BOOK OF MEME price

in AEDAED0.0071838

-AED0.0₄33054 (-0.46%)

AED

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

Market cap

AED495.93M

Circulating supply

69B / 69B

All-time high

AED0.046177

24h volume

AED101.54M

About BOOK OF MEME

BOOK OF MEME issuer risk

Please take all and any precaution and be advised that this crypto-asset is classified as a high-risk crypto-asset. This crypto-asset lacks a clearly identifiable issuer or/and an established project team, which increases or may increase its susceptibility to significant market risks, including but not limited to extreme volatility, low liquidity, or/and the potential for market abuse or price manipulation. There is no absolute guarantee of the value, stability, or the ability to sell this crypto-asset at preferred or desired prices.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

BOOK OF MEME’s price performance

Past year

-67.83%

AED0.02

3 months

+3.98%

AED0.01

30 days

+10.13%

AED0.01

7 days

-10.73%

AED0.01

BOOK OF MEME on socials

ZachXBT Warns New Token Project Links To Known NFT Scammers

Key Insights:

ZachXBT warned that the Web3 token project was linked to team members behind the 2022 Squiggles NFT scam.

Web3 employed a controversial deposit-for-airdrop strategy that gained notoriety after the Book of Meme episode in 2024.

Squiggles NFT was exposed as a $20 Million scam. Utilizing shadow wallets to inflate trading volume in the lead-up to its launch.

Blockchain investigator ZachXBT issued a community alert after discovering that a new project called Web3 was connected to alleged scammers. They were tied through previous rug pull operations that had drained millions from unsuspecting investors.

The warning came after Web3 announced a token airdrop on Aug. 27 via X. Using a deposit strategy that required users to send SOL tokens to receive airdrops back to their wallets.

ZachXBT replied the following day with a direct warning. He stated that Web3 was linked to a team member of the Squiggles NFT rug and Raichu. These were individuals he had previously exposed for fraudulent activities across multiple crypto projects.

Notorious Deposit Strategy

The Web3 project announced its presale with a pattern that became infamous in crypto circles during 2024. Users send SOL to an address and wait to gain an equivalent amount in tokens.

This deposit-for-airdrop strategy gained notoriety in 2024 with the release of the Book of Meme (BOME) episode.

BOME launched in March 2024 and employed this approach to create a decentralized storage system for memes on the blockchain. Thus offering early investors returns of up to 20 times their investment within weeks.

However, the strategy was increasingly exploited by scammers. Scammers usually collected funds without delivering promised tokens or delivered worthless tokens after taking users’ money.

The mechanism became particularly dangerous because it appeared legitimate. While providing an easy way to drain user wallets under the guise of airdrops.

$20 Million NFT Related Scam Blueprint

ZachXBT’s warning referenced the Squiggles NFT project, which YouTuber Coffeezilla exposed as an alleged scam in February 2022.

The project had generated massive attention, with over 230,000 X followers. It was positioned to raise approximately $20 Million through its NFT drop, scheduled for February 10.

Hours before the anticipated launch, an anonymous user published a detailed 60-page dossier that alleged Squiggles’ founders were paid puppets working for serial NFT scammers.

The document meticulously documented how the real operators belonged to a group of fraudsters operating under the umbrella name “NFT Factory LA.”

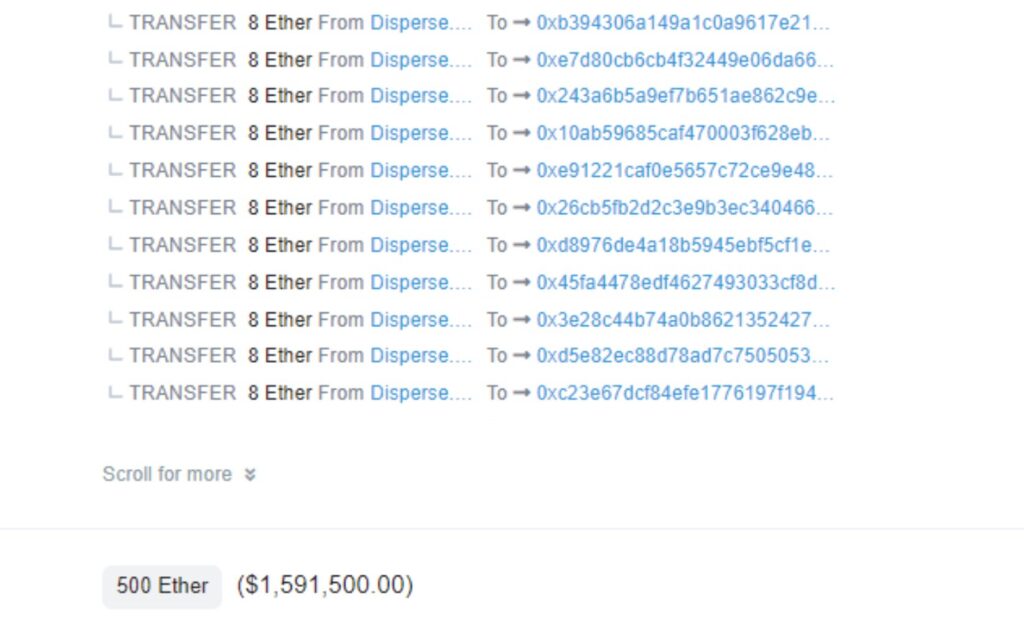

Coffeezilla’s investigation contained on-chain data revealing that Squiggles used a series of shadow wallets to artificially inflate trading activity and create the illusion of legitimate demand.

On-chain data with transfers from the Squiggles NFT team | Source: Trading

A single account created hundreds of wallets and moved around $7 Million worth of Squiggles by purchasing NFTs and reselling them on OpenSea for less than the purchase price.

The episode was orchestrated by three individuals known as Gavin, Gabe, and Ali, who had previously executed multiple NFT rug pulls, including League of Sacred Devils, League of Divine Beings, Vault of Gems, Sinful Souls, and Dirty Dogs.

The shadow wallets bought exactly three Squiggles each, attempting to generate hype and interest before immediately trying to flip them to unsuspecting buyers on the secondary market.

Celebrity-Backed Crypto/NFT Projects Facilitator Joins

ZachXBT also pointed to the involvement of a person identified as Raichu.

The blockchain investigator published a report in April 2023, revealing that Raichu, identified as Ryan, claimed to have helped sell over $15 Million worth of projects through marketing and celebrity promotions.

However, ZachXBT shared information pointing out that many of these projects were outright rug pulls or pump-and-dump schemes.

Raichu’s promotional network systematically connected various celebrities and influencers with alleged scams.

He collaborated with rapper Lil Xan to promote Baller Ape Club, which ultimately became a $2.6 Million scam resulting in wire fraud and international money laundering charges by the US Department of Justice in June 2022.

He also connected celebrities with Crazy Lemur Club, which rug-pulled with $320,000 shortly after launch.

The founder was later exposed for being behind over $5 Million in additional phishing scams targeting crypto users.

Additional projects facilitated by Raichu included Ancient Cats Club, which stole over $1.7 Million after involving Rich The Kid, and Vault of Gems, promoted by Antonio Brown before the team disappeared with over $1 Million.

ZachXBT documented over 50 examples of scams or pump-and-dump schemes that Raichu helped promote through celebrity endorsements, with many influencers failing to disclose the promotional nature of their involvement in these fraudulent projects.

The deposit-for-airdrop mechanism became increasingly exploited during last year’s memecoin frenzy.

Malicious actors reportedly stole 655,000 SOL tokens, valued at $141.3 Million as of press time, through 27 fraudulent memecoin presales on Solana.

Some scammers even hacked verified social media accounts, including hardware wallet provider Trezor’s X account, to promote fraudulent presales and collect SOL from unsuspecting individuals.

As a result of this backdrop, ZachXBT advised community members to steer clear of the Web3 project.

The post ZachXBT Warns New Token Project Links To Known NFT Scammers appeared first on The Coin Republic.

Have you noticed? BTC is sluggish, ETH should rise. Today BTC dropped, but ETH, BNB, and SOL are holding their ground, and even giants like WLFI and XPL can still rally against the trend.

Previously, everyone was playing on-chain, mostly on ETH. Then SOL saw the emergence of meme coins, which was the first step towards aesthetic diversification.

I remember in 2023, I was working at DODO, and at that time Uniswap still held the top spot with a 50% market share. But soon, projects like maverick, Ray, and those on SOL and AVAX chains began to carve up the market. The landscape shifted from "one dominant player" to "one strong player among many," gradually changing the dynamics.

The diversification of aesthetics is still ongoing. Everyone is playing their own altcoins, trading their own meme coins, and attention is scattered, making it harder to find a universally acclaimed "god-tier" coin. As a result, moments of widespread enthusiasm for coins like bome, goat, and moodeng are becoming increasingly rare.

Behind this is essentially market fragmentation. Funds are sliced, narratives are fragmented, and emotions are divided. Thus, what you see is: at the same time, some coins are halving while others are doubling. In the past, they moved together; now, they rise and fall independently.

I once asked a guest at a sharing session why ETH suddenly weakened. He replied: aside from BTC, whether altcoins can rise depends on BTC. Only when BTC rises and stabilizes can altcoins discuss fundamentals. Otherwise, the market at that time would be: when BTC is bearish, altcoins are useless.

But now, the landscape has changed. BTC is moving sideways in the 11k range, while ETH is performing solo, with a list of altcoins doubling in a day. Strategic reserves are no longer just MicroStrategy hoarding BTC; instead, there’s a blooming variety of coins and stocks: SOL and BNB both have their own funds, and Pengu can even ring the bell on Nasdaq.

Even more extreme, even if BTC drops, XPL and WLFI are still rising, and SOL and BNB can hold their own market.

So, the diversification of aesthetics may be a trend, an inevitable evolution of the market. The next development might be BTC gradually fading into the background in the future blockchain boom. It will be remembered like Ordi as a pioneer. But if it cannot truly empower, its status may ultimately remain just as a "pioneer."

Guides

Find out how to buy BOOK OF MEME

Getting started with crypto can feel overwhelming, but learning where and how to buy crypto is simpler than you might think.

Predict BOOK OF MEME’s prices

How much will BOOK OF MEME be worth over the next few years? Check out the community's thoughts and make your predictions.

View BOOK OF MEME’s price history

Track your BOOK OF MEME’s price history to monitor your holdings’ performance over time. You can easily view the open and close values, highs, lows, and trading volume using the table below.

BOOK OF MEME FAQ

Currently, one BOOK OF MEME is worth AED0.0071838. For answers and insight into BOOK OF MEME's price action, you're in the right place. Explore the latest BOOK OF MEME charts and trade responsibly with OKX.

Cryptocurrencies, such as BOOK OF MEME, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as BOOK OF MEME have been created as well.

Check out our BOOK OF MEME price prediction page to forecast future prices and determine your price targets.

Dive deeper into BOOK OF MEME

A memecoin on Solana network, BOOK OF MEME (BOME) is an experimental project poised to redefine Web3 culture by amalgamating memes, which endeavors to encapsulate the ever-evolving meme culture within a digital compendium.

ESG Disclosure

ESG (Environmental, Social, and Governance) regulations for crypto assets aim to address their environmental impact (e.g., energy-intensive mining), promote transparency, and ensure ethical governance practices to align the crypto industry with broader sustainability and societal goals. These regulations encourage compliance with standards that mitigate risks and foster trust in digital assets.

Market cap

AED495.93M

Circulating supply

69B / 69B

All-time high

AED0.046177

24h volume

AED101.54M