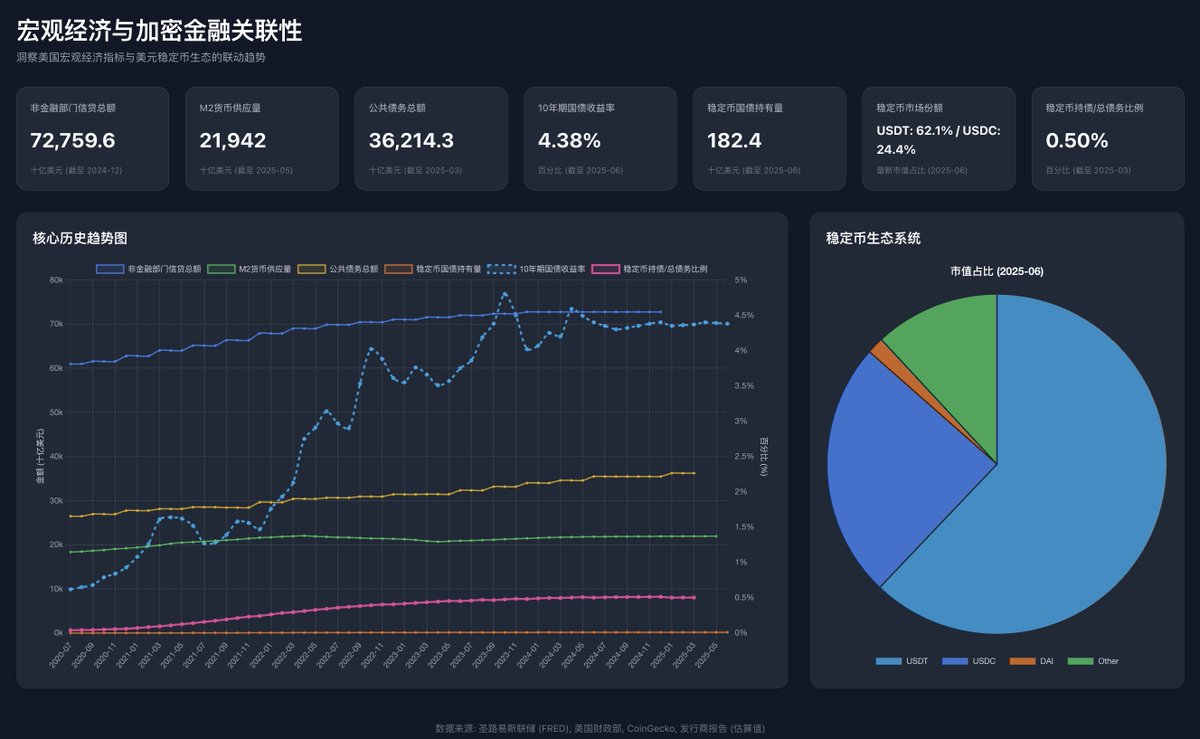

"The Relationship Between Macroeconomics and Cryptocurrency Finance" 📊

Insights into the linkage trends between U.S. macroeconomic indicators and the U.S. dollar stablecoin ecosystem.

Total U.S. credit, total U.S. money supply, total U.S. government bonds, bond interest rates, stablecoin bond holdings, stablecoin market share, stablecoin debt ratio.

Credit + Money Supply = Total Expenditure (the driving force of the economy)

Government bonds represent the total amount issued by the U.S. federal government.

Credit is the most important component of the economy.

Powered by AI.

Show original

2.33K

6

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.