GM! I think it’s time we start paying more attention to stablecoin issuers.

Because something very different is happening this time around.

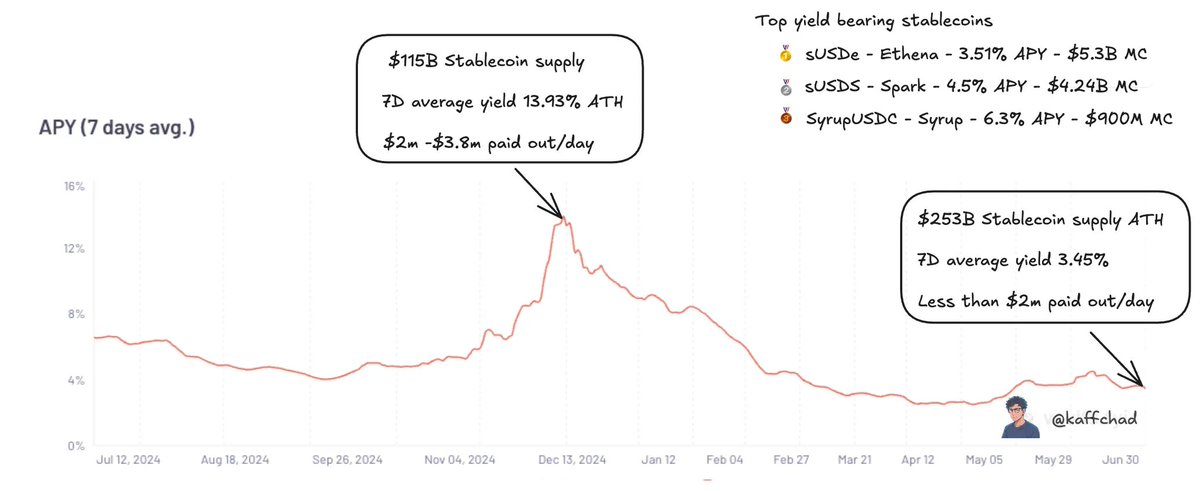

▫️In December 2024, stablecoin yields peaked at 13.93% APY, but total supply was only around $115B (basically flat since 2023).

Fast forward to June 2025:

▫️Stablecoin supply has surged past $253B, hitting an ATH

▫️But yields down to just 3.45% APY

▫️And only ~$2M in daily yield being paid out/day

So what’s going on?

It’s a weird split: supply is growing like crazy, but actual liquidity in the market still feels drained.

→ My take: A large part of stablecoins are getting parked in savings/yield protocols, waiting for the next surge.

→ And that means the issuers behind these stablecoins become the biggest players to watch until then:

🥇 @ethena_labs with sUSDe - $ENA: $1.64B MC

🥈 @SkyEcosystem with sUSDS - $SKY: $1.74B MC → $SPK | @sparkdotfi is the 2nd play with only $37M MC

🥉 @syrupfi with SyrupUSDC - $SYRUP: $613M MC

15.69K

95

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.