Interest rate cuts, DAT and sell-offs, has the crypto bull market peaked or is it still in its middle?

Written by: Ignas

Compiled by Luffy, Foresight News

As I write this, the biggest short-term uncertainty about cryptocurrencies is the trend of interest rates. The key points are two points: one is Powell's statement at the Jackson Hole meeting (Thursday, August 22), and the other is how the Fed will determine interest rates at the Federal Open Market Committee (FOMC) meeting on September 16-17.

-

If dovish signals are released→ 2-year US Treasury yields and the US dollar index will fall→ Bitcoin/Ethereum will rise

-

If there is a hawkish interest rate cut or keep interest rates high for longer→ risk assets are sold off, altcoins will plummet first

which is the conclusion of the ChatGPT 5 thinking model and Deepseek's Deepthink model. And many people on the X platform also hold the same view, which also explains the recent decline in altcoins.

To be honest, the dependence of cryptocurrencies on macro factors is quite frustrating, but the fact that the last cycle peaked due to global interest rate hikes shows that we cannot ignore these factors.

However, as Jack Wintermute trader said, my AI model also paints a bullish outlook: rate cuts are coming. The uncertainty lies in "when, how many times, and how much."

In this way, it is the opposite of the end of the previous cycle: interest rate cuts are coming, so is the peak of the bull market far from here?

I hope so, but everyone I talk to plans to sell. So who is buying to offset the selling pressure?

The retail speculators we relied on in the last cycle have not yet entered the market (as can be seen from the encrypted app data on the iOS app store). The biggest buyer at the moment is:

-

Spot ETF

-

Crypto Asset Treasury (DAT)

My concern is: Can the purchasing power of institutions, crypto asset treasury and other large investors offset the rounds of retail selling? Or will they run out of purchasing power?

Ideally, this is a process that lasts for several years, and steady price increases will gradually weed out less committed investors.

Perhaps the most interesting result is that even though most crypto "natives" sell-off, cryptocurrencies continue to rise, triggering further gains.

In any case, the crypto asset treasury is both a significant risk point and a key bullish factor, and I would like to briefly talk about this.

Now look at the crypto asset treasury,

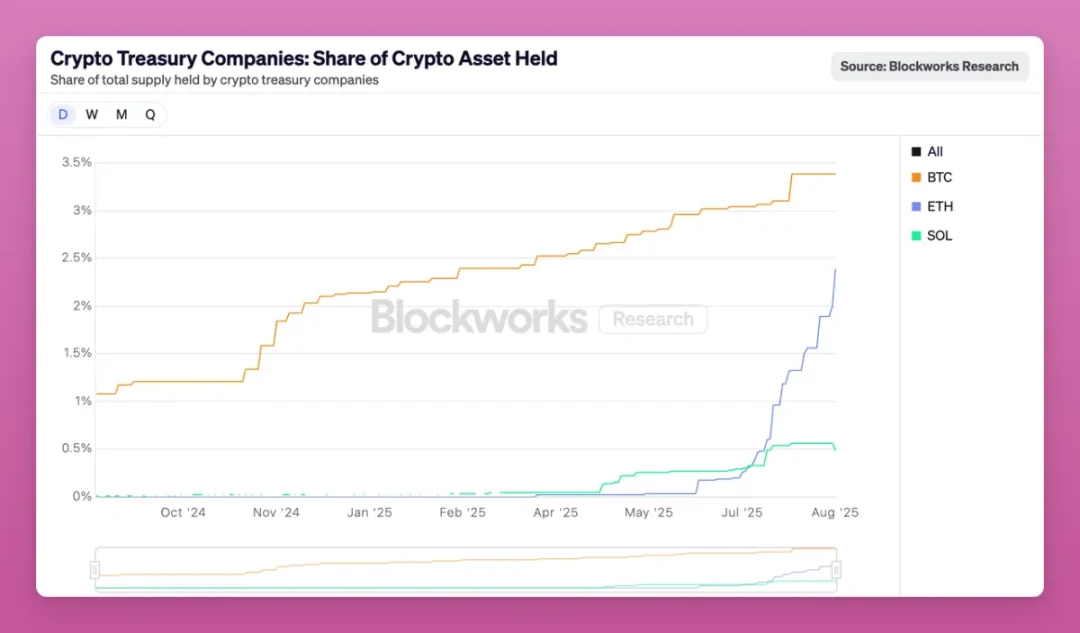

just look at the speed of the crypto asset treasury's acquisition of Ethereum.

It took less than 3 months for the Ethereum crypto asset treasury to acquire 2.4% of Ethereum's total supply.

Looking at it from another perspective: the current holdings of the largest Ethereum crypto asset treasury (Bitmine) are comparable to those of crypto exchange Kraken, surpassing exchanges such as OKX, Bitfinex, Gemini, Bybit, Crypto.com, and even exceeding the holdings in the Base Chain cross-chain bridge.

At this rate, within a few months, the Ethereum crypto asset treasury will hold more than Bitcoin. In the short term, this is good for Ethereum, but once the crypto asset treasury needs to liquidate Ethereum positions, the risk will come.

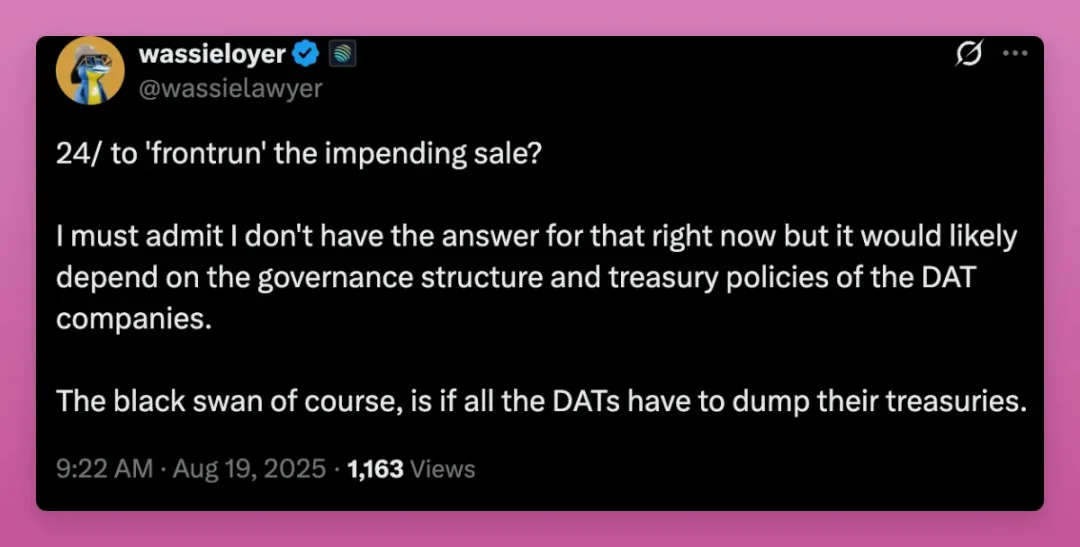

But even Wassie admitted that it is still unclear what happens to the crypto asset treasury when the adjusted net asset value (mNAV) turns negative.

There is a lot of speculation on the X platform, but my advice is to keep track of the data from the crypto asset treasury, especially to see if the adjusted net asset value continues to be below 1.

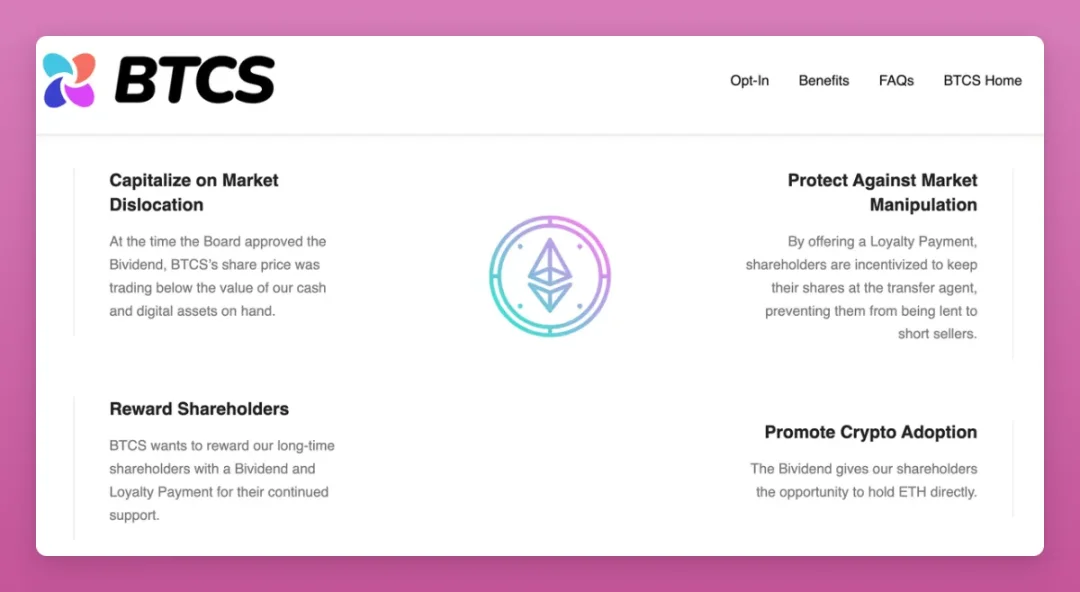

As I write this, SBET, BMNR are trading slightly above the adjusted net asset value of 1, while BTCS is below 1.

So what is BTCS doing?

To attract more stock buyers, BTCS announced its first "double dividend": a one-time ETH dividend of $0.05 per share, and a cash dividend of $0.35.

Most importantly, they offer...... Please read ...... carefully "We will offer a one-time Ethereum loyalty reward of $0.35 per share to shareholders who register their shares with our transfer agent and hold them until January 26, 2026."

For crypto natives, BTCS is like engaging in a "pledge mechanism" in traditional finance, with the aim of preventing shareholders from selling stocks. Their motivation for paying a "double dividend" stems from the adjusted net asset value of less than 1 and to "prevent market manipulation" - to prevent stocks from being lent to short sellers.

Also, where do these dividends come from? In fact, it was paid with the Ethereum they acquired.

Doesn't look great, right?

At least they haven't publicly sold Ethereum yet. I guess the first treasury to be unable to hold on and sell crypto assets will be the small companies that do not attract stock buyers. So track these dashboards below, identify crypto asset vaults and study how they handle crypto holdings.

Crypto Twitter may overlook small crypto asset vaults, but their movements allow us to predict what will happen to larger, systemically important crypto asset vaults.

A few dashboards worth paying attention to are recommended:

-

Blockworks

-

The Block

-

Delphi

-

Crypto Treasuries 1 Crypto Treasuries

-

2

-

Crypto Stock Tracker

It's important to note that the data reported by different dashboards varies slightly, which can make analysis more difficult. We need to keep a close eye on the movements of other crypto asset treasuries.

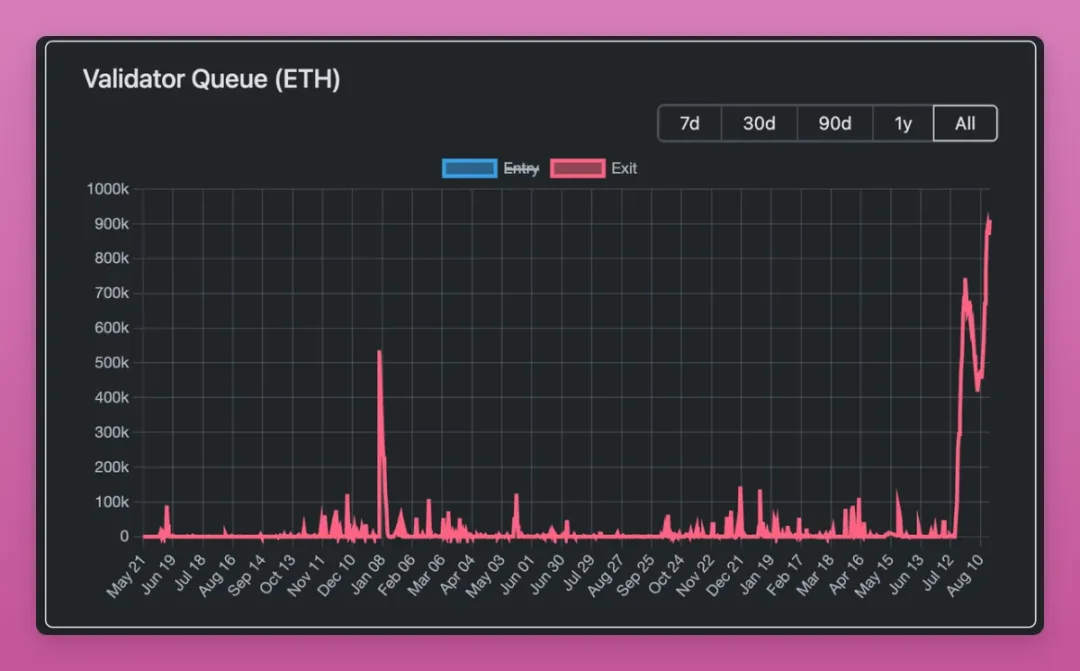

However, given the current low adjusted net asset value premium and the record number of Ethereum unstaking queues, it is not surprising that the Ethereum rally could slow for a few days or even weeks.

Before moving on to other topics, I would like to add: I am becoming more and more optimistic about the altcoin crypto asset treasury.

Thebullish logic of altcoin crypto asset treasury

In this cycle, the issuance of new tokens has set a record. While most of them are worthless meme coins, the cost of token issuance has actually dropped to zero.

Compare previous cycles: proof-of-work forks require miners (e.g., Litecoin, Dogecoin) or staking infrastructure (e.g., EOS, SOL, ETH). Even in the last cycle, issuing tokens requires a certain amount of technical knowledge.

Before this cycle, the number of tokens worth paying attention to is "controllable", including several lending protocol tokens, decentralized exchange tokens, several public chain tokens, infrastructure tokens, etc.

And now, with token issuance costs returning to zero and more projects launching tokens, especially with the rise of Pump.fun, it is becoming increasingly difficult for altcoins to attract enough attention and inflows.

For example: I have listed 11 numbers below, but what if there are thousands? There is no "Schelling point" (referring to the default consensus point when there is no communication).

previously only the difference between Bitcoin and "other coins". Coupled with MicroStrategy's continued buying, only Bitcoin can rise.

And the altcoin crypto asset treasury has changed this landscape.

First, very few altcoin projects can plan to acquire crypto asset treasuries. This requires specific knowledge and skills, which most programs do not have.

Second, only a limited number of altcoins "worth" have a treasury of crypto assets. For example, Aave, Ethena, Chainlink, Hype, or DeFi token indices.

Third, and perhaps most importantly, crypto asset treasury gives ICO projects an "IPO moment" that can attract institutional funds that would otherwise be out of reach. Like I wrote on the X platform:

I used to think that altcoin crypto asset vaults were crazy Ponzi games. But if you think about it, the crypto asset treasury allows altcoins to "go public" - from ICOs to IPOs. BNB's crypto asset treasury is like Binance's IPO, which may not have been able to do a serious IPO in the first place. Another example is $AAVE's crypto asset treasury, which allows traditional financial capital to invest in the future of the lending field. Let's get more of these crypto asset treasuries.

Finally, unlike Bitcoin and Ethereum, altcoins do not have ETFs to attract institutional investors.

Therefore, the altcoin crypto asset treasury is an area I would focus on. They make a difference, such as over-the-counter sell-offs that absorb VC capital or buy tokens at a discount.

Ethena is an early example, but I also want to see what happens when an altcoin with a high percentage of circulation has a crypto asset treasury.

Is it time to sell?

As I said earlier, there are many people around me who plan to sell. But they don't want to sell at the current price.

Why? Because all indicators still look surprisingly healthy. CryptoQuant's "Universal Momentum Indicator" tracks bull-bear cycles through the P&L index.

core conclusion (not much changed from a few months ago):

-

Bitcoin is in the middle of a bull market.

-

Holders are taking profits, but there is no extreme frenzy yet.

-

Prices are still likely to rise until they are overvalued.

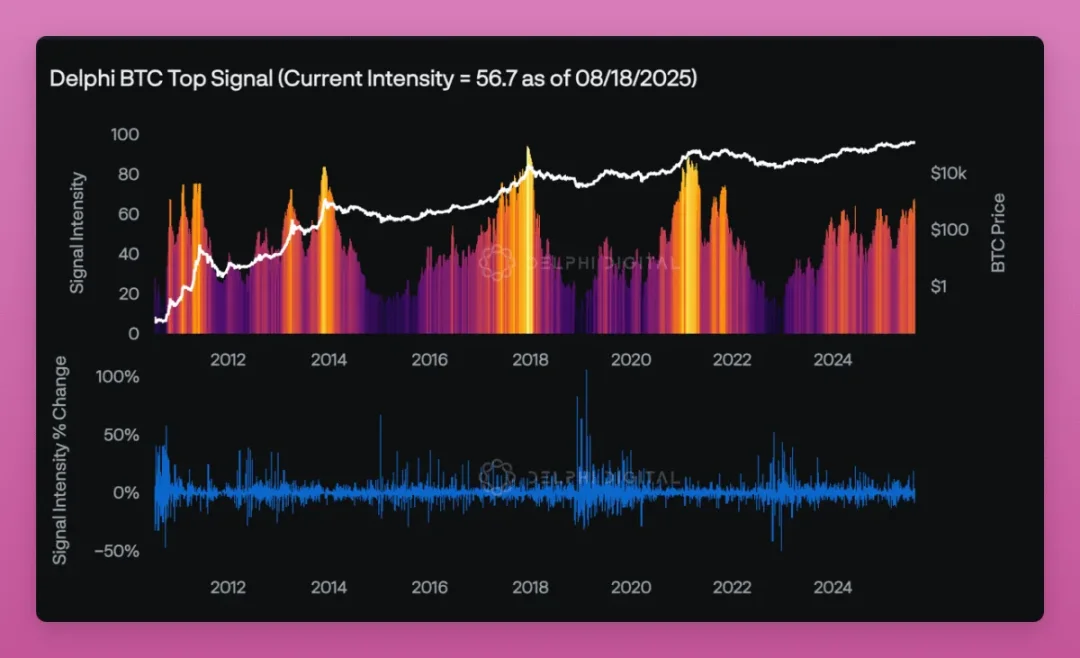

Still, Delphi's Bitcoin Top Signal dashboard shows that the market is close to overheating but is still within manageable range: a strength score of 56.7, while tops are typically around 80.

Fear & Greed Index has returned to neutral.

Additionally, none of the 30 metrics tracked by Glassnode show the market peaking.

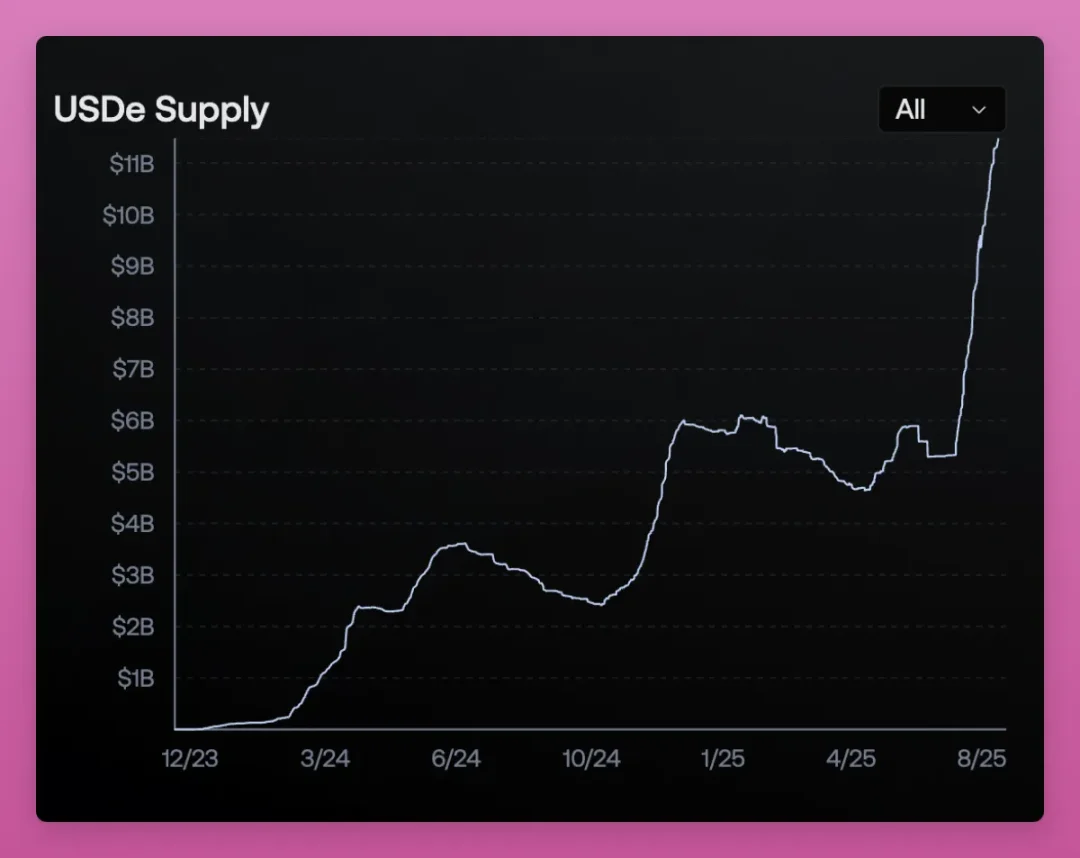

I used to judge market tops by peak funding rates, but now I doubt this metric is skewed by Ethena.

In the past, high funding rates meant that too many speculators went long, usually followed by a plunge. But Ethena's USDe broke the signal.

USDe mints stablecoins by going long on spot and shorting perpetual contracts, earning funding rates as income. When the funding rate rises, more USDe is minted, increasing short positions and lowering the funding rate. A cycle is formed.

So now the high funding rate no longer means that the market is overheated, it may just be that Ethena is issuing more USDe.

Why not track the supply of USDe instead? If you look at it this way, the market is really hot, and the supply of USDe has doubled in a month.

Overall, I think the market is in good shape. However, because many speculative retail investors in the third and fourth cycles held unrealized income positions that were "enough to change lives", they would be sold off every time they rose sharply.

Hopefully, crypto asset treasuries and Ethereum will absorb this selling pressure.

Alternatively, the bear market could come unexpectedly again due to macro turmoil that could expose hidden leverage in the crypto space that we have yet to discover.

In the first article of the "State of the Market" series, I mentioned several areas where leverage may exist:

-

Ethena: USDe's collateral has shifted from Ethereum's majority to Bitcoin, and now to liquid stablecoins.

-

Re-staking: While the narrative is quiet, liquid re-staking protocols (LRTs) are being integrated into mainstream DeFi infrastructure.

-

Circular arbitrage: In order to chase high returns, speculators use cyclic operations and leverage mining.

Ethena used to be my biggest concern, but now the crypto asset treasury is the main focus. What if there are hidden levers that we are completely unaware of? This always keeps me awake.

What to do after selling?

After moving the tax base to Portugal, my investment strategy for cryptocurrencies changed.

In Portugal, capital gains tax is 0% if the asset is held for more than 365 days; Additionally, transactions between cryptocurrencies are not taxed.

This means that I can convert it into a stablecoin, hold it for a year, and earn tax-free income.

The question is: where to store stablecoins to maximize returns while sleeping peacefully?

Surprisingly, there are few protocols that are reliable enough. Chasing high returns requires switching back and forth between different protocols, and you have to be wary of "vault migration" (such as contract upgrades), and of course, there are hacker risks.

Aave, Sky (Maker), Fluid, Tokemak, Etherfi vaults are the most withdrawn, but there are many other options like Harvest Finance, Resolv, Morpho, Maple, etc.

The question is: which protocol allows you to put stablecoins for a year with peace of mind? I may only trust two.

The first one is Aave. But the growth of USDe and the cyclical arbitrage of LST ETH/ETH made me a little worried about mass liquidations (although Aave's new "umbrella" mechanism helped).

The second is Sky. But S&P Global Ratings gave it a "first-time stablecoin system credit rating", and the result is worrying - the rating is B-, which is in the "risky but not on the verge of collapse" grade.

Weaknesses include:

-

Concentration of depositors

-

Governance is still deeply tied to Rune (founder of MakerDAO)

-

Weak capital buffer

-

Unclear regulation

This means that Sky's stablecoins (USDS, DAI) are considered credible but fragile. Normal times are fine, but during stressful events such as large-scale redemptions or loan defaults, they can be hit hard.

As PaperImperium said, "This is a disastrous rating for mainstream stablecoins."

However, traditional finance has a much lower risk tolerance than crypto natives, but it is certainly not possible to put all stablecoins in one protocol.

This also shows that cryptocurrencies are still in their early stages and there is no real "passive investment" yet, except for Bitcoin and Ethereum.