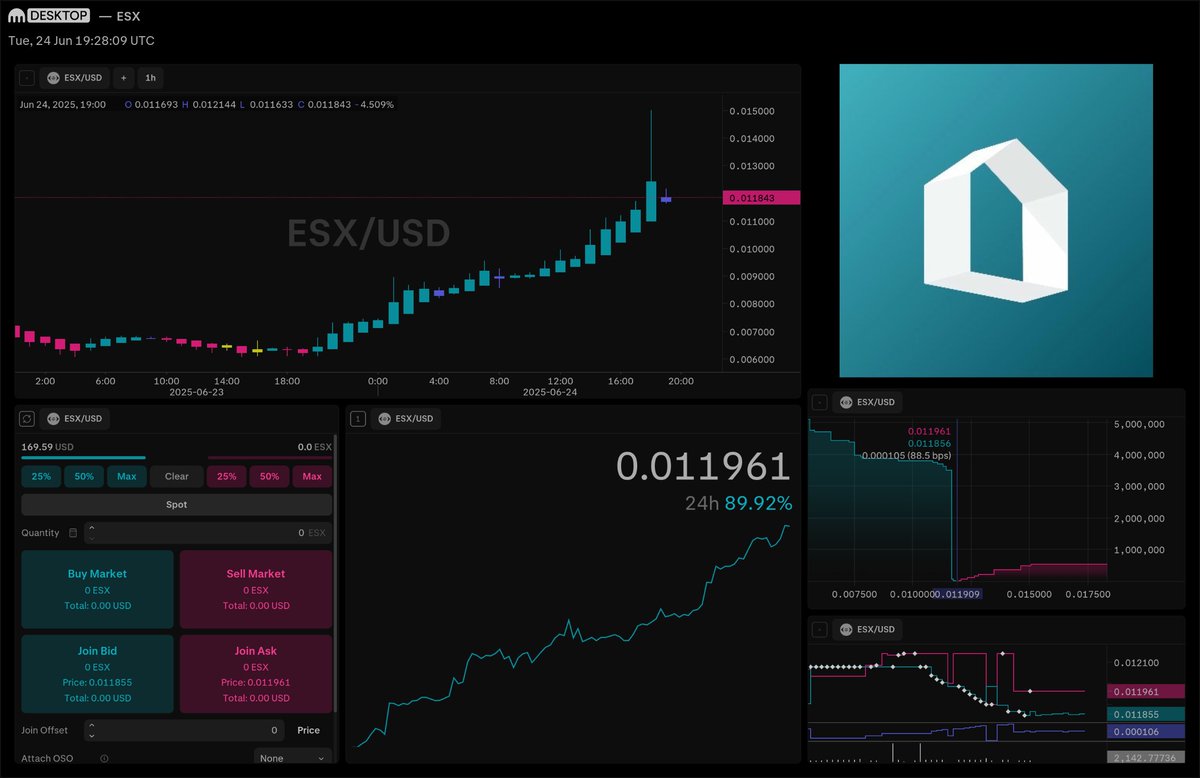

🔥 In fact, I joined the early sale of $ESX during its launch, and it turned out to be a big success. I like how @estatexeu | $ESX is dominating a vertical most teams ignore:

- Real Estate

- RWAs

- Onchain property infrastructure

And with a token that's already hit 30x from TGE, they're only just warming up. Let's dive in 🧵

🔥 Enjoy the following themes:

1⃣ What’s it?

2⃣ Key products

3⃣ This @estatexeu is battle-tested

4⃣ Most impressive part?

5⃣ Speaking of holders...

6⃣ Practical Roadmap

7⃣ My takes

8⃣ Final thought

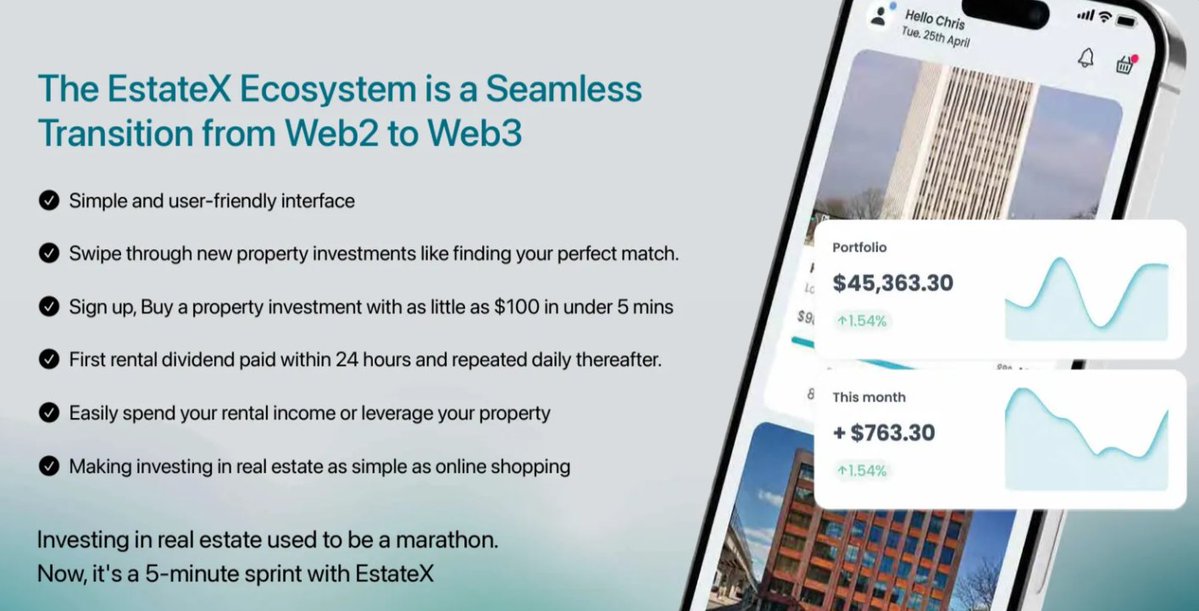

🔹 @estatexeu didn’t try to boil the ocean.

Instead of chasing all RWAs, they focused on one thing: Property.

It’s the #1 way crypto users diversify into stable yield.

It’s globally understood.

And it’s ripe for onchain disruption.

2⃣ Key products

They’ve already sold their first onchain property.

But that’s just the start.

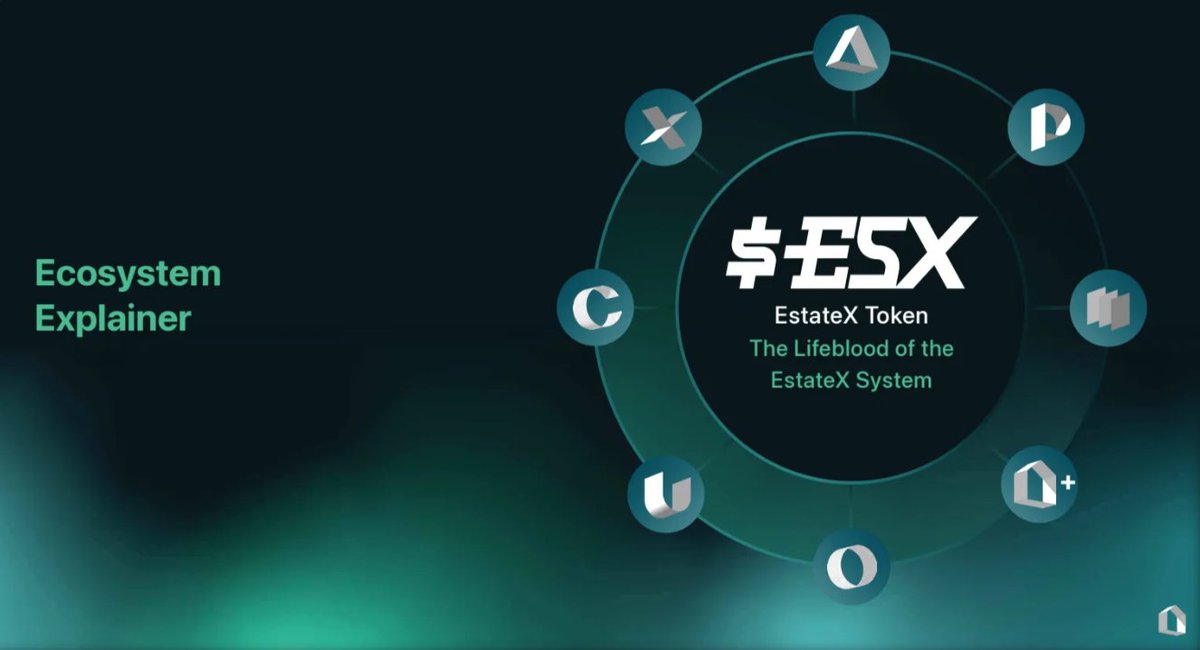

@estatexeu is building an entire ecosystem stack:

- PropXChange – trade tokenized real estate

- LaunchX – launchpad for IREOs

- TokenizeX – compliant tokenization infra

- EstateX Pay – fiat utility from assets

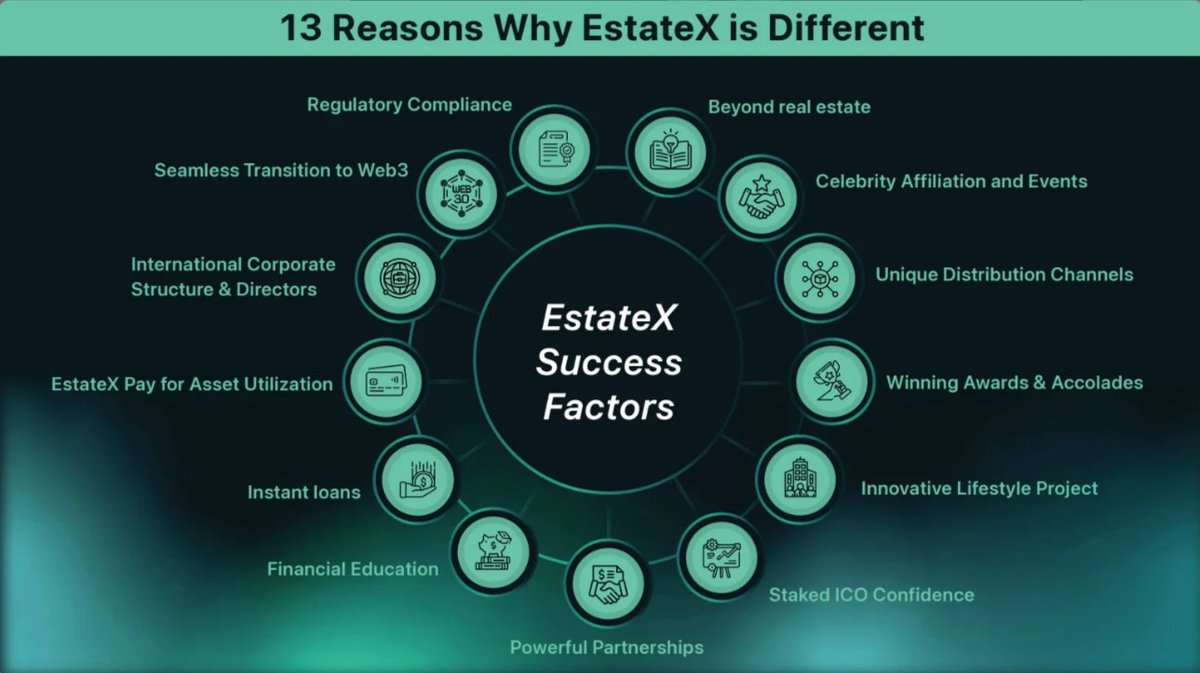

3⃣ This @estatexeu is battle-tested:

✅ $ESX launched & 80% staked

✅ Avg staking period ~ 7 years (!)

✅ Listed on @krakenfx, @MEXC_Official, @HTX_Global, @Uniswap

✅ Backed by Brock Pierce (co-founder of USDT)

✅ Microsoft Startups, RE/MAX CEO on board

4⃣ Most impressive part?

🔹 @estatexeu is launching its own RWA L1 blockchain.

But not with empty slogans like “finality” and “slashing.”

They’re doing it pragmatically with legal compliance, regulated tokenization, and a testnet launching July 16.

It’s purpose-built for RWAs.

🔹 The L1 chain is designed for:

- Onchain proof of ownership

- Whitelabel tokenization tools

- RWA dApps to plug in instantly

- Launchpad-native projects raising directly on-chain

And yes, revenue flow goes back to $ESX holders.

6⃣ Practical Roadmap

And they’re just getting started, soon they’ll roll out these:

- A property #AI agent is coming

- A regulated #RWA DAO fund is forming

- A major Launchpad partner is dropping

- New #DeFi tools like CapitalX (loans against real estate) are live-tested soon

And Q3–Q4 roadmap is stacked.

🚨 ADDITIONAL ROADMAP AND TOKENOMICS RELEASE 🚨

Hello EstateX family,

We have developed an additional roadmap for some developments outside of the ecosystem, including staking launch, Season 2 NFT release, the AIESX token launch, and the AI Property Agent.

In addition, from popular demand the updated EstateX Website that incorporates all of the growing EstateX ecosystems including the Web2 side and much more…

We've also released our updated tokenomics. For an L1 RWA Blockchain, all-in-one investment platform and RWA authority, we have the lowest FDV out there on the market.

Choosing this strategy has helped give our $ESX token holders, investors and the biggest community in tokenized real estate, an amazing upside potential.

Imagine where we will be when the utilities are live, with up to 20-35% of projected company revenue flowing back into the $ESX token. Our investment platform will have the hottest property offers, institutions and projects are building on our blockchain, and the TVL has massively increased. All to be done in the upcoming year!

Onwards & upwards!

SECURE YOUR $ESX NOW 👇👇

7⃣ My takes

In a year where RWAs are the dominant narrative...

@estatexeu is doing what others just tweet about.

They have the property deals, the token, the chain, the infra, and the backers.

And they’re onboarding both retail and whales, organically.

This might be the blueprint.

8⃣ Final thought

@estatexeu didn’t rush to scale.

They validated the model, built infra, and now they’re ready to onboard capital at scale.

#RWA meets DeFi, meets compliance, meets cashflow.

I’m watching $ESX closely.

✅ Useful link:

✅ Pitch Deck:

Some chads that called this early or are great to follow to keep up with the project - $ESX:

@milesdeutscher

@Overdose_AI

@Bullrun_Gravano

@ElCryptoDoc

@kingmeta_

@BartEstateX

@DarknightHimslf

@KongBTC

@brockpierce

@MuazXinthi

@TheDustyBC

@YVR_Trader

@cryptofleh

7.1K

121

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.