. Basis OS @BasisOS's YeildAI Autopilot has been officially upgraded to V2 and claims to have performed well in backtesting.

The upgrade is mainly reflected in three aspects:

One is to adopt a new strategy as a benchmark;

Second, the vault and risk ceiling in the high-fidelity simulation suite are adjusted and increased accordingly to improve the risk management capability.

The third is the use of a better model (O4-mini), which enables faster, smarter decision-making and reduced latency.

Previously, the @BasisOS first-generation model worked well when the amount was small, but it had the problem of insufficient scalability. As the business grows, the amount of storage increases, and the volatility of the deposit limit increases, and the first-generation model struggles to adapt to this change, and begins to misjudge and fail to process relevant information accurately, resulting in reduced operational efficiency and reliability. To address these issues and meet growing business needs, @BasisOS launched YieldAI Autopilot V2 to improve system performance.

At present, it can be seen on the official website of @BasisOS that its base yield is about 10%, and the annualized APY of the two pools, namely the WBTC pool and the Link pool, is 10%, and if you participate in mining platform coins, you can also get an additional APR reward of 399.48% annualized. APY considers compound interest, APR does not consider compound interest.

In addition, the APY peak of the whole life cycle of @BasisOS reached 39%, which was basically stable at about 32%, and the overall baseline level was 27%, compared with the previous model, the V2 version showed obvious advantages in revenue acquisition ability and stability, and is expected to bring higher revenue to users.

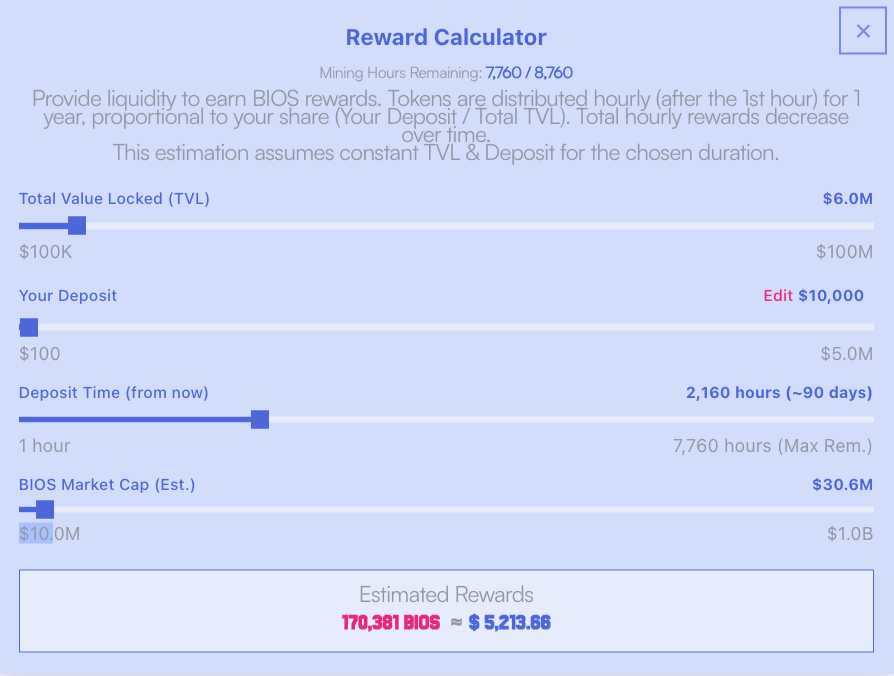

With the improvement of deposit TVL, the optimization model makes @BasisOS have a better profit base, and we look forward to the subsequent performance. The income estimation calculator on this official website is quite interesting, 1wu deposit, assuming tvl 6M, token market value 30M, deposit for 90 days, and the expected mining profit can be 5000U, which looks quite attractive, and you can regularly monitor your principal, no lock-up period, or very good.

Basis OS @BasisOS team, at present, you focus your strategy on mainstream large contract exchanges, ensuring security and stability, but emerging contract exchanges such as @Backpack, @Lighter_xyz, @Aster_DEX and other emerging contract exchanges that have not yet issued airdrops have great potential, it is recommended to apply existing strategies to these platforms, and launch options with high risks and high potential returns, which can not only attract risk-appetite users who pursue high returns, but also help expand the user base. Enhance the competitiveness of the platform in emerging markets.

Basis OS @BasisOS team, currently you are focusing your strategies on mainstream large contract exchanges, which ensures safety and stability. However, emerging contract exchanges like Backpack, Lighter, and Aster, which have not yet issued airdrops, have huge potential. It is recommended to apply the existing strategies to these platforms and launch options with higher risks and potential returns. This can not only attract risk - seeking users pursuing high returns but also help expand the user base and enhance the platform's competitiveness in emerging markets.

Exciting news for the BIOS BOIS!

BasisOS YieldAI Autopilot has leveled up to v2 - and backtests are looking fantastic.

Here’s the update you’ve been waiting for 🧵

38.93K

30

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.