👉 Are DeFi options on @Base outperforming Ethereum?

New quantitative research analyzes the price, implied volatility, and bearish/bullish strategies across Ethereum and Base revealing surprising insights:

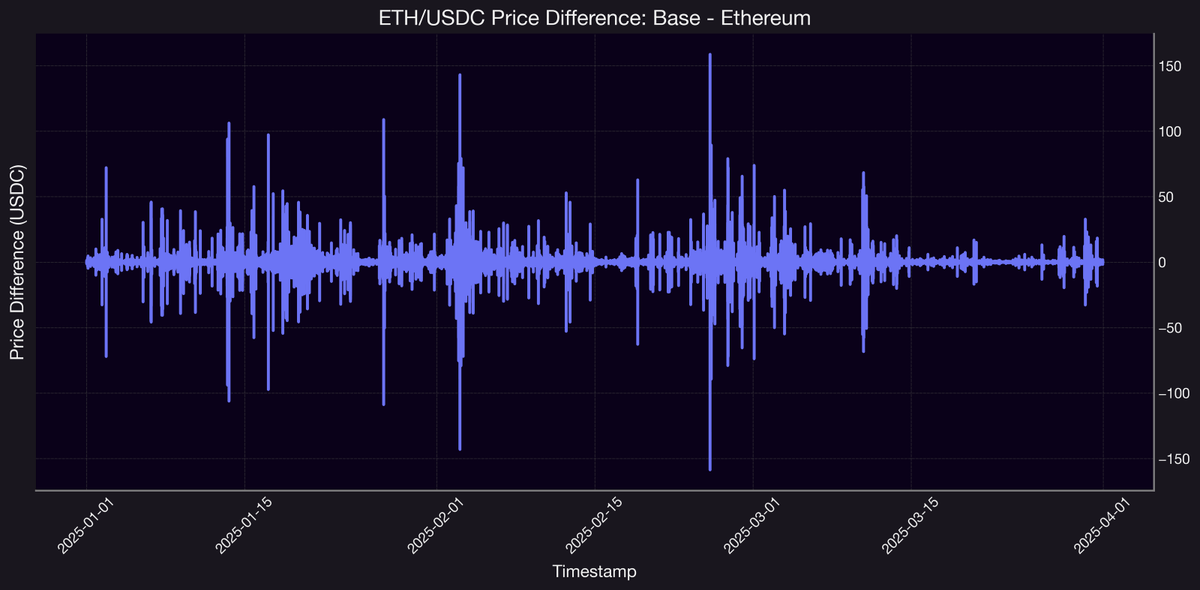

💧 ETH/USDC Pool Price

• Minute-level analysis shows frequent dislocations between Base and Ethereum prices and deviations of up to $150 USDC in either direction.

• These deviations were transient and often clustered during volatility events.

• Likely drivers: sequencer delays, cross-chain latency, and JIT liquidity provisioning on Base.

⇒ These dislocations present short-lived arbitrage opportunities for high-frequency or cross-chain traders.

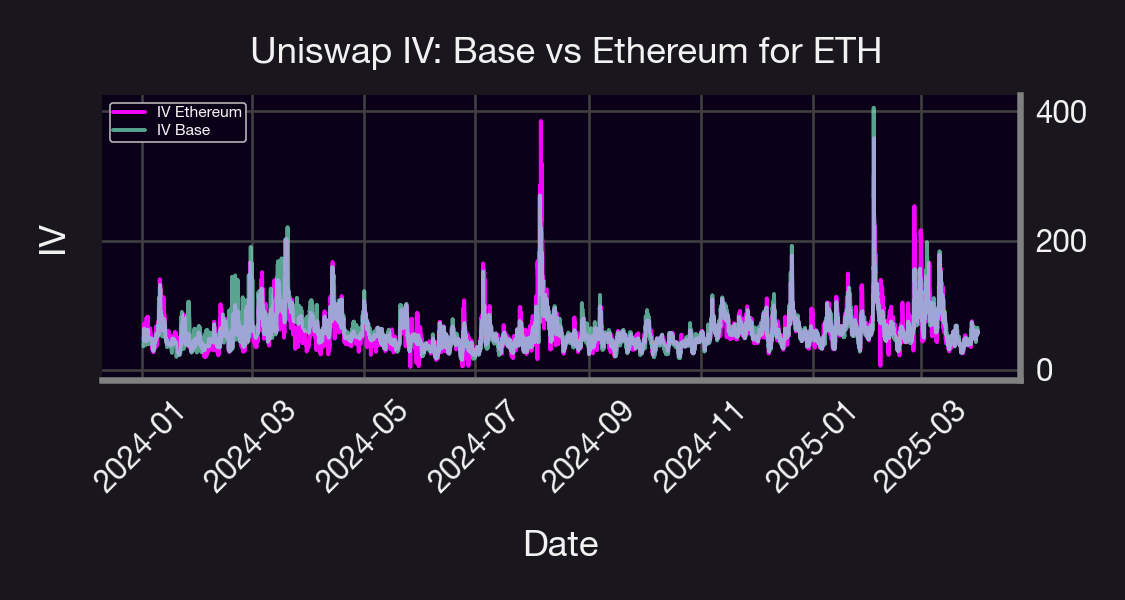

🌡️ Implied Volatility (IV) Findings

• Ethereum exhibited sharper IV spikes, particularly mid-2024 — consistent with deeper liquidity and speculative flows.

• Base showed a slightly higher baseline IV but with smoother and more stable behavior.

• The IV spread (Base – Ethereum) hovered slightly above zero on average, confirming Base tends to price in more persistent tail risk.

• Large negative IV spreads (–100 IV pts) appeared during Ethereum IV surges—ideal windows for cross-chain vol trades.

⇒ Trading edge: short Ethereum vol during spikes, long Base vol during low-IV periods.

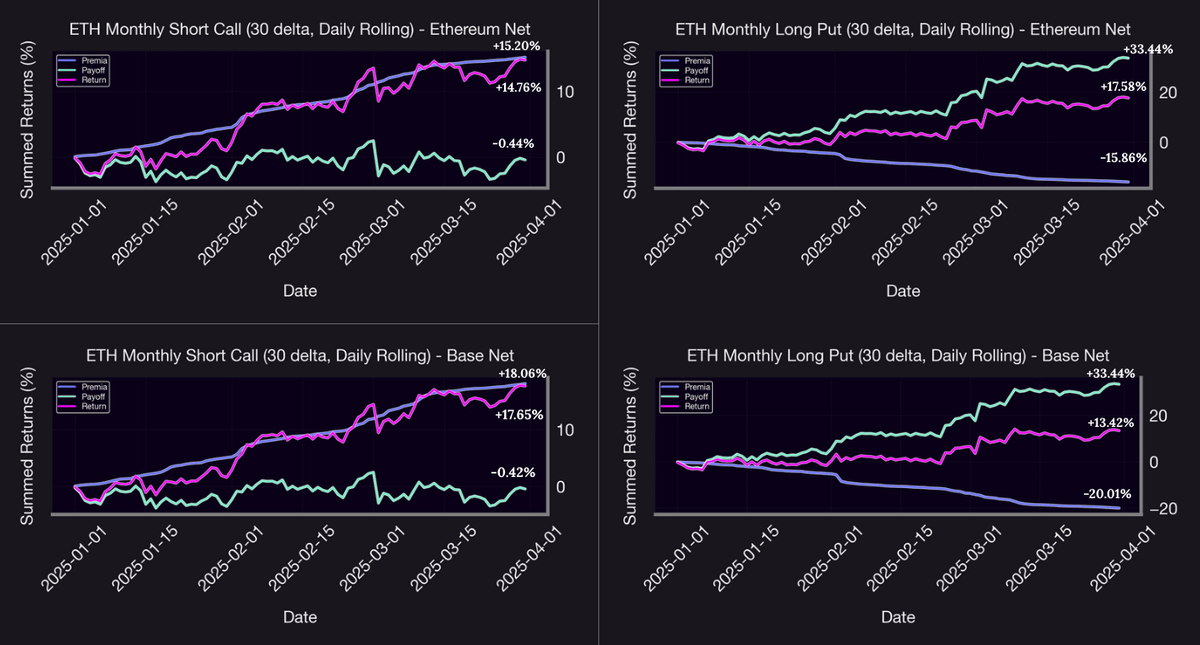

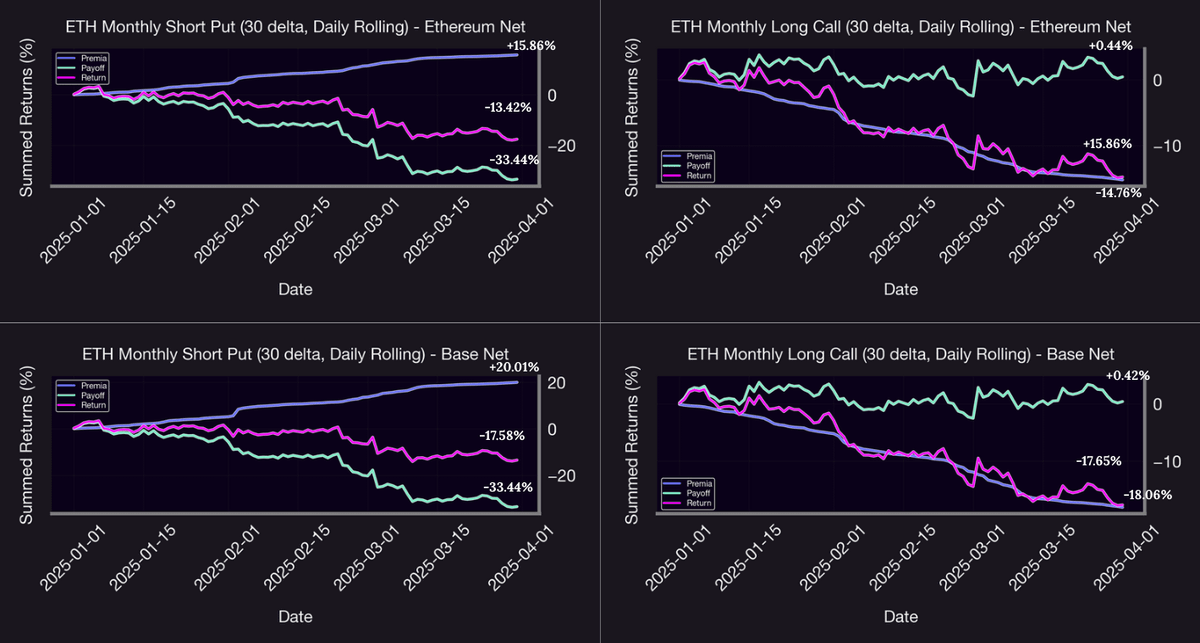

🧠 Strategy Results

• Short Calls: Outperformed with +17.65% on Base and +14.76% on Ethereum; benefited from high IV and low realized volatility.

• Long Calls: Underperformed with –18.06% on Base and –14.76% on Ethereum; premium drag outweighed limited upside.

• Long Puts: Best-performing strategy; returned +17.58% on Ethereum vs. +13.42% on Base despite identical payoffs—reflecting Ethereum’s cheaper IV.

• Short Puts: Negative returns (–17.58% ETH, –13.42% Base), but Base’s higher premia helped cushion downside.

#DeFi #Ethereum #Base #QuantResearch #CryptoOptions #Panoptic #IV #Volatility #Arbitrage

8.16K

6

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.