ZK has always been the proposed endgame for Ethereum scaling and is advancing faster than anticipated, aggressively pulling forward timelines. Still, there is a lack of clarity around the market design when enshrining ZK in the L1.

A short 🧵of my EthCC talk on this topic ↓

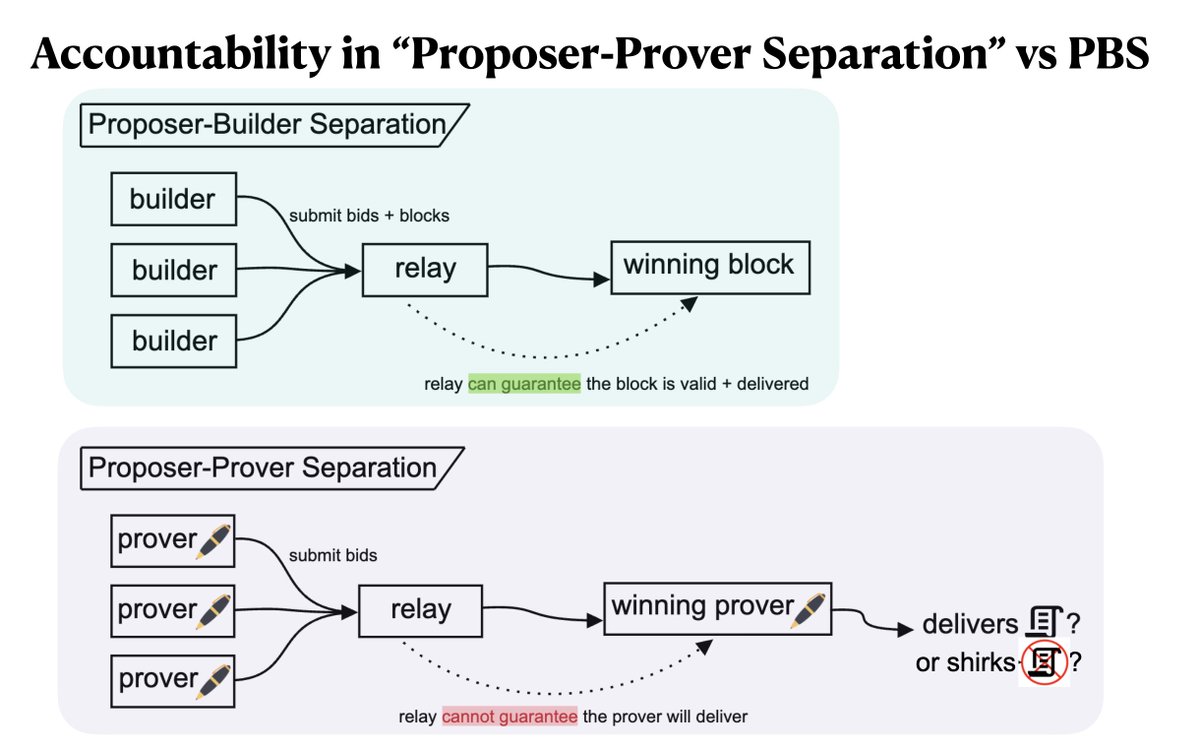

1/ It’s helpful to compare proof delegation to the familiar PBS auction. Both outsource complex tasks to external parties, but cash flows in opposite directions:

builders buy valuable blockspace

provers sell the service of proof generation

This makes prover accountability harder

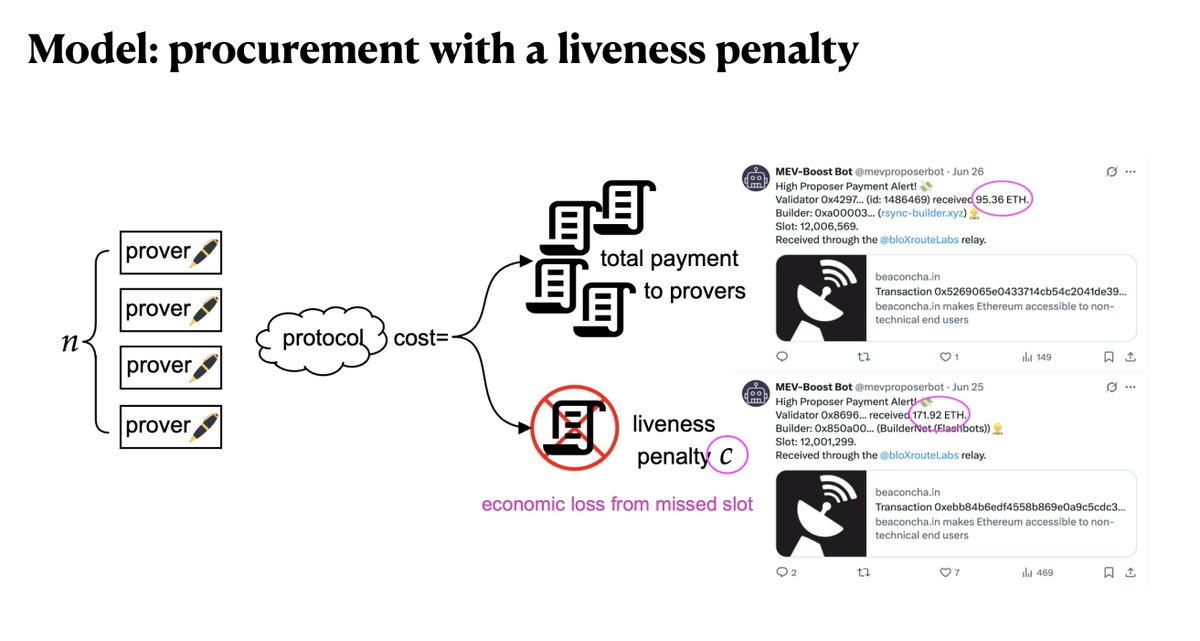

3/ We introduce a model for procurement with a liveness penalty. The penalty C captures the economic loss from a missed slot, and is incurred if no proof is supplied. This can be as large as hundreds of ETH (per recent MEV-Boost winning bids @mevproposerbot)!

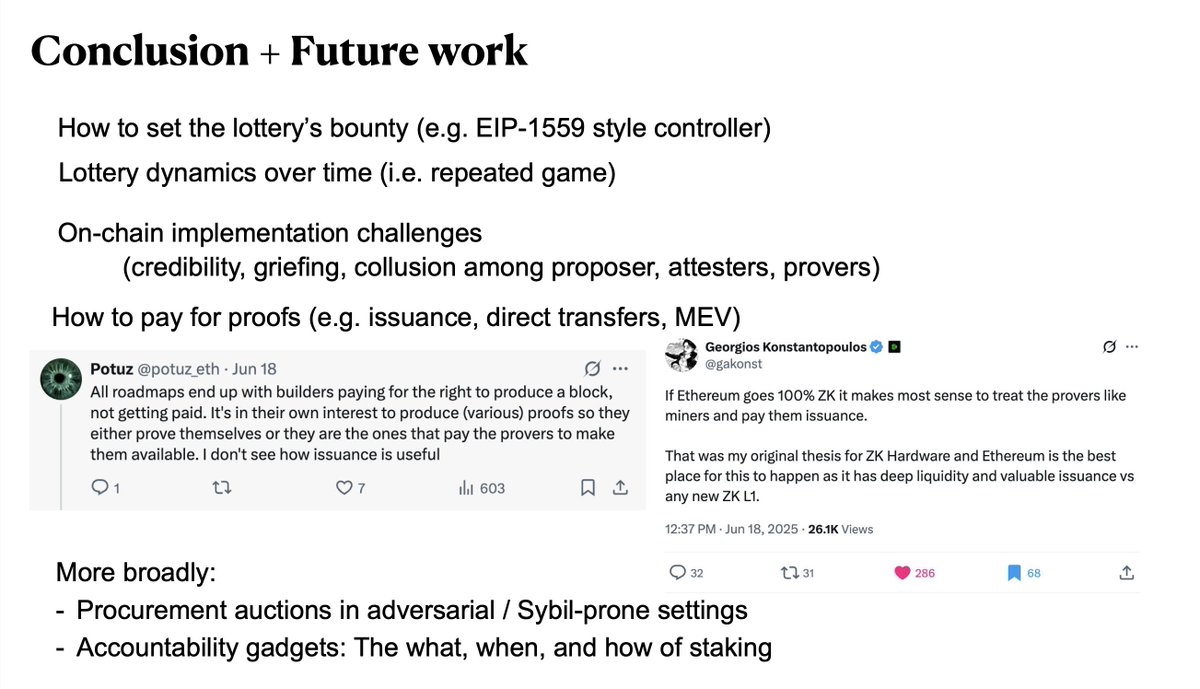

7/ In summary, proof procurement is not one size fits all. The adversarial environment is akin to (and arguably more nuanced than) the one in TFM design, but without nearly as much supporting literature. Some open questions below.

h/t @ks_kulk @_julianma @kevaundray for their related posts:

-

-

6.56K

34

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.