Take stock of the data performance of 8 mainstream public chains in the past 3 months: the return of the king of Ethereum, and the data of Base and Hyperliquid soared

Original author: Frank, PANews

The crypto market has experienced a notable rally over the past three months. The performance of mainstream public chains has become the focus of the market, and Ethereum has staged the return of the king with the dual boost of ETF funds and the buying of listed companies. Solana, Sui, Hyperliquid, and others have also seen significant price increases. Judging by the price action, the market seems to be entering a long-lost altcoin season. But behind the price, what is the development status of these public chains?

This article sorts out the core indicators of 8 major public chains with high TVL amount and popularity in the past three months - price, TVL, capital flow, on-chain activity, and ecological progress - in an attempt to outline the real situation of this round of public chain racing. The data period is April 20 to July 20.

Ethereum: The return of the king catalyzed by capital

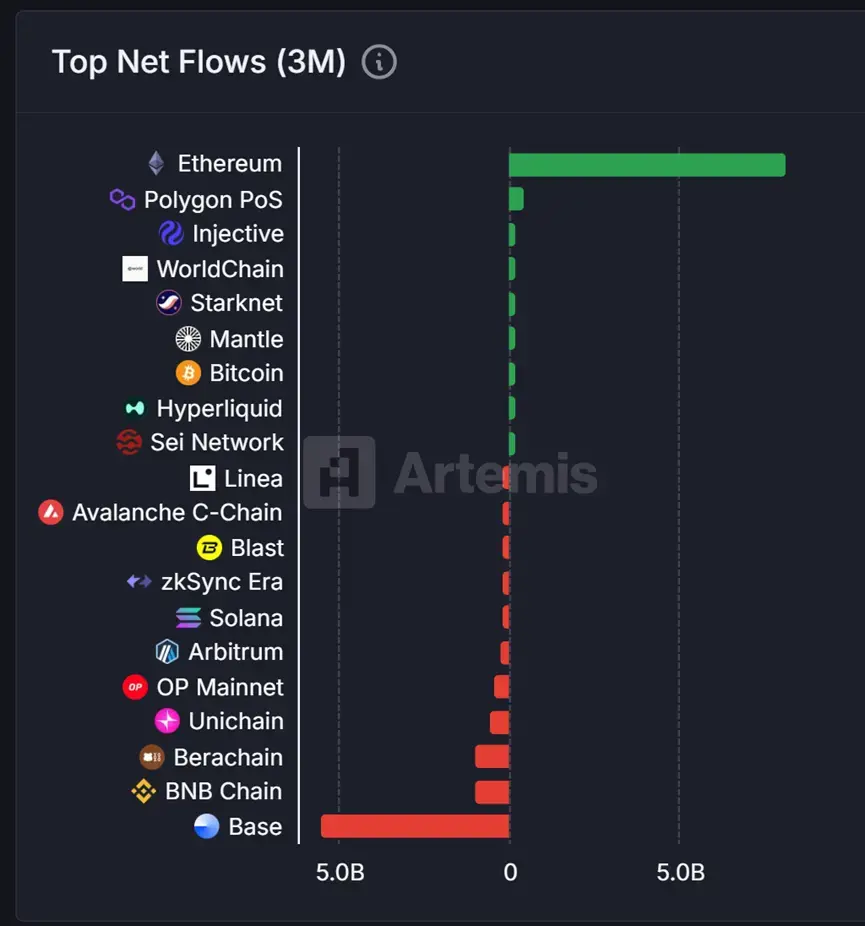

Ethereum has recently seen a significant increase in various data, which is also in line with its price performance. In the past three months, the price of Ethereum has grown from $1,600 to a maximum of over $3,800, an increase of more than 130%. Behind the price surge, the TVL volume of the Ethereum ecosystem also increased by 61.34% during the same period, and the net inflow of on-chain funds reached $8.3 billion in the past three months, once again becoming the public chain with the largest inflow of funds. However, the growth of TVL is mainly due to the rise in the price of ETH tokens, and in terms of the amount of ETH, the amount of ETH in the Ethereum ecosystem has been on a downward trend recently, from 28.39 million in April to about 22.28 million now, a decrease of 21%.

In terms of daily activity and the number of transactions on the chain, they have increased by 11.94% and 16% respectively in the past three months, with no particularly significant improvement. Alternatively, Ethereum's spot ETFs have shown significant growth during this three-month period, with a net increase of approximately $5 billion. In addition, a number of U.S. listed companies have followed the micro-strategy and used Ethereum as a reserve token, which has also provided more buying and positive market sentiment for Ethereum. Taken together, capital drive may be the main factor in the significant increase in Ethereum's price.

Solana: A headwind test for market capitalization recovery and reduced activity

Unlike Ethereum, SOL's price has also seen a significant increase in recent times, bouncing from a maximum of $139 to $189. However, judging from the data of the Solana ecosystem, many data not only did not improve significantly, but also showed a downward trend. Among them, the net outflow of funds on the chain was about $112 million in three months, and the number of daily active addresses also fell by 14%. The issuance of stablecoins also declined slightly, decreasing by about $1.5 billion.

TVL amount increased during this period, from $7.3 billion to $9.237 billion. In terms of performance within the ecosystem, Pump.fun is still the platform with the largest trading volume in the Solana ecosystem, contributing $234 billion in transaction volume in the past month. In addition, among the top DEXs, OKX DEX ranked in the top ten with a monthly trading volume of $4.6 billion, which is also unexpected.

In terms of meme coins, the current daily issuance of new tokens on Solana is about 40,000 to 50,000, a significant decline from the level of 90,000 to 100,000 in January this year. However, it is still relatively stable overall, and there has been no cliff-like decline.

Currently, Solana's staking rate is around 66%, but it is clear that the number of validators is declining, which also means that large validators on Solana are gradually replacing small validators.

BSC: Alpha event ignites on-chain renaissance

BSC's data effect seems to be the exact opposite of Solana's. Looking at the token price, BNB has not changed significantly in the past three months, rebounding by nearly 30%. There has been significant growth in daily activity, transaction number, and stablecoin issuance on the chain. First, the number of daily active addresses increased from 25.2 million to 44 million, an increase of 74.6%; the number of daily transactions increased from 7.85 million to 16.82 million, an increase of about 114%; Stablecoin issuance increased by 55% from $7.12 billion to $11 billion. From these data, BSC has seen a significant change in data in the past three months, likely driven by alpha activity.

While on-chain activity has increased significantly, BSC has seen a net outflow of $950 million in the past three months in terms of on-chain inflows. How to convert active users attracted by activities into deposited funds may be the next problem for BSC to solve.

Base: High-speed expansion for Ethereum blood transfusion

Base's on-chain data performance is also impressive, with TVL growing from $2.4 billion to $4 billion in three months, an increase of 63%. The number of daily active addresses increased from 15.6 million to 33.6 million, an increase of 115%, and the number of daily transactions increased by 23%. Overall, Base's on-chain data has improved significantly, but there has been a significant outflow of funds on the chain, with a net outflow of $5.6 billion in three months, making it the public chain with the largest net outflow. The data shows that these funds eventually flow to Ethereum. Base has also become the largest source of funding for the Ethereum mainnet in recent times.

Additionally, the Base chain launched Flashblocks technology, reducing block generation time from 2 seconds to 200 milliseconds, making it the fastest EVM chain available. At the same time, Coinbase launched the Base App to create a one-stop social and trading platform, which will further promote the development of the Base ecosystem.

Arbitrum: Holding the L2 runner-up charging period

Arbitrum's data hasn't changed much overall, with a 22% increase in transactions, in addition to a 34% increase in TVL. The data on the number of daily active addresses has hardly changed, from 3 months ago to 4.6 million now. However, ARB's price has rebounded by 66% recently, which is relatively strong among several major public chains. This may be due to the effect of Ethereum's price rise, although the data has not changed much, Arbitrum still maintains its second position in Ethereum L2.

Sui: TVL and currency price both took off

SUI's price has seen a significant increase in recent times, rising from a high of $2.15 to $4.24, a 97% increase that nearly doubled. Behind this surge, there is also some underlying data support. Mainly TVL data, which rose from $1.2 billion in April to $2.2 billion, an increase of more than 84%. In addition, the issuance of stablecoins has also exceeded $1 billion. In terms of the number of daily active addresses, from May to June, Sui's daily active users experienced a roller coaster, first from 1.5 million to 400,000 per day, and then rebounded to around 1 million in early July. However, it has not yet returned to its previous peak.

Hyperliquid: A rocket climb after the trust storm

Hyperliquid is almost the public chain with the best rally in nearly three months, with the token price soaring from $18 to $49.9 and its market capitalization surpassing $15 billion, ranking thirteenth among all tokens.

Reflected in the on-chain data, the TVL volume also increased from $640 million to $1.943 billion, an increase of 202%. Stablecoin issuance increased from $2.1 billion to $4.9 billion, quickly becoming the fifth-largest public chain by issuance. After experiencing the previous decentralized trust crisis, Hyperliquid's treasury HLP yield has also climbed again recently and exceeded $68 million, setting a new all-time high. After entering July, the number of new daily users of Hyperliquid also rose to more than 3,000 again.

Aptos: Lurker in data stall

Compared to other public chains, Aptos is a bit unsatisfactory in terms of on-chain data and price. The price has increased by 10% in 3 months, while several key data such as TVL, inflows, and daily active addresses are negative. Probably the biggest change is the 34% increase in daily transactions and the increase in stablecoin issuance by $300 million. Compared to Sui, which is also the MOVE language, Aptos seems to have fallen behind in multiple data dimensions.

Overall, the recent performance of public chain data is not as intense as the market's response to token prices, although driven by the market, networks such as Sui, Hyperliquid, and Base have also seen significant improvements in data, but this increase is obviously lower than the increase in token prices. Obviously, this is a round of capital recovery stage before the ecology, and behind this recovery, whether the price performance of tokens can be transformed into the ecological prosperity of various public chains, and even drive actual application tracks such as DeFi and blockchain games like the previous bull market, may be the core factor that can last longer in this round of altcoin season. Therefore, although the current price and on-chain data may not seem to be at the same frequency, in subsequent development, these data may also become the decisive factor for price.