But this wave of data is incentivized through $UNI.

Selling $UNI incentivizes Unichain -> Unichain data is very good -> Everyone buys $UNI.

The core reason for my heavy investment in $uni this time is not much related to unichain, but I have been tracking the data changes in L2.

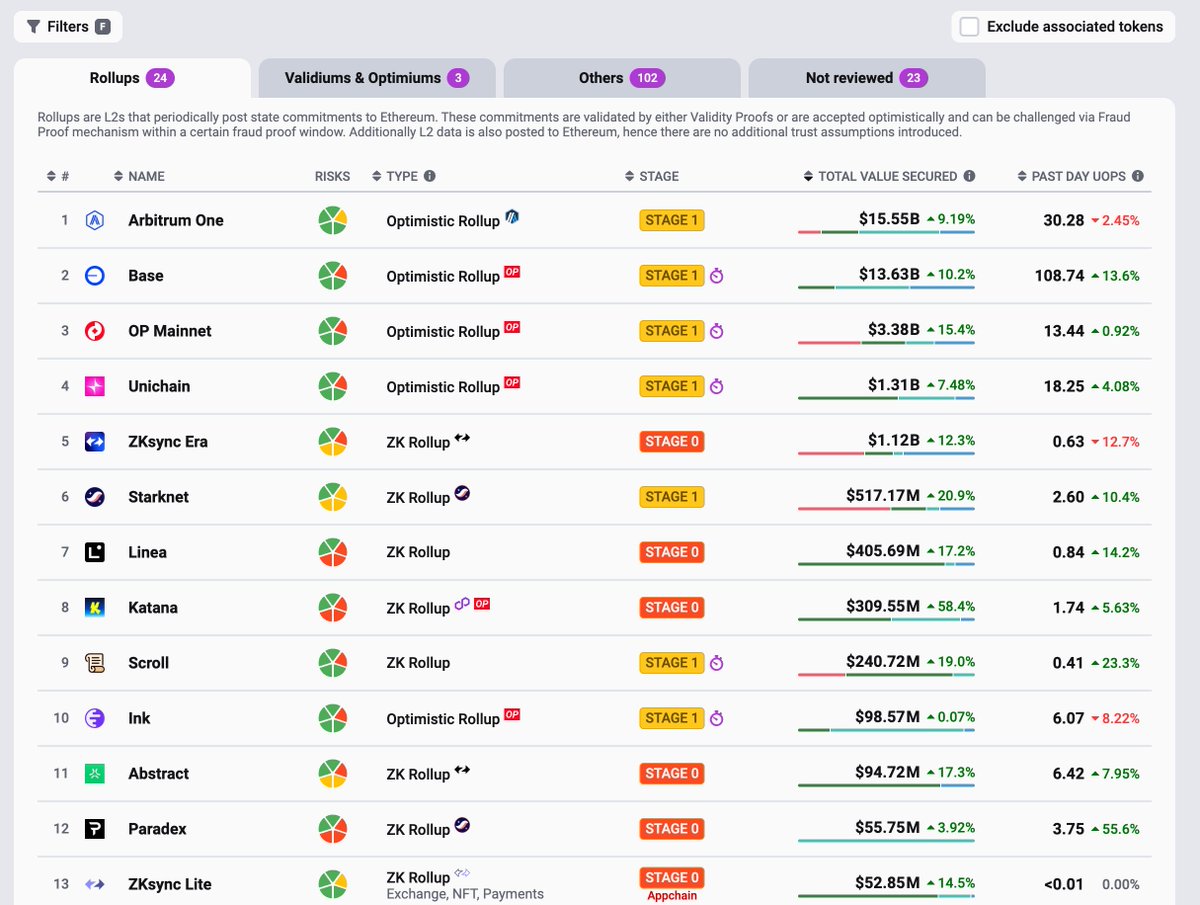

Unichain is an L2 that started halfway through; I can't say it has done particularly well or made significant progress, but in terms of TVL and trading volume, it consistently ranks in the top 5.

However, one conclusion can be drawn: the upcoming L2s are basically paper-thin, collapsing completely, and there is a serious issue of homogenization. Currently, the data aspect has basically been completely abandoned by the market, and the project has made no progress, likely it won't in the future either.

Starknet, Linea, Scroll, and Blast were all the rage at one point, but at this moment, I can't think of any advantages that could break the deadlock; currently, it seems like a project that has already died once.

4.65K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.