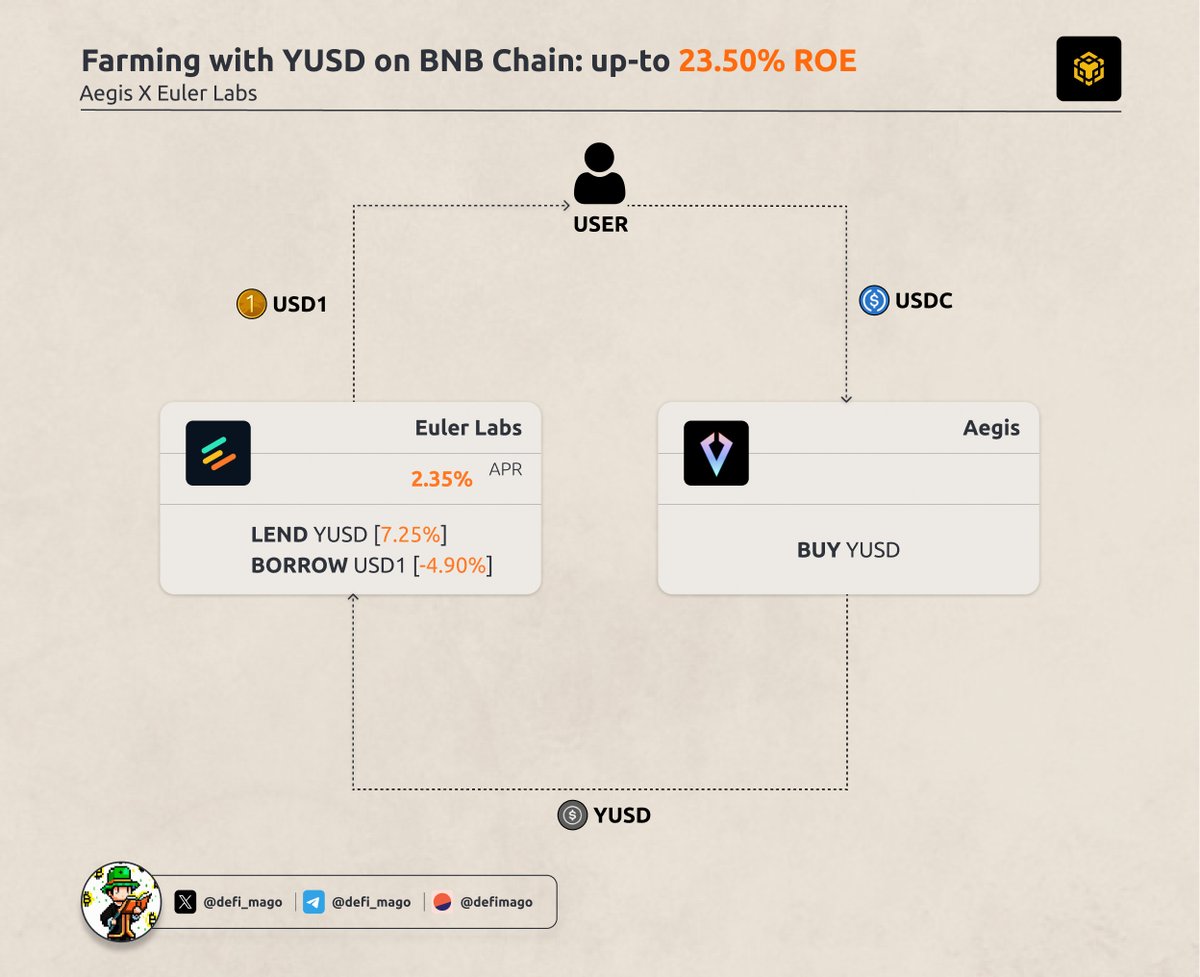

Stablecoin farming strategy on @BNBCHAIN: up-to 23.50% ROE

The core idea:

Farm the spread between lending and borrowing rates.

• Supply $YUSD → earns 7.26% APY

• Borrow $USD1 → costs only -4.9% APY

So if you loop it (borrow + resupply) enough times, you’re farming leveraged APY out of thin air.

───────

The loop (manual version):

1️⃣ Get $YUSD from @aegis_im → bonus 10% points link

→

2️⃣ Supply $YUSD to @eulerfinance

3️⃣ Use it as collateral → borrow $USD1

4️⃣ Swap $USD1 back to $YUSD

5️⃣ Repeat the loop

LTV = 90% → Max ~10x leverage

→ Do this around 20 times and you’re looking at ~23% APY

───────

Lazy mode?

Use Euler’s built-in Multiply button. It handles all the loops for you.

You’ll earn ~1.5% less APY

BUT it’s way safer + faster

And you still get ~27x points from 9 loops × 3x boost

→ Big if you’re farming future airdrops or multipliers

───────

Not into leverage?

Just throw your $YUSD into the Re7 Labs Cluster Vault

Still 7.26% APY

Plus a 3x points multiplier

→ So it’s better than just holding YUSD

───────

Easy money for stable holders. DeFi's alive if you know where to look 🧪

17.12K

117

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.