Cardano Price Holds Key Support As Institutional Flows Grow

Key Insights:

- Institutional inflows into ADA reached about $73M this year, with $900M held in custody.

- Cardano price was around $0.88 at press time, up 2.9% in 24 hours but down 12% weekly.

- The network processed more than 112 Million transactions while fees stayed below $0.25.

Cardano price was steady above major support in August 2025 as institutional inflows increased and network activity accelerated.

Analysts said the token was preparing for another attempt to break above the $1 level, which remained a crucial psychological barrier.

Cardano Price Supported by Rising Institutional Inflows

ReserveOne data showed institutional demand for ADA increased throughout 2025. Inflows reached around $73 Million this year, bringing total holdings in custody to more than $900 Million.

Analysts said large investors were allocating because of structural value rather than short-term speculation.

Institutions typically expand exposure when assets show liquidity, reliable infrastructure, and a maturing ecosystem.

Cardano met these requirements, with steady transaction volumes and ecosystem development supporting accumulation.

This trend suggested that ADA was evolving into a longer-term portfolio asset for funds and advisory groups.

At press time, Cardano price was around $0.86, up 0.59% in the past 24 hours but down 5.9% over the week. Analysts identified a demand zone near $0.84 created by strong volume activity.

Maintaining this level signaled continued strength and provided a base for potential advances toward the $1.20 to $1.30 resistance cluster.

Analyst Altcoinpediax said the token had retested its prior breakout level and was now forming higher lows, a technical structure often seen before further upward movement.

The risk remained clear: a drop below $0.84 could send the token back to the previous accumulation band around $0.70 to $0.72.

A confirmed breakout above $1 would likely improve sentiment and reinforce institutional flows.

Traders noted that such a move could trigger further buying toward the $1.20 to $1.30 area, a zone where earlier rallies had stalled.

Cardano Price Analysis Shows Key Technical Levels

Technical analysis highlighted Cardano’s stair-step structure, with a series of higher lows across the daily and weekly charts.

This pattern suggested the market was transitioning from consolidation into expansion. Analysts said the next pivot remained the $0.84 to $1.00 band, which defined the balance between bullish continuation and renewed sideways action.

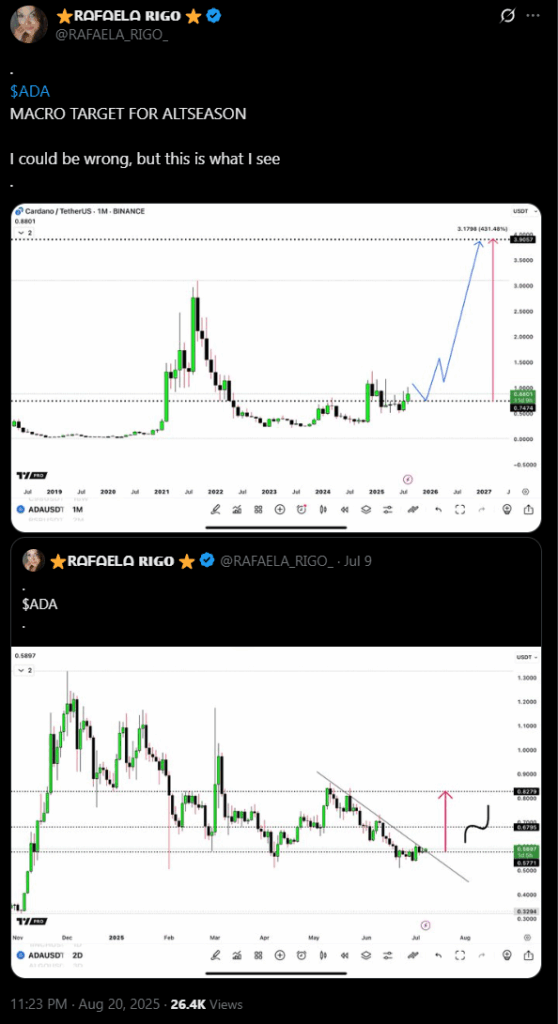

Macro analyst Rafaela Rigo projected a long-term path toward the $3.00 to $3.20 zone if broader altcoin momentum developed.

She noted that ADA maintained a higher low formation on the monthly chart, consistent with the end of an accumulation phase.

In the near term, resistance appeared in the $1.50 to $1.80 range. A breakout through that area could open the path toward retesting the 2021 highs near $3.10.

Market data also showed rising futures open interest for ADA, with levels approaching those last seen during the previous peak cycle.

Open interest measures the total value of outstanding futures contracts. Analysts often view increasing open interest as a sign of growing market participation.

Rising values can precede stronger volatility, creating conditions for directional price moves.

On-chain Growth Supports Longer-term Outlook

Cardano’s network processed more than 112 Million transactions this year, according to blockchain data. Average transaction fees remained below $0.25 at press time.

Compared to other blockchains where fees often spiked during periods of congestion, Cardano maintained affordable costs. This efficiency positioned the network for applications beyond speculation.

Analysts said sustained low fees were important for adoption in payments, decentralized finance, and enterprise use cases. Broader adoption required consistent affordability at scale, which Cardano demonstrated through transaction metrics.

Institutional flows aligned with this trend. Funds expanding their ADA positions cited consistent liquidity and ongoing ecosystem upgrades.

Developers continued building decentralized applications on the chain, adding to the activity measured on-chain.

Cardano price action also mirrored these fundamentals. Analysts said higher transaction volumes often accompanied accumulation periods that later developed into expansion cycles.

By processing more activity at low cost, Cardano reinforced its base case for broader integration across the digital asset sector.

Cardano’s market setup in 2025 combined institutional accumulation, on-chain growth, and rising derivatives activity.

This alignment would increase the probability of a larger move if the token maintained its support band, per analysts.

At press time, the critical area remained between $0.84 and $1.00. Holding this structure kept the technical outlook constructive.

A sustained breakout above $1.20 could shift momentum toward the next resistance levels near $1.50 and beyond.

If the trend of higher lows continued, the next expansion phase could target the $3.00 region identified in macro projections.

Analysts said the technical structure, coupled with institutional flows, supported this scenario as long as key support held.

The post Cardano Price Holds Key Support As Institutional Flows Grow appeared first on The Coin Republic.