Trade Idea V2: Relative Value - Long $JUP / Short $UNI

Disclaimer: This document outlines a revised thesis based on new information. It is for illustrative purposes and is not financial advice.

Trade Structure:

Type: Relative Value (Pairs Trade) / Growth vs. Incumbency

Position: Long Jupiter ($JUP) vs. Short Uniswap ($UNI)

Objective: To capture the alpha from the divergence in ecosystem growth velocity and product innovation speed between the Solana and Ethereum DEX leaders.

Pillar 1: The Revised Research Desk Thesis

The original regulatory thesis is dead. The new thesis is that Jupiter, as the epicenter of a high-growth ecosystem, will fundamentally outpace Uniswap, which is tied to a more mature but slower-moving incumbent ecosystem.

The Core Long Thesis (Why Long JUP):

Ecosystem Velocity: Solana's user activity, transaction counts, and new project launches are consistently higher than Ethereum's. Jupiter is the primary "picks and shovels" play for this activity, capturing value from every swap and launch on its LFG platform. We are buying the market leader of the fastest-growing ecosystem.

Product Innovation Speed: The Jupiter team ships new features (perpetuals, launchpad enhancements, etc.) at a much faster rate than Uniswap. This agility allows them to capture new trends and user demand more effectively.

The Core Short Thesis (Why Short UNI):

Incumbent Inertia: Uniswap is a mature, blue-chip protocol. This is a strength, but also a weakness. Its development and governance processes are necessarily slower and more deliberate. It cannot match the pace of a younger, more centralized competitor like Jupiter.

Value Accrual Limbo: While the SEC news is a positive, it does not automatically activate the "fee switch" for $UNI holders. This remains a contentious and complex political process within the Uniswap DAO. The path to direct value accrual is still uncertain and likely months, if not years, away. We are shorting this continued state of uncertainty.

Pillar 2: The Revised Risk Framework

The risk profile of this trade has changed dramatically. The original trade had a clear, asymmetric catalyst (regulatory action). This new trade is a slower, more fundamental grind.

Primary Risk - The Fee Switch: The single biggest risk to this trade is the Uniswap DAO successfully pushing through a vote to turn on the fee switch. The positive SEC news increases the probability of this happening. Such an event would be a massive bullish catalyst for $UNI and would likely cause the JUP/UNI ratio to collapse, stopping us out.

Secondary Risk - Solana Momentum Stalls: If the retail frenzy on Solana dies down or the network experiences significant technical issues, JUP's growth narrative would be severely damaged.

Conclusion on Risk: The short UNI leg of this trade is now significantly riskier than in our original thesis. We are no longer shorting a clear headwind; we are shorting a potential coiled spring. Therefore, the conviction level for this trade is lower, and the position size must be adjusted accordingly. A professional fund would likely allocate half the capital to this trade compared to the original idea, reflecting the less asymmetric risk/reward profile.

Pillar 3: Execution & Management

The technical plan remains the same, but our interpretation is now viewed through this new lens.

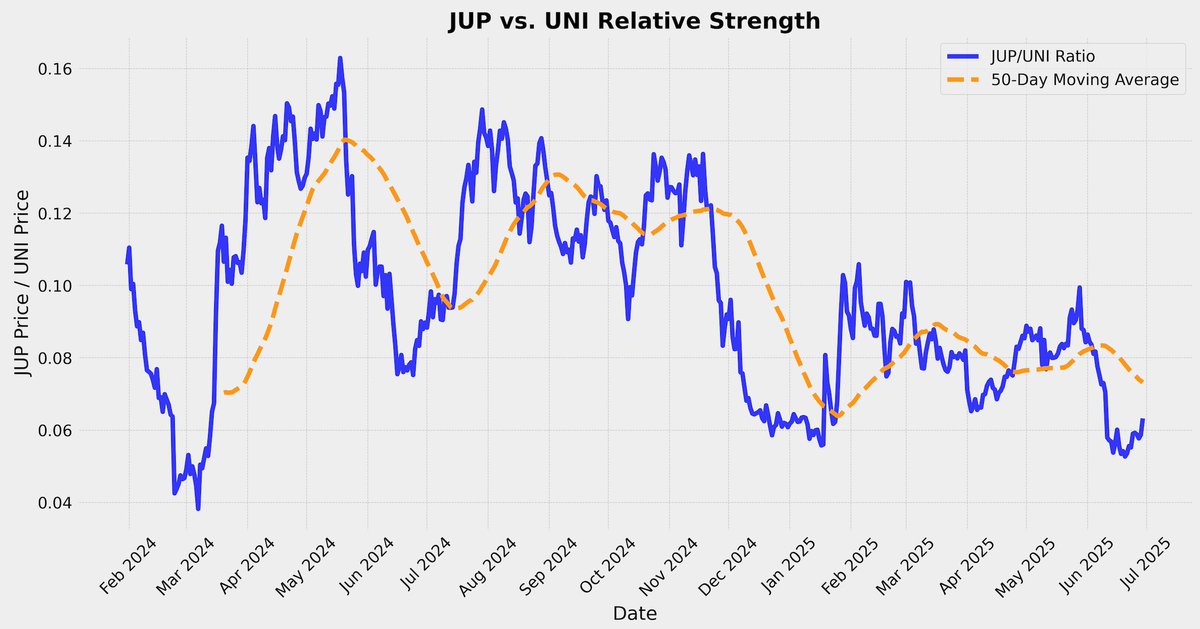

Entry Trigger: Wait for the JUP/UNI ratio to reclaim its 50-day moving average on a daily closing basis.

Stop Loss: A 15% drop in the JUP/UNI ratio from our entry point.

Take Profit: The multi-tiered TP strategy remains valid, targeting the 2:1 R/R level and the previous ATH ratio.

This is now a different trade. It's a bet on pure execution and ecosystem momentum, with a clearly defined and significant risk on the short side.

Entry Rationale (Setup vs. Trigger): It is critical to distinguish between the trade setup and the entry trigger. The current price action, with the ratio below its 50-day moving average, represents a potential setup that aligns with our fundamental thesis. However, it is not a trigger. Entering now would be a "mean reversion" trade against an established technical downtrend—a low-probability strategy. Our thesis is based on "trend following." Therefore, we wait for the market to confirm our thesis by having the ratio reclaim the moving average. This discipline prevents us from "catching a falling knife" and ensures we enter with momentum on our side, even if it means sacrificing the absolute bottom of the price ratio.

12.84K

12

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.