A Deep Dive into Uniswap V4 Incentivized Farming Pools on Unichain

Uniswap, the leading DEX in the DeFi ecosystem, has undergone significant evolution with the release of Uniswap V4 and the launch of Unichain, a L2 solution designed to optimize DeFi trading.

This post provides a comprehensive exploration of Uniswap V4’s incentivized farming pools on Unichain, covering their mechanics, benefits, risks, and strategic considerations for liquidity providers and farmers.

By leveraging recent developments and technical advancements, we will unpack how these pools function, why they are attractive, and what users need to know to participate effectively.

What is Uniswap V4?

Uniswap V4, launched on January 31, 2025, represents a significant upgrade to the Uniswap protocol, building on the capital efficiency of Uniswap V3 while introducing unprecedented flexibility and cost optimizations.

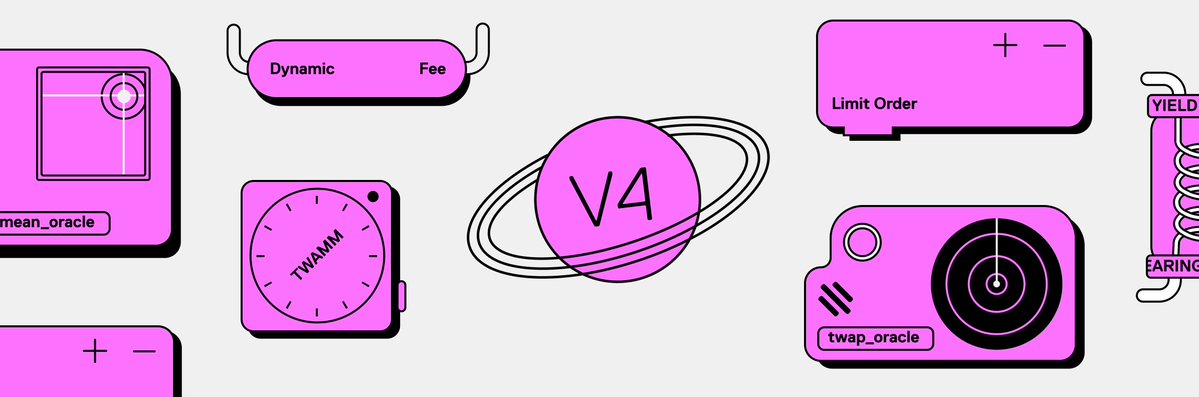

Key features of V4 include:

🟢Singleton Contract Architecture: All liquidity pools are managed under a single contract (PoolManager.sol), reducing gas costs for pool creation and multi-hop swaps by up to 99% compared to V3. This eliminates the need to deploy separate contracts for each pool.

🟢Hooks: Hooks are external smart contracts that allow developers to customize pool behavior at various lifecycle stages (e.g., before/after swaps, liquidity addition/removal). This enables advanced features like dynamic fees, on-chain limit orders, and timeweighted average market makers (TWAMMs).

🟢Flash Accounting: Using EIP-1153 Transient Storage, V4 optimizes token transfers by netting balance changes within a transaction, reducing gas costs for complex operations like multi-pool swaps.

🟢Dynamic Fees: Pools can adjust fees based on market conditions (e.g., volatility, trading volume), offering LPs better compensation and traders’ lower costs.

🟢Native ETH Support: V4 supports native Ether without requiring wrapping to WETH, simplifying transactions, and reducing costs.

These features make Uniswap V4 the most customizable and gas-efficient version of the protocol, setting the stage for advanced DeFi strategies, including incentivized farming pools.

What is Unichain?

Unichain is an Ethereum L2 rollup developed by Uniswap Labs, launched on mainnet in February 2025.

Built on the Optimism OP Stack and integrated into the Superchain ecosystem, Unichain is designed to be the liquidity hub for DeFi, addressing key challenges like high gas fees, slow transaction finality, and liquidity fragmentation across chains.

Key features of Unichain include:

🟢Low Transaction Costs: Transactions cost approximately $0.0002, making it highly cost-effective for users and LPs.

🟢Fast Block Times: Unichain offers near-instant transaction finality, improving user experience for trading and farming.

🟢Rollup-Boost Upgrade: Introduced in May 2025, this feature uses a trusted execution environment (TEE) for block building, further enhancing performance.

🟢Liquidity Incentives: Unichain launched a $50 million liquidity incentive program, driving total value locked (TVL) from $9 million to over $267 million within 48 hours.

🟢Superchain Integration: Unichain unifies liquidity across Optimism-based L2s, allowing seamless cross-chain operations.

Unichain’s synergy with Uniswap V4 creates a powerful platform for incentivized farming, attracting both retail and institutional participants.

Understanding Incentivized Farming Pools

Incentivized farming pools on Uniswap V4 and Unichain are liquidity pools where LPs are rewarded with additional tokens (e.g., UNI) or points for potential airdrops, on top of standard trading fees. These incentives aim to bootstrap liquidity, increase trading volume, and attract users to the ecosystem. Let’s break down how these pools work.

Mechanics of Farming Pools

1. Providing Liquidity:

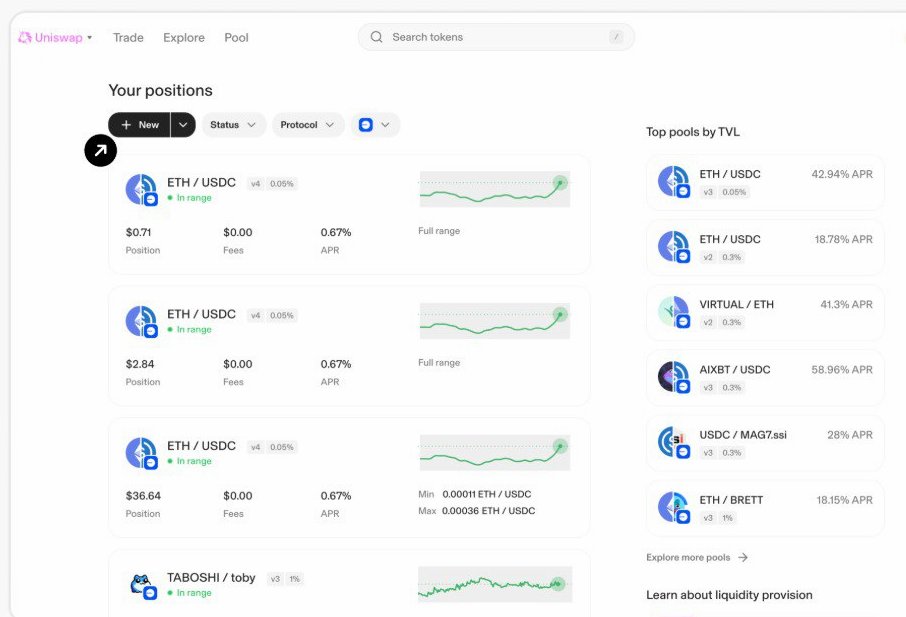

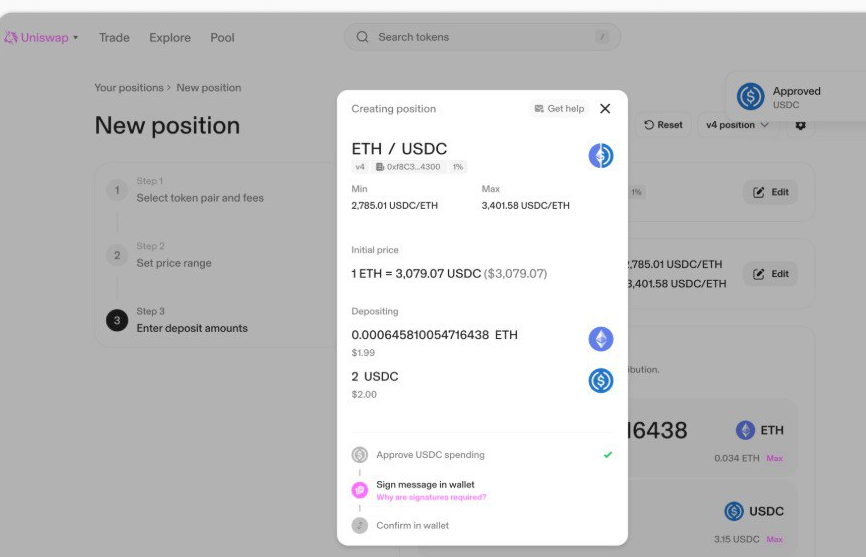

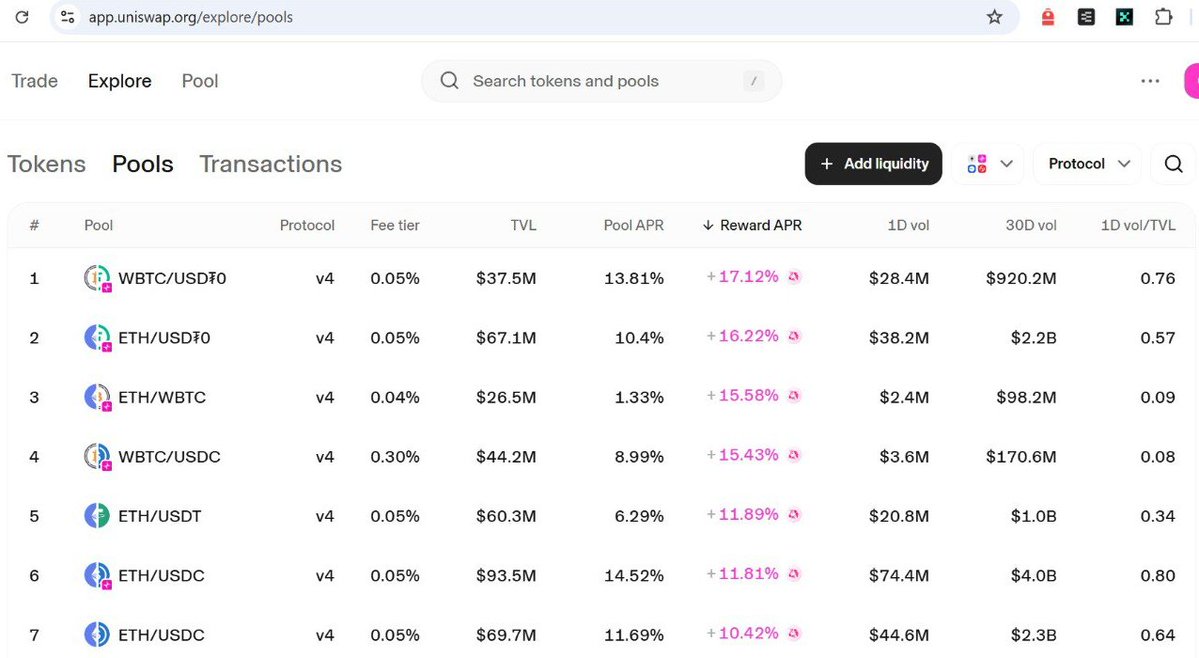

🟢LPs deposit equal values of two tokens (e.g., ETH/USDC) into a Uniswap V4 pool on Unichain. For example, the ETH/USDC (V4) pool offered APRs around 130%, while USDC/WBTC (V4) offered ~124%, however these APR’s came down now.

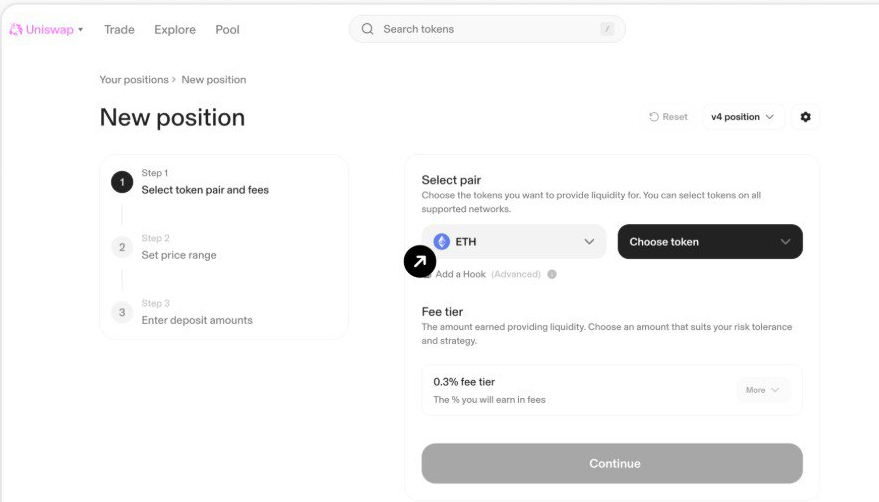

🟢LPs can specify price ranges for concentrated liquidity, a feature inherited from V3, to optimize capital efficiency. Narrower ranges increase fee earnings but expose LPs to higher impermanent loss (IL).

🟢In V4, LPs can attach hooks to customize pool behavior, such as dynamic fee adjustments or automated rebalancing.

2. Earning Rewards:

🟢Trading Fees: LPs earn a portion of the pool’s trading fees (e.g., 0.3% per swap) proportional to their share of the pool’s liquidity. V4’s dynamic fees can adjust to market conditions, potentially increasing returns.

🟢Incentive Rewards: Unichain’s $50 million liquidity program distributes UNI tokens or points to LPs in select pools. For example, providing $200 in the ETH/USDC pool can yield ~$1/day in rewards, excluding airdrops.

🟢Airdrop Potential: Early adopters who bridge assets, swap tokens, or provide liquidity may qualify for retroactive airdrops from Unichain or bridge protocols like Bungee or Jumper.

3. Staking Process:

🟢LPs receive non-fungible liquidity (NFL) tokens (NFTs) representing their pool position. These NFTs can be staked in farming contracts to earn additional rewards.

🟢To participate, users need ETH on Unichain for gas fees (available via bridges like Bungee or Jumper or purchased on centralized exchanges like Binance).

4. Automation and ALMs:

🟢Some pools leverage active liquidity managers (ALMs) powered by V4 hooks to automate LP strategies, such as rebalancing positions to minimize IL or optimize fee collection.

How to Participate

Here is a step by step guide to joining an incentivized farming pool on Unichain:

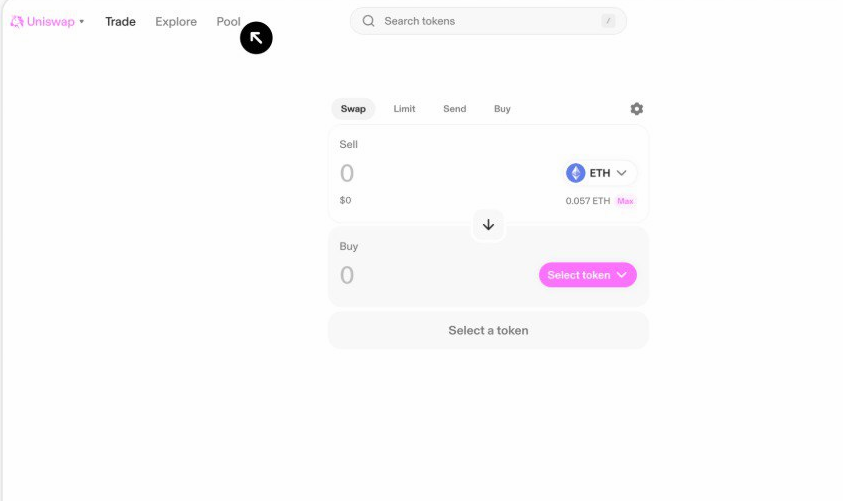

1. Set Up a Wallet: Use a wallet like MetaMask and connect it to the Unichain network

2. Acquire Tokens: Obtain the required tokens (e.g., ETH, USDC) on Unichain. Bridge assets from Ethereum or other chains using Bungee or Jumper, or buy on exchanges like Binance

3. Access Uniswap V4 : Visit select Unichain, and connect your wallet.

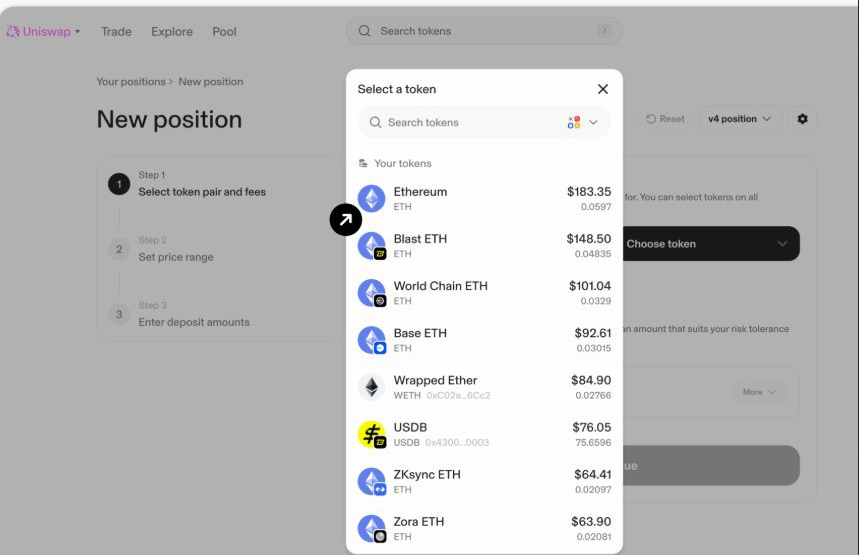

4. Choose a Pool: Navigate to the “Explore” tab and select an incentivized pool (e.g., ETH/USDC V4). Check the APR and incentive details.

5. Add Liquidity:

🟢Specify the token pair, fee tier (e.g., 0.3%), and price range

🟢Optionally, attach a hook contract for custom logic (e.g., dynamic fees).

6. Stake LP Tokens: Deposit your NFL tokens into the farming contract to earn UNI rewards or airdrop points.

7. Monitor and Manage: Track rewards and adjust positions as needed. Use ALMs for hands-off management if available.

Benefits of Incentivized Farming Pools

High Yields: APRs of 100–130% in pools like ETH/USDC and USDC/WBTC make farming highly lucrative, especially for early participants However it has come down now.

Low Costs: Unichain’s low gas fees (~$0.0002) and V4’s gas optimizations reduce the cost of providing and managing liquidity.

Airdrop Opportunities: Early adopters may receive retroactive airdrops from Unichain or bridge protocols, adding speculative upside.

Capital Efficiency: V4’s concentrated liquidity and customizable hooks allow LPs to maximize returns on their capital.

Ecosystem Growth: Unichain’s integration with the Superchain and high trading volumes ($85M daily peak) create a vibrant ecosystem for LPs and traders.

Automation: Hooks and ALMs enable sophisticated strategies, such as automated rebalancing or fee optimization, reducing manual effort.

Risks and Considerations:

While incentivized farming pools offer attractive rewards, they come with risks that LPs must carefully evaluate:

1. Impermanent Loss (IL):

🟢IL occurs when the price of tokens in a pool diverges from their initial ratio, causing LPs to lose value compared to holding the tokens. Volatile pairs (e.g., ETH/USDC) are more susceptible.

🟢Concentrated liquidity in V4 amplifies IL for narrow price ranges. LPs must actively manage positions or use ALMs to mitigate this risk.

2. Incentive Sustainability:

High APRs (10-20% now) are driven by UNI token incentives, which is not be sustainable longterm. As incentives taper, yields dropped significantly now.

3. Smart Contract Risks :

🟢While Uniswap’s core contracts have a strong security track record ($2.75T in volume without hacks), custom hooks introduce new risks. LPs should verify hook contracts before using them

🟢Unichain’s Rollup-Boost TEE introduces a trusted execution environment, which, while efficient, may raise concerns about centralization or vulnerabilities.

4. Market Risks:

🟢Price volatility in pooled assets (e.g., ETH, WBTC) can erode returns, especially in bear markets.

🟢Slippage in low-liquidity pools can impact swap efficiency, though Unichain’s high TVL mitigates this.

5. Airdrop Uncertainty:

🟢Airdrops are speculative and not guaranteed. Eligibility criteria (e.g., trading volume, liquidity provision) may change, and rewards may be diluted among many participants.

6. Gas Costs for Setup:

🟢While Unichain’s gas fees are low, initial bridging or token swaps on other chains (e.g., Ethereum) can incur significant costs. LPs should factor this into their calculations.

1.09K

18

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.