"What does it feel like to carve a bloody path out of a sea of enemies with Spark?"

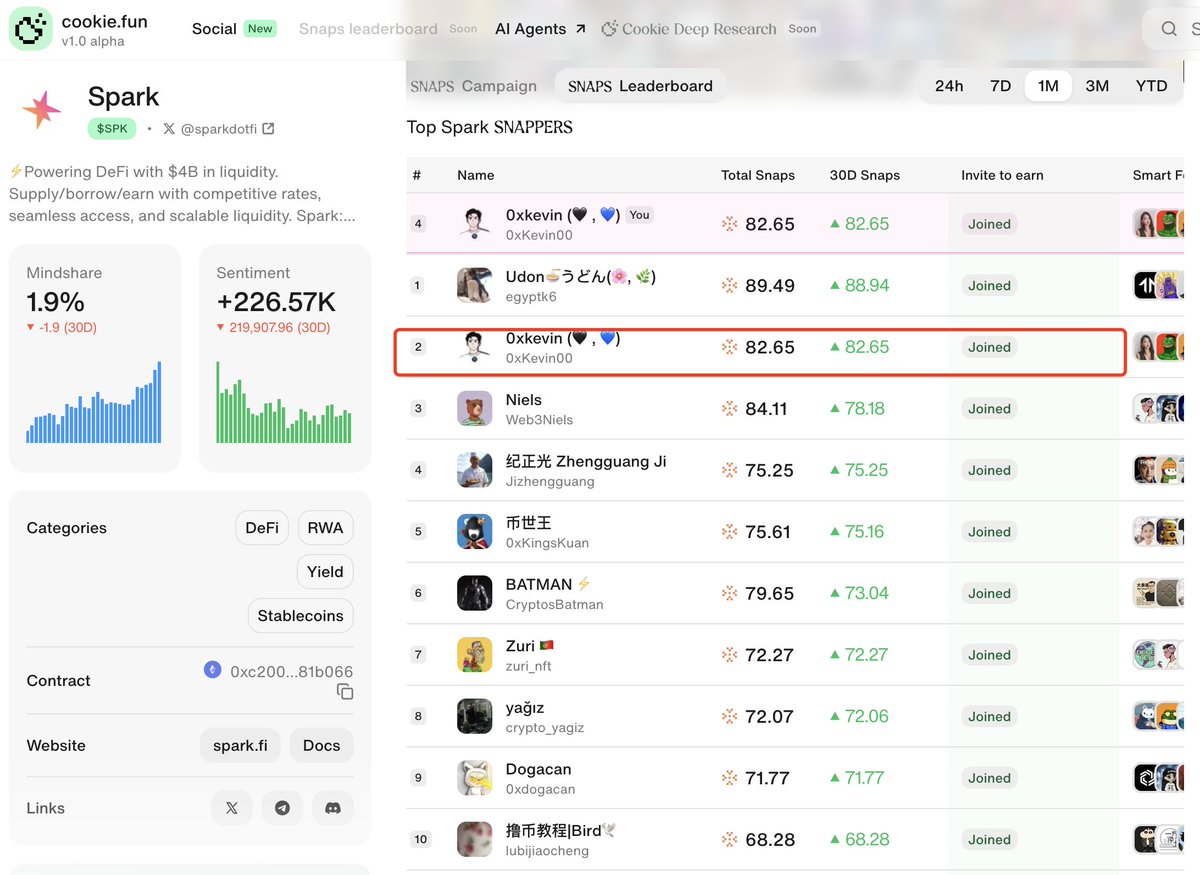

Cookie's listed projects only need to tweet or comment to earn points, and the first project, Spark, ends in two days. I should firmly hold the second place, having earned 82 points in a month, carving a bloody path out of 10,000 people.

Some estimate that one point is worth 100, making these 82 points worth 8200U.

But what’s valuable is not this reward, but what it has taught me about the Spark project. It has also made me understand how significant Cookie is for grassroots individuals!

› ••••••••• ‹

@Cookiedotfun The reason I suggest many newcomers participate in Cookie is that this platform is friendly to newcomers or retail investors; its algorithm leans more towards content. As long as you have genuine material, you can showcase it here.

You just need to continuously produce quality content; even if you have no followers, you can still grow your account.

In Cookie, even if you start from zero, you can make a name for yourself on the public leaderboard, earn points, and accumulate real followers through continuous participation and deep output.

For grassroots individuals, #cookie is an opportunity window to "carve a bloody path through content."

Currently, there are already 4 projects on the leaderboard, with rewards for one week, 15 days, and 30 days, each with different rewards ranging from 50,000U to 2,000,000U. Choose the project you believe in and keep building; you will always get a return!!

› ••••••••• ‹

Back to @sparkdotfi, the reason I am optimistic about $spk.

The core of Spark is its USDS, which is a stablecoin.

For decades, cross-border transfers have been an extremely inefficient process. You need to go through banks, remittance agencies, cumbersome compliance steps, along with opaque exchange rates and high fees, often taking several days to arrive.

For people living in countries with severe inflation, like Argentina, Nigeria, and Venezuela, this waiting period itself means asset depreciation—by the time the money arrives, it’s already lost value.

And this is precisely where stablecoins come in.

$USDS, as the "on-chain dollar" launched by #Spark, not only enables instant transfers with extremely low fees but, more importantly, it provides a financial option beyond sovereignty.

You are no longer bound by your country's banking system; you don’t have to wait for the dollar clearing system's open hours. As long as you have an on-chain wallet and the internet, you can freely send and receive value.

Furthermore, USDS is not just a passive pegged dollar shadow; it is a stablecoin with an endogenous yield structure. It is backed by the lending rate structure of SparkLend and the real returns from real-world assets (like short-term U.S. Treasury bonds).

For many people in capital-restricted countries, this is not just "financial innovation"; it is an alternative solution for the right to financial survival. They cannot hold dollars or access stable interest rate products, but Spark provides a channel—on-chain, permissionless, and independent of their country's banks—to obtain real returns and store dollar value.

The significance of stablecoins has never been just about "pegging to the dollar"; it is about rebuilding trust mechanisms.

Spark and USDS are building an on-chain financial system that does not rely on a single sovereignty while ensuring capital efficiency and credit protection, addressing the structural dysfunction of traditional financial architecture in global liquidity allocation.

Show original

93

19.26K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.