Celestia price

in USDCheck your spelling or try another.

About Celestia

Disclaimer

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

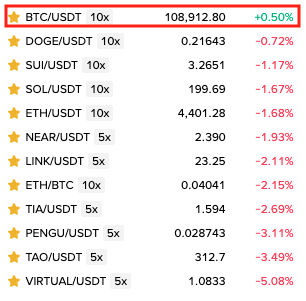

Celestia’s price performance

Celestia on socials

Guides

Celestia on OKX Learn

Celestia FAQ

Dive deeper into Celestia

Celestia is a modular blockchain network that enables developers to build scalable, secure, and interoperable decentralized applications (dApps). Celestia decouples the data availability layer from the execution layer, allowing each layer to be optimized for its specific purpose. This makes Celestia more scalable and efficient than traditional monolithic blockchains.

How does Celestia work?

Celestia works by separating the blockchain into two layers: the data availability layer and the execution layer. The data availability layer is responsible for storing and validating transaction data, while the execution layer is responsible for executing transactions and updating the state of the blockchain.

The data availability layer uses a sampling mechanism to ensure that all transaction data is available to all nodes on the network. This makes Celestia more secure than traditional blockchains, as it is more difficult for attackers to tamper with the transaction data.

The execution layer can be implemented using any type of virtual machine, which makes Celestia more flexible and adaptable than traditional blockchains. Developers can choose the virtual machine that best suits their needs, and they can even build their own custom virtual machines.

Celestia price and tokenomics

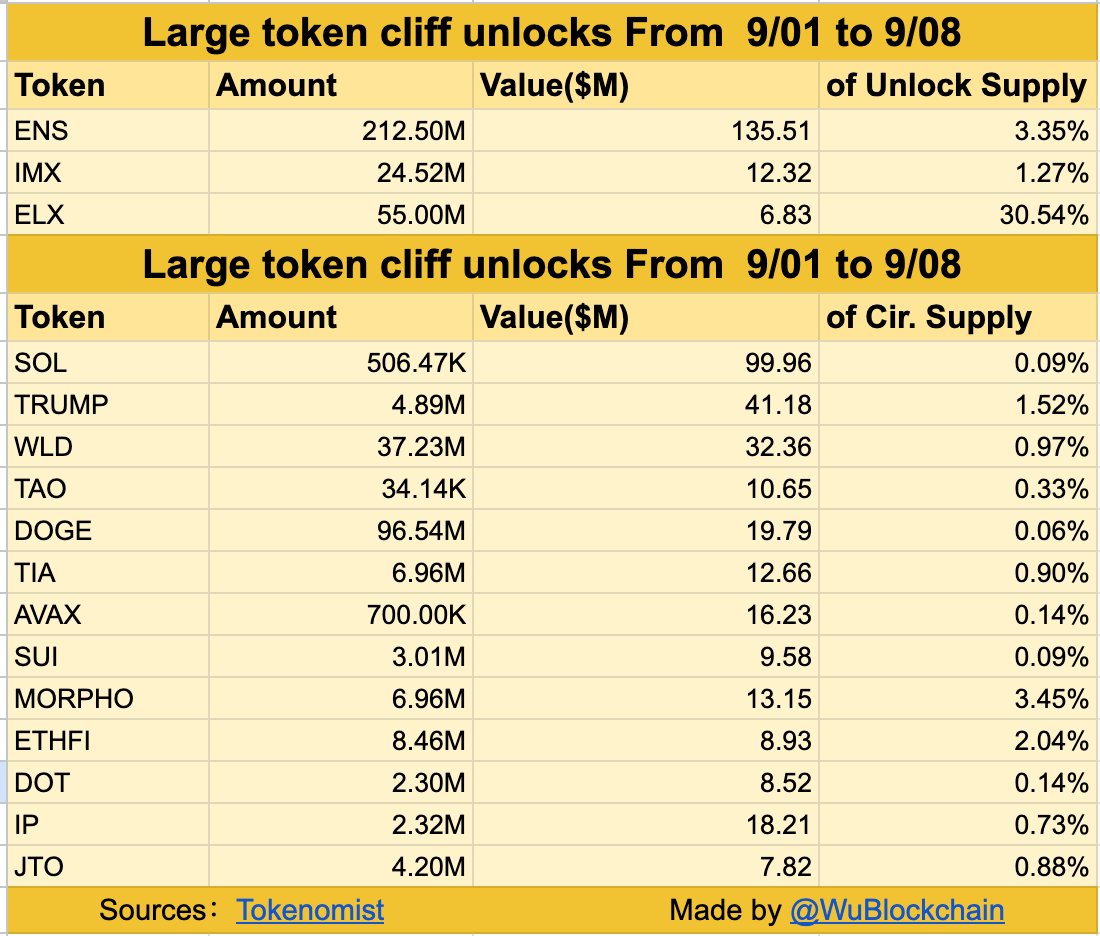

Celestia's native token is TIA. TIA is used to pay for transaction fees, secure the network, and participate in governance.

TIA has a total supply of 1 billion tokens. The tokens are allocated as follows:

- 26.8% - R&D and ecosystem

- 19.7% - Series A and B investors

- 17.6% - Initial core contributors

- 15.9% - Seed investors

- 12.6% - Future initiatives

- 7.4% - Genesis drop and incentivized testnet

TIA is currently trading at $2.38 (as of November 1, 2023). It has a market capitalization of $336.99 million.

About the founder

Celestia was founded in 2021 by Mustafa Al-Bassam and Ismail Mahmutovic. Al-Bassam is a former software engineer at Google, where he worked on the development of the WebAssembly virtual machine. Mahmutovic is a former software engineer at Facebook, where he worked on the development of the Novi digital wallet.

Celestia highlights

- Scalability: Celestia is designed to be scalable to millions of transactions per second.

- Security: Celestia uses a variety of security features to protect the network and its users, including proof-of-stake consensus, sharding, and fraud proofs.

- Interoperability: Celestia is interoperable with other blockchains, which means that Celestia dApps and smart contracts can communicate and interact with dApps and smart contracts on other blockchains.

- Flexibility: Celestia is a modular blockchain, which means that its different components can be upgraded or replaced without disrupting the entire network. This makes Celestia more flexible and adaptable than traditional monolithic blockchains.

ESG Disclosure