Stablecoins Are Becoming the Infrastructure for Global Dollar Access

Q2 2025 confirmed the stablecoin sector’s growing role as financial backbone:

• $2T+ in monthly adjusted volumes

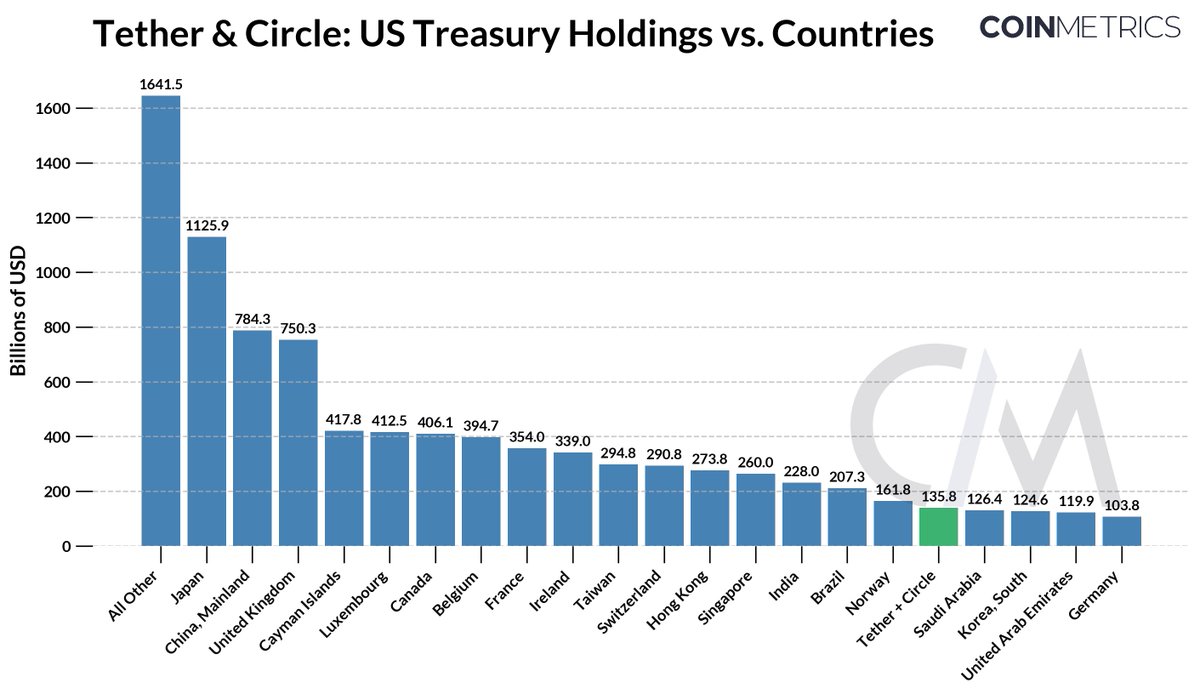

• $135B+ in U.S. Treasuries held by $USDT and $USDC issuers

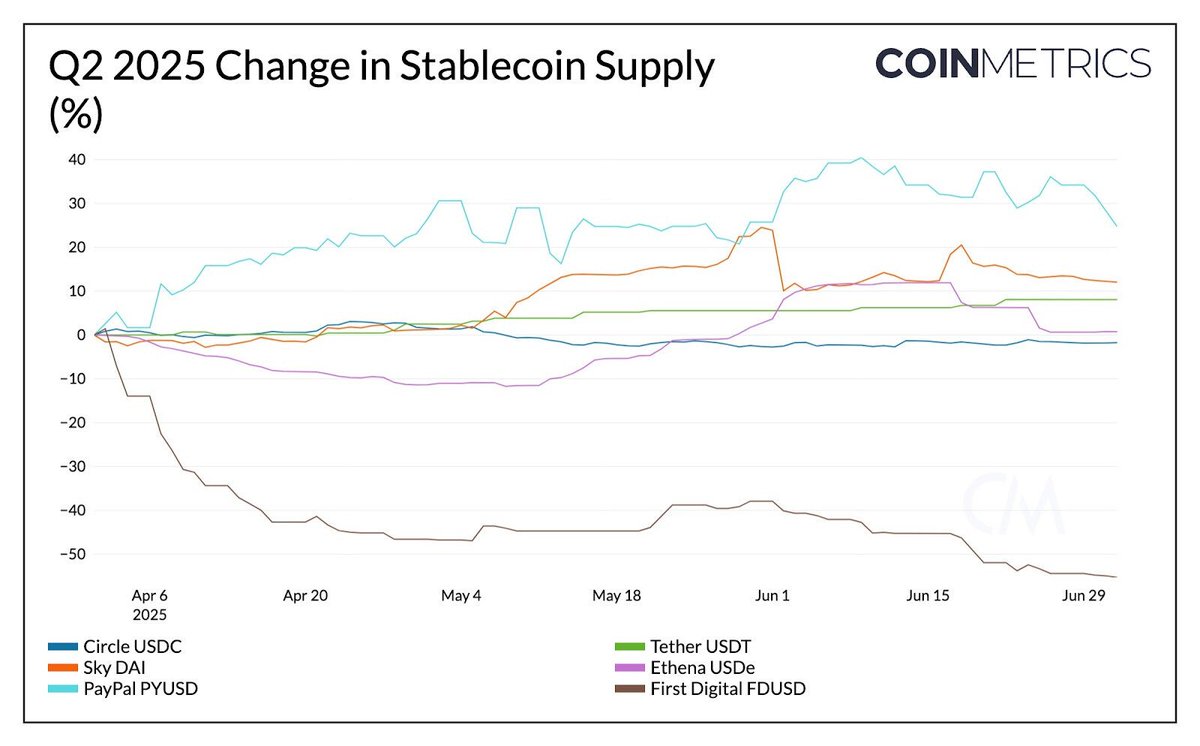

• $245B total supply, with $PYUSD crossing $1B

• GENIUS Act advanced in the Senate, setting the stage for U.S. regulatory clarity

Stablecoins are no longer just crypto plumbing - they’re emerging as programmable dollars with real monetary reach. The GENIUS Act proposes strict reserve, reporting, and compliance standards that could invite banks, fintechs, and Big Tech into the issuer landscape.

@Circle’s IPO, @Stripe’s product push, @JPMorgan’s @Base-based $JPMD pilot, and ongoing @Visa and @Mastercard integrations all point to one thing:

Stablecoins are evolving into global-scale dollar rails.

Full Q2 analysis in our latest State of the Network report: Link in replies

32.49K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.