1/

Solana had a record-breaking Q1.

Q2? More of a reset & regroup.

Onchain activity fell sharply — and so did yield, burned SOL, and tokenholder value.

We covered it all in Q2-25 edition of The SOL Report.

No noise or hype. Just facts & data w/qtr-to-qtr explanation.

Here’s what every SOL holder needs to know 👇

[link to the Q2 report + 9 supporting data dashboards below]

2/

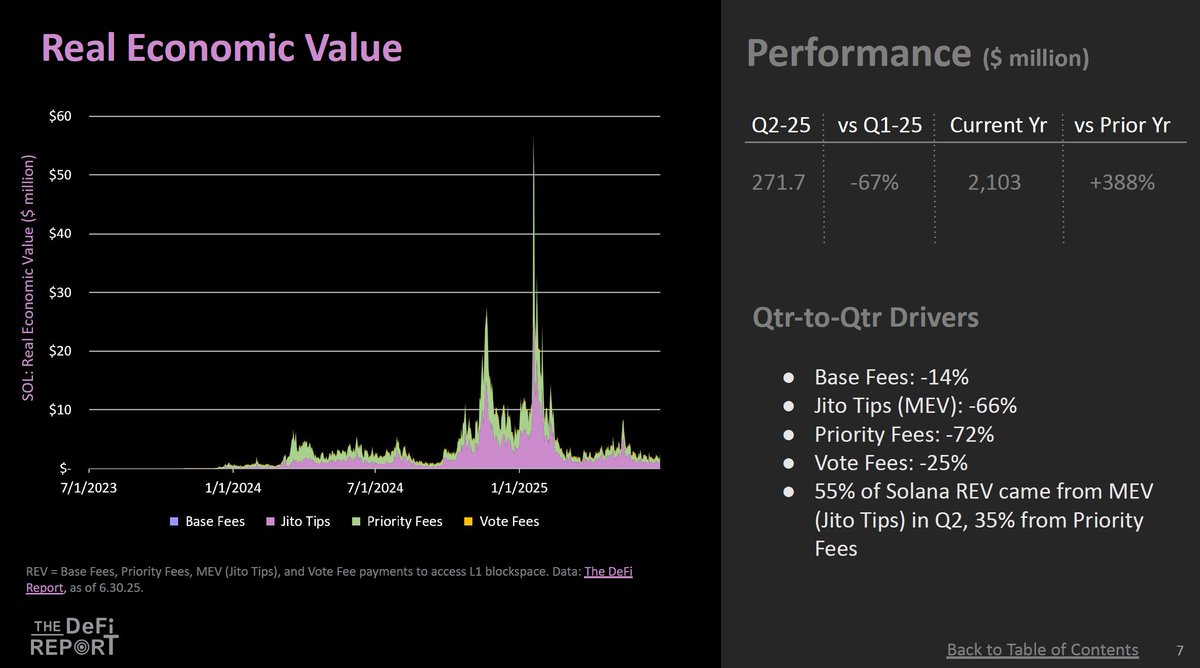

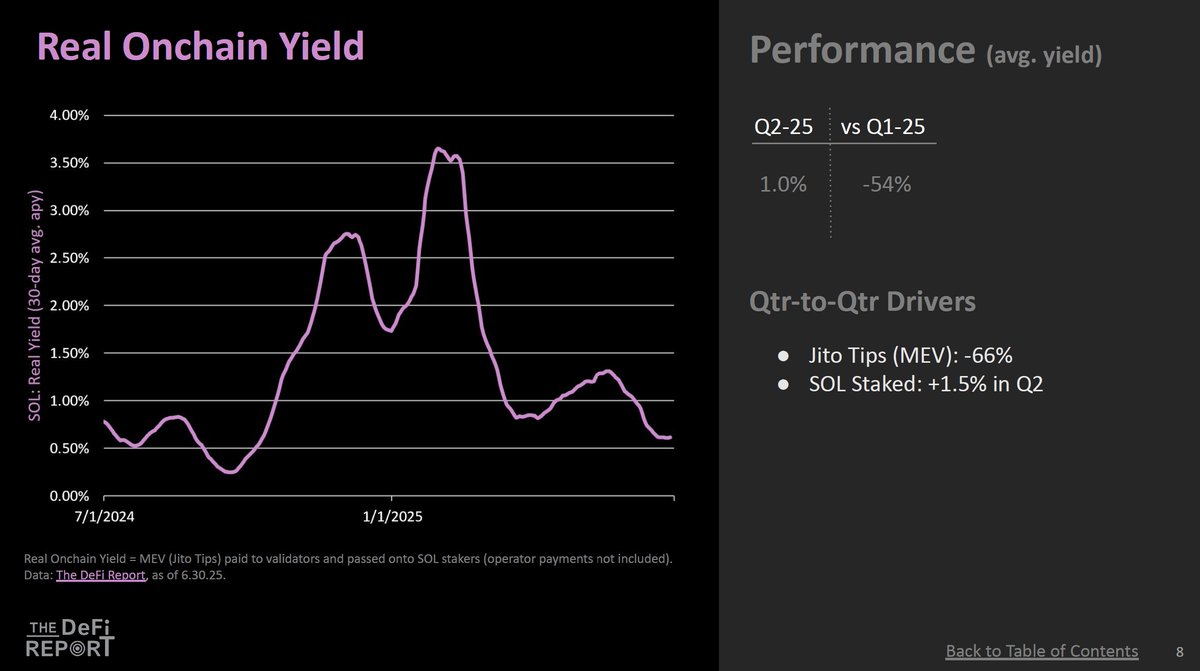

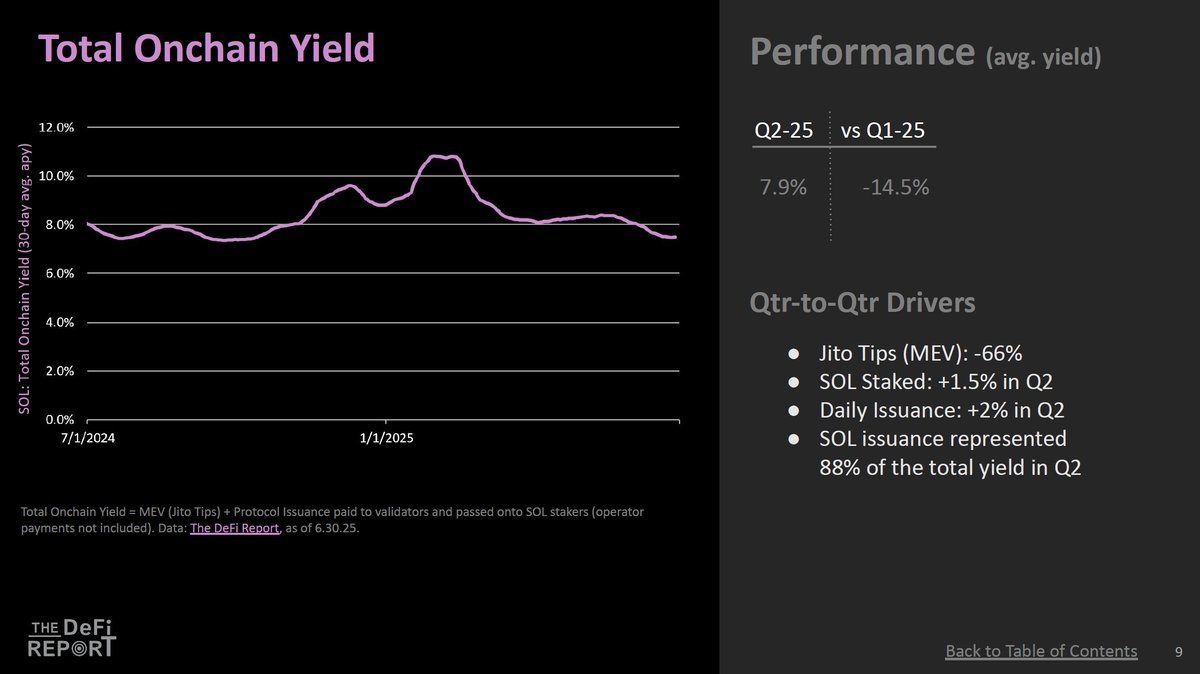

Revenue & Yields:

Solana’s Real Economic Value fell 67%, and the average Real Onchain Yield in the quarter fell 54% due to a 66% decline in Jito Tips (MEV).

Total Onchain Yield dropped a more modest 14.5%, supported by issuance, which made up 88% of the yield in Q2 (up from 80% in Q1).

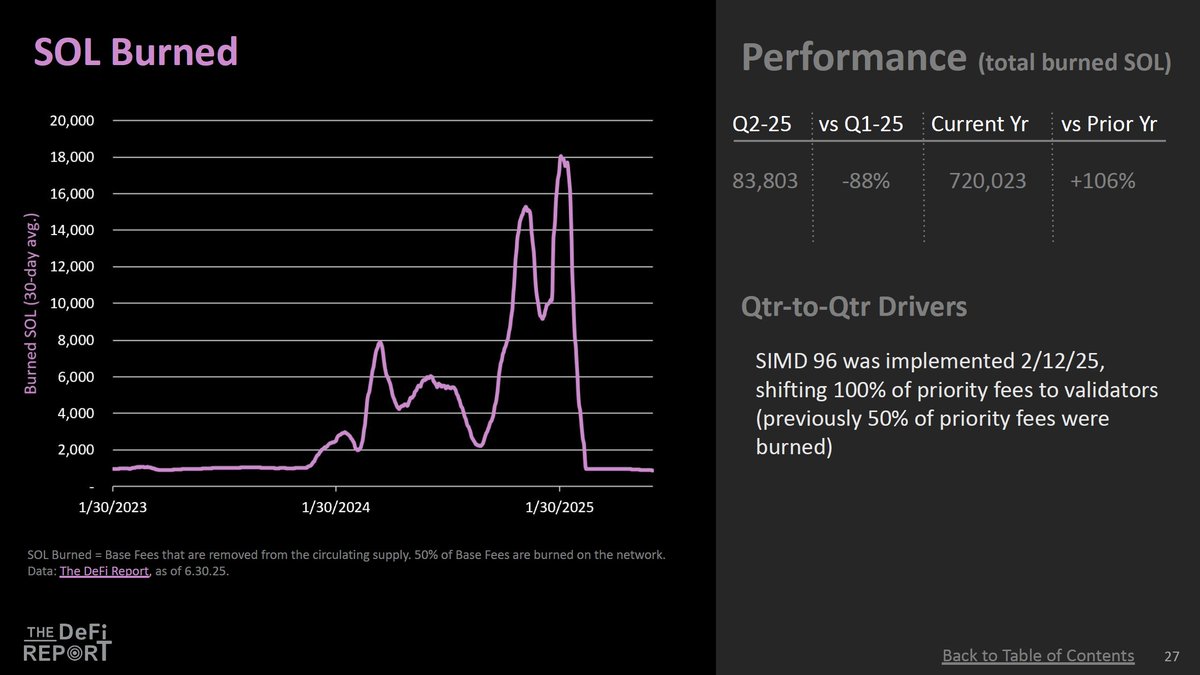

4/

Token Economics

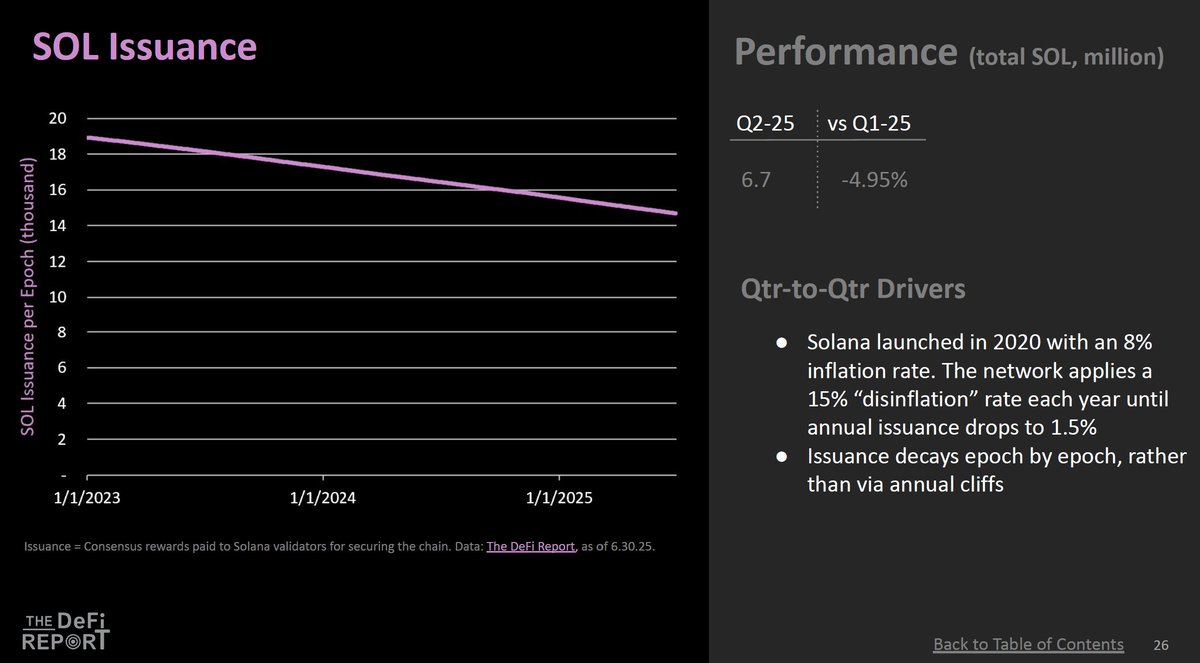

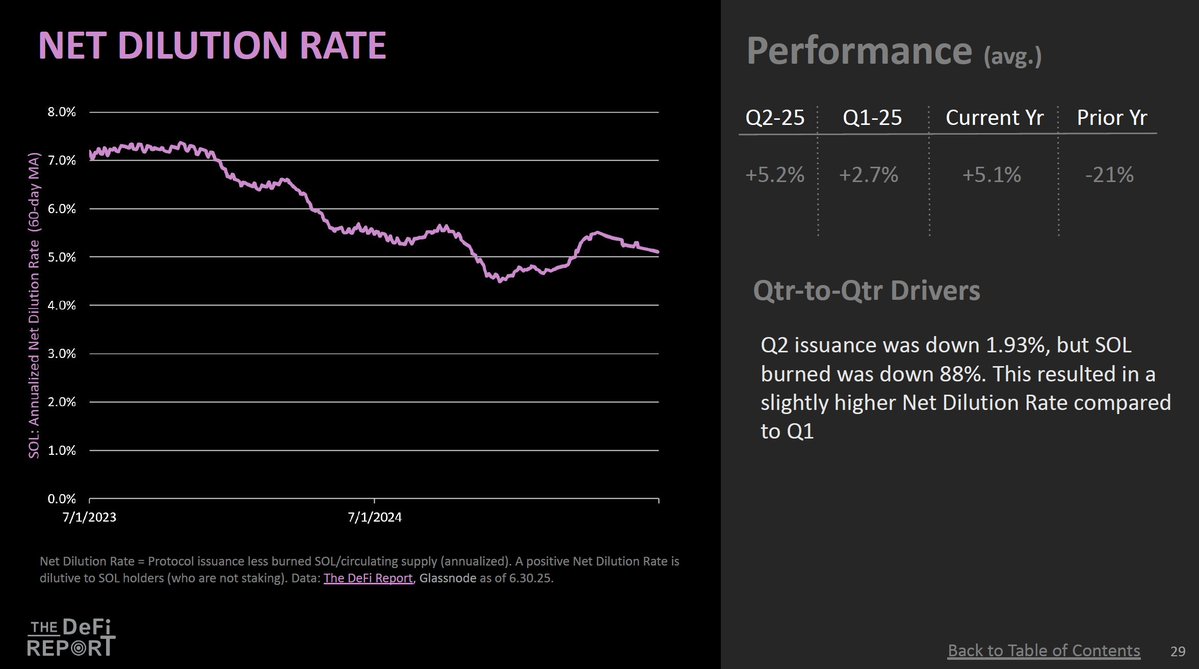

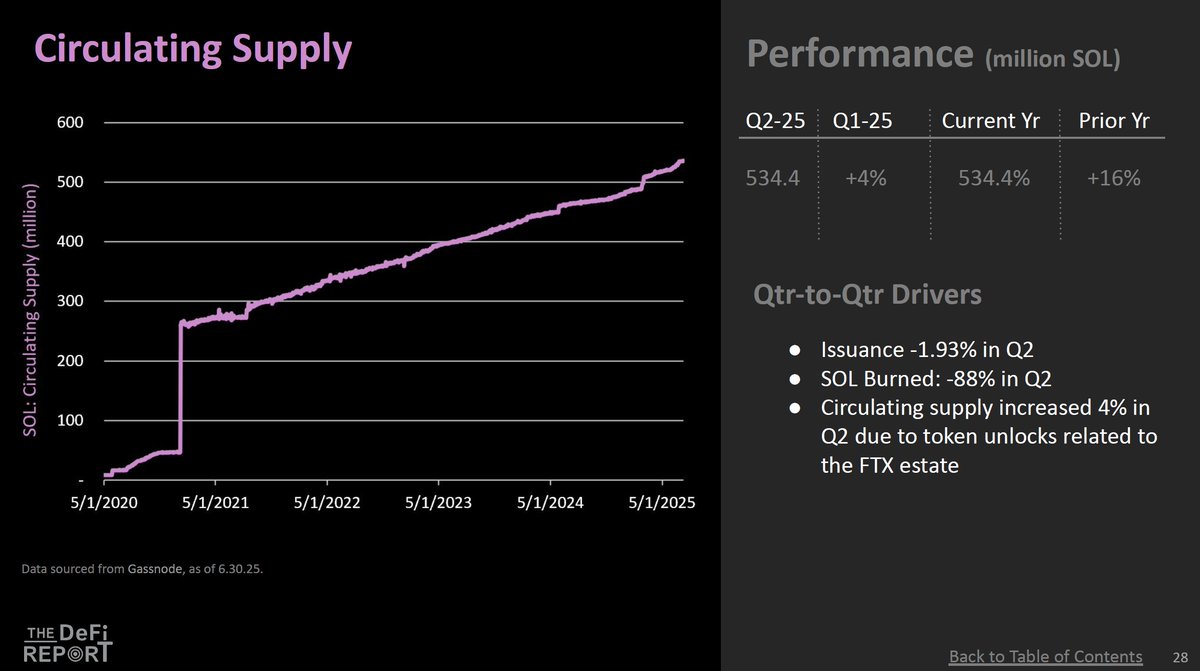

SOL burned collapsed 88% in the second quarter, offset by issuance dropping 4.95%.

The end result was an increase in the Net Dilution Rate to 5.2% (up 2.7% from Q1).

Furthermore, unlocks related to the FTX estate pushed the circulating supply up 4% in Q2.

11.48K

20

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.