🔵 Kamino V2: a full-stack infrastructure for on-chain credit on Solana

The V2 release of @KaminoFinance marks a major milestone: new markets, advanced products, and key partnerships.

Kamino is positioning itself as a core pillar of Solana’s DeFi revival 👇

◻️ Kamino: a leading protocol on Solana

With V1, Kamino became Solana’s top lending protocol:

▪️ $4.2B+ in cumulative TVL

▪️ 0 bad debt

▪️ 14 audits

With V2, Kamino takes it to the next level: a modular, scalable and interoperable infrastructure built for Solana’s next growth phase.

◻️ Kamino V2 architecture

Kamino V2 introduces a modular design built to multiply lending use cases on-chain.

It’s structured around 2 key layers:

▪️ Market Layer – permissionless creation of custom markets with tailored risk parameters, oracles, illiquid assets, etc.

▪️ Vault Layer – automated lending vaults designed to deliver yield strategies based on user risk profiles.

◻️ V2 flagship product: Multiply

Multiply enables automated leverage loop strategies, already used for over $1B in TVL.

Examples: mSOL/SOL, bSOL/SOL, PT/SOL…

Kamino V2 also introduces Spot Leverage: a simple 2x–4x leverage strategy on spot markets.

At launch, 10 markets went live with $285k+ in monthly incentives, including:

▪️ Marinade (mSOL/SOL, 10x)

▪️ Maple Finance (SyrupUSDC/USDC, 5x)

▪️ SolBlaze (bSOL/SOL, 7.5x)

▪️ Sanctum (INF/SOL, 4x)

◻️ Kamino V2 key metrics

In just 3 weeks, Kamino V2 markets crossed $200M in TVL.

In detail:

▪️ $216M deposited

▪️ $85M borrowed

▪️ 2,350+ active positions

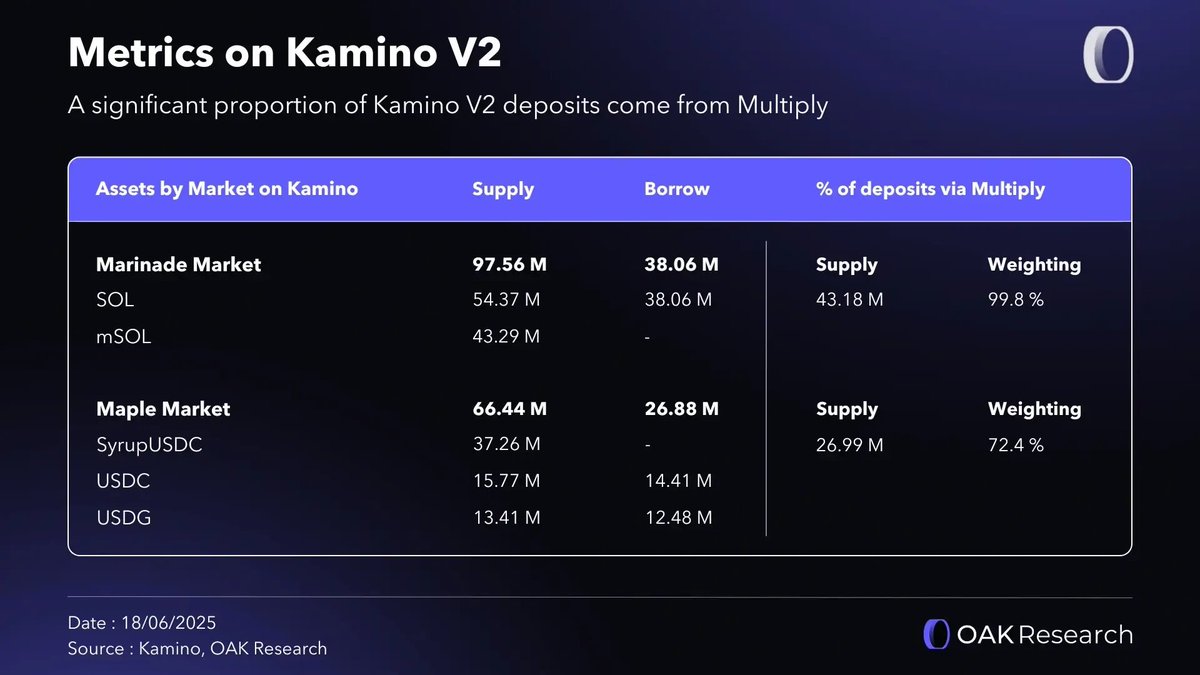

Two markets in particular illustrate the efficiency of Kamino’s V2-Multiply synergy:

1.33K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.