If you're lookin’ for a solid spot to park your USDC right now, this might be the one

I’ve always been a fan of lending with fixed returns. I like knowing how much I’ll earn ahead of time. No constant APRs checking, no constant portfolio restructuring!

➩ That’s why I’m lowkey in love with @useteller’s fixed interest rate pools. No oracles, just time-based lending. You borrow for 30 days, pay it back on time, no liquidation! Kinda like TradFi...

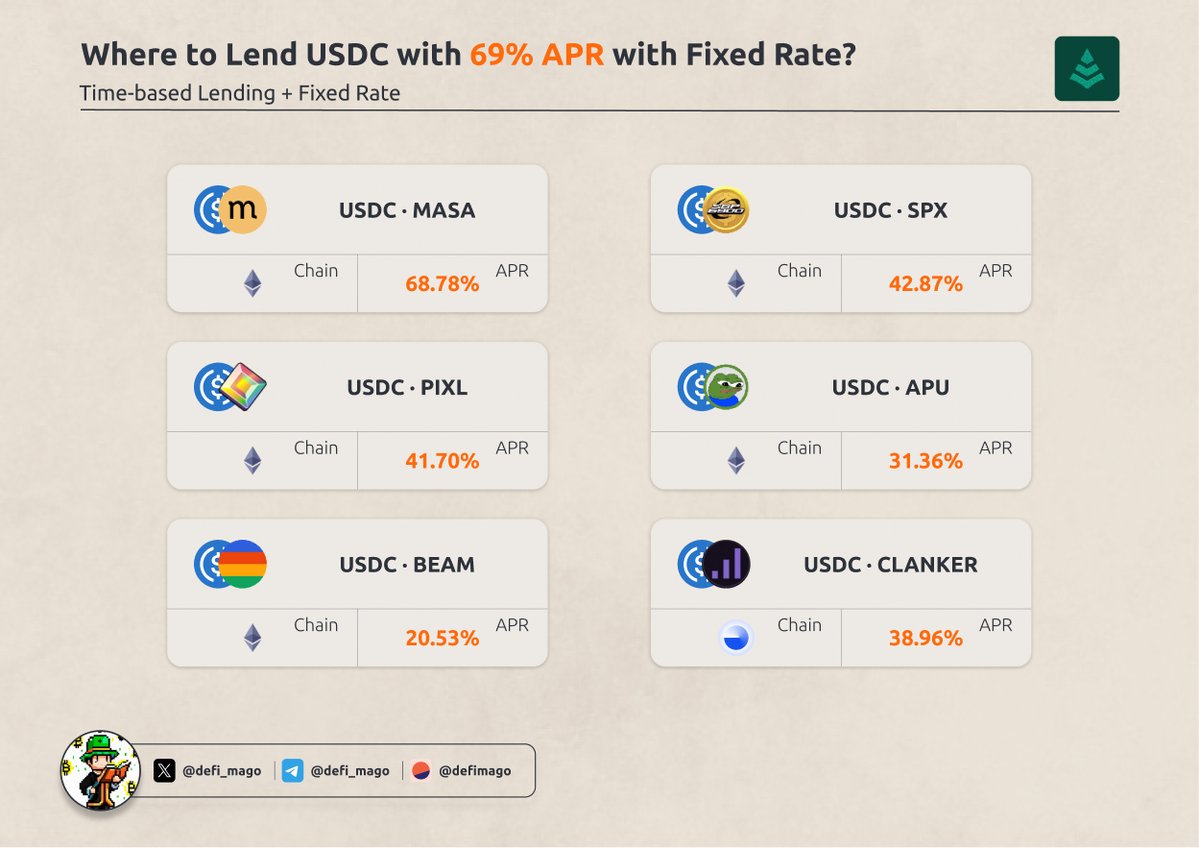

Here are some juicy APRs I spotted on Ethereum rn:

• USDC/MASA – 68.78%

• USDC/SPX – 42.87%

• USDC/PIXL– 41.70%

• USDC/APU – 31.36%

• USDC/BEAM – 20.53%

Oh, and on @base:

• USDC/CLANKER – 38.96%

║ Bonus points: you can also borrow at fixed rates. The cost shows up right on the UI.

➩ They have USDC/WBTC and USDC/ETH pairs if you’re feelin’ spicy and wanna long/short with size. And nope, no market maker hunting your stops like Jame Wynn 👀

I know sharing this might hurt my own yield... but I’m choosing MINDSHARE over YIELD today. So yeah, your interaction will boost my mood and let’s farm this alpha, friends 👇

49

19.83K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.