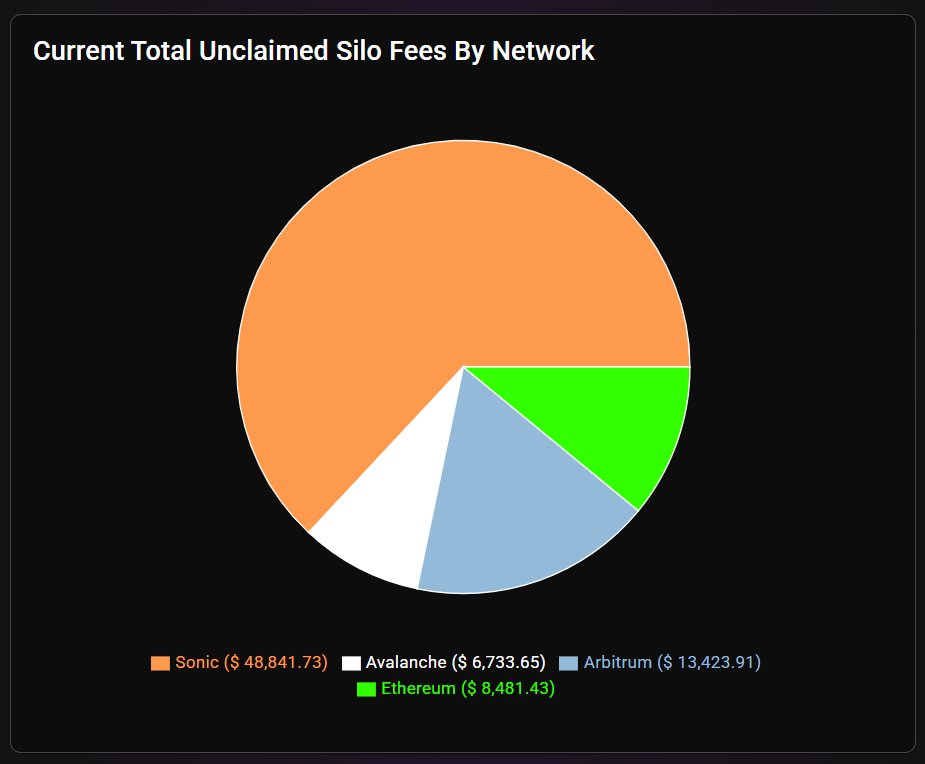

DAO revenue is now healthily diversified across our 4 v2 deployments:

🟠 Sonic → 63.0%

🔵 Arbitrum → 17.3%

🟢 Mainnet → 11.0%

🔴 Avalanche → 8.6%

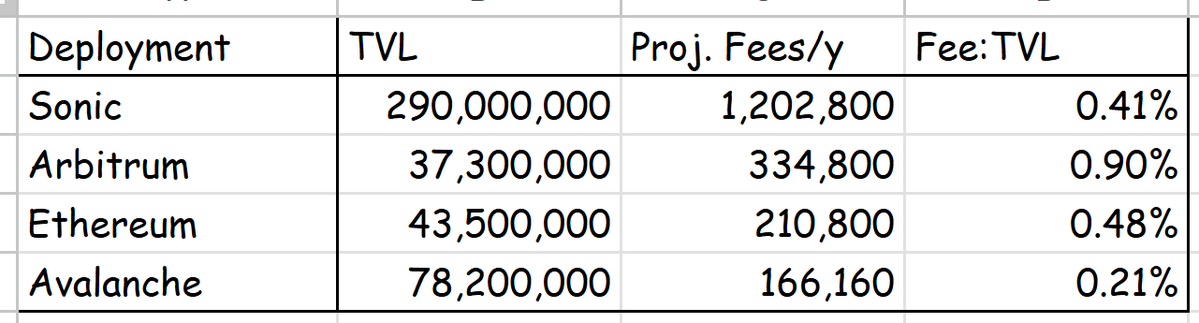

Fees to date is ~2x ⏫ from this time last month with projected annual revenue @ ~$1.9m (giving us a P/S of 17.9x).

As a point of comparison, Silo Arbitrum is the most fee:TVL efficient deployment largely driven by high borrow demand against sUSDX.

Silo Avalanche appears to be underperforming at a surface level but this is driven by immense TVL growth (+62% MoM) with utilization lagging.

TL;DR send this shit to the moon BABY

SILO INTERN

6.38K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.