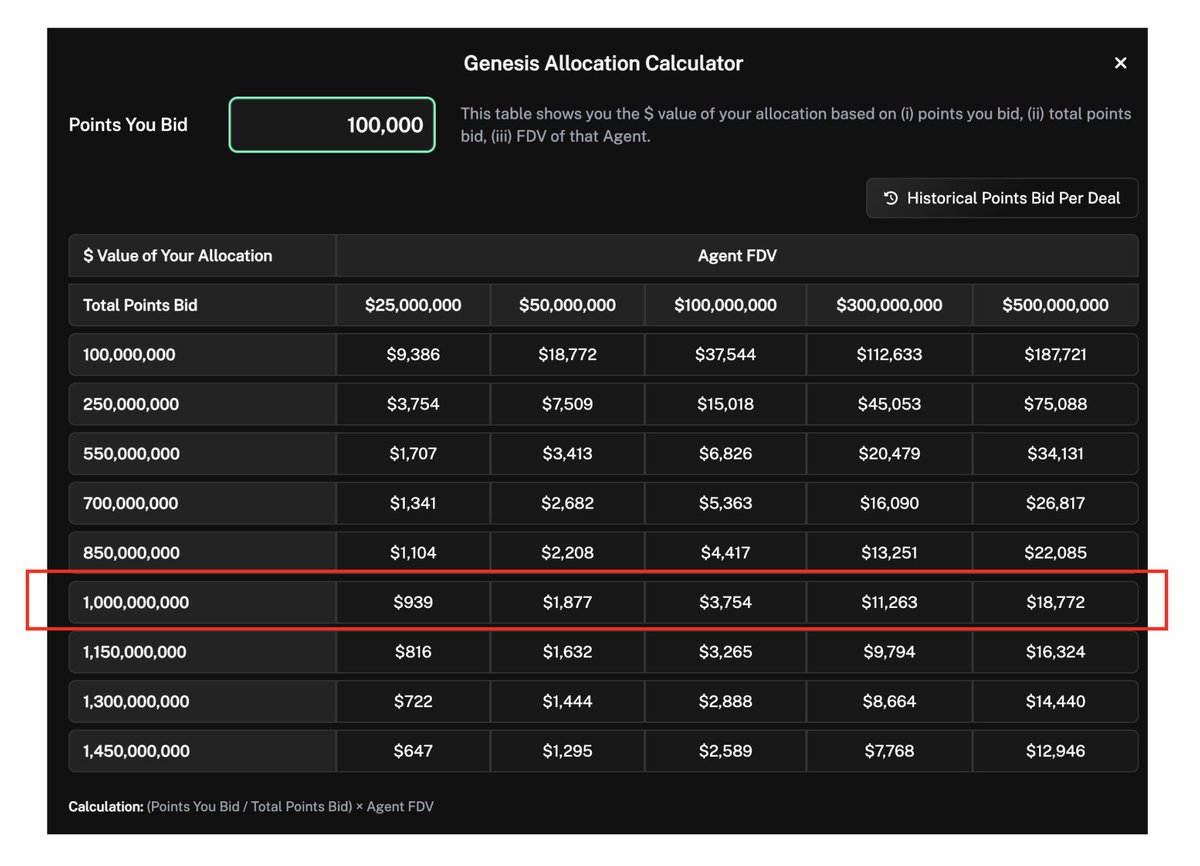

1.25bn points pledged and IRIS has opened around the ~$100m mark.

This means that 100k points would have netted you ~$3k in the token allocation.

Now let's see how the pony rides.

Will you sell for the 10 day take profit cooldown, or stake for the next Virtuals Genesis launches?

Only an hour remains until IRIS goes live on @virtuals_io

We'll likely see a billion points bid in total.

This means that if you bid 100k points, and it hits $25mm market cap, then your allocation will be worth just shy of $1k.

Are you bidding or preserving your points?

h/t @Vader_AI_ for the calculator.

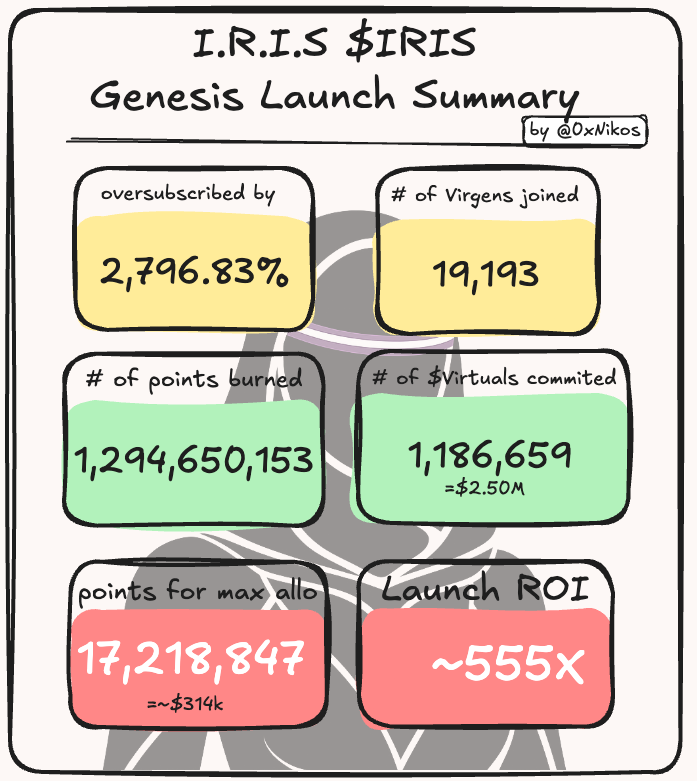

Statistics on the launch:

Genesis Launches on @virtuals_io Summary | $IRIS @UndercoverIRIS

Well there you have it Virgens, the 1st ETH launch for Virtuals was a massive success.

- At opening $IRIS did a ~555X ROI

- For the max allocation you needed 17M points. If you had that much points then congrats you are rich, as I am writing this this is about $214,000 and going down. (Double that amount for the ATH price)

- From about 2.5B in existence about ~1.3B of them got burned on the Iris launch.

- The total virtuals pledged to the raise make a total of $2.5M. (will make some stats regarding the total virtuals pledged on all raises to-date)

Not sure what else I can say, crazy stats across the board.

Congrats on the @virtuals_io / @UndercoverIRIS team and to the Virgens that got in.

------

As always tyvm @VaderResearch senpai for the data.

@tuthanhan11 @virtuals_io STRATOS imo

1. Why we should rethink Portfolio Management

$STRATOS Virtuals Genesis; June 15th, 1pm UTC

Traditional portfolio theory is focused on expected return and volatility. The math is simple but myopic. Optimizing over arithmetic expectations does not lead to lifetime wealth accumulation.

Additive expected value optimizes for a single round of investing; it is focus on the geometric mean of returns that maximizes lifelong wealth.

Ruin is inevitable as arithmetic means misrepresent compounding effects. Each loss permanently impairs your capital base, making recovery almost impossible. ‘The truth lies in geometric returns‘.

In fat-tailed crypto markets, black swans strike often. ”Optimal" portfolios turn into catastrophe engines. Surviving the event cone—the complete set of possible future paths—demands prioritizing compounded annualized growth rate (CAGR), the true metric of long-term wealth accretion.

This demands buying insurance and convexity with options.

Unless portfolios are evaluated across all possible paths, tail events will truncate your lifetime wealth accumulation. Without options, disaster can and will strike.

( enjoy simulation feature in ‘ Odyssey of Fate ‘ ) to examine how CAGR under standard equity market return distributions is supported by option insurance: the only free lunch in finance )

Ithaca Protocol AI Agent Infrastructure

168

57.17K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.