Bear Market Survival: Solana: 11 DeFi Protocols to Make Money Guide

Words: 0x Sketon, DeFi Researcher

Compilation: CryptoLeo

Editor's note: After the "Black Monday" and "CNBC oolong incidents", the market has cooled again. BTC remains at around $80,000, most altcoins have halved since a year ago, the secondary market is wailing, and friends who fight dogs may be able to meet a golden dog or two.

In general, the development of tariffs and Trump's "big mouth" characteristics have led to the current market being completely driven by news, and the difficulty of making money by speculating in coins has risen again. DeFi researcher 0x Sketon has written about 11 yield-earning DeFi protocols worth participating in on Solana recently, among which there are more lending and stablecoin deposits, compiled by Odaily Planet Daily below.

In this article, we'll look at the top 11 DeFi strategies for earning passive income on Solana, looking for 15% to 50% APY through lending, vaulting, and farming, and here's a curated list of protocols that earn a steady yield:

1、Adrastea Finance

lend USDC, offering 13.94% APY;

Provide SOL (Solayer) to participate in liquidity restaking, with an APY of 9.7%.

2、NX Finance

Deposit SOL into the GMS lending pool (APR 16.68%) and "earn yield + double points" by partnering with Fragmetric.

3、Vaultka

JLP mining (15% -20%), V1 version lends SOL (APY 16.65%), USDC (10.27%), USDT (12.65%);

In addition, you can also borrow JLP and SOL for leveraged mining (to maintain the health of borrowing), and the partners are: Jupiter, Solayer, and Jito.

4. RateX

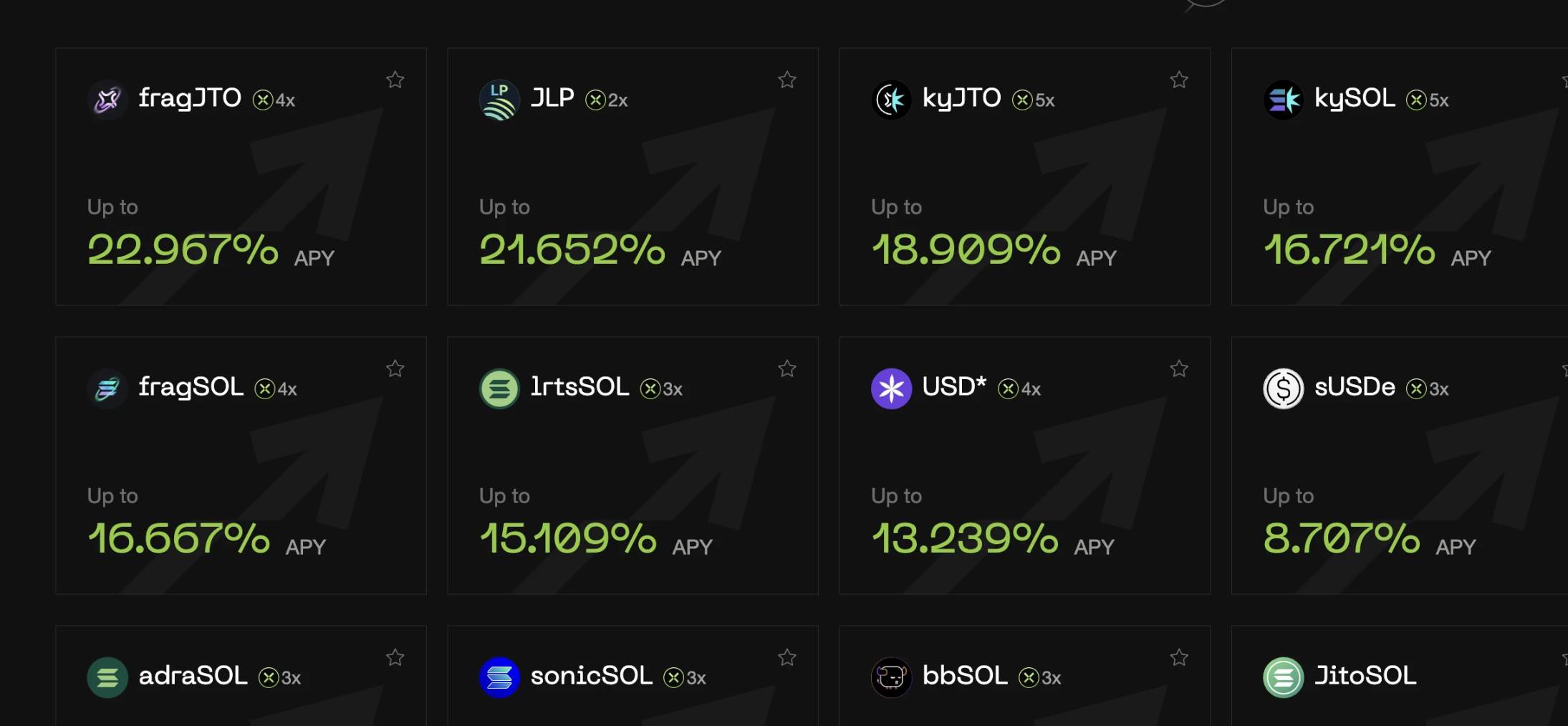

Choose a high APY pool to deposit staked tokens and earn Fragmetric + native points.

5、DeFituna

Borrow tokens into protocol pools, currently the pools with higher APY include SOL, Fartcoin, USDS.

6、Pluto

Deposit money to borrow USDC, SOL, and PYUSD and earn higher APY with its JLP and INF revolving compounding.

7、Exponent

A Pendle-style DeFi protocol on Solana, where the corresponding tokens are swapped and deposited into a matching pool via Jupiter, the protocol also features Farm and Deposit Liquidity Vault rewards (including Points bonus bonuses for staking token protocols: Fragmetric, Fyros).

8、Sandglass

Lending aggregators, select JLP pool deposits, APY is 5 – 20%.

9、Vectis Finance

Delta neutral strategy, choose a gold deposit to deposit in USDC, and get 6 – 25% stablecoin APY.

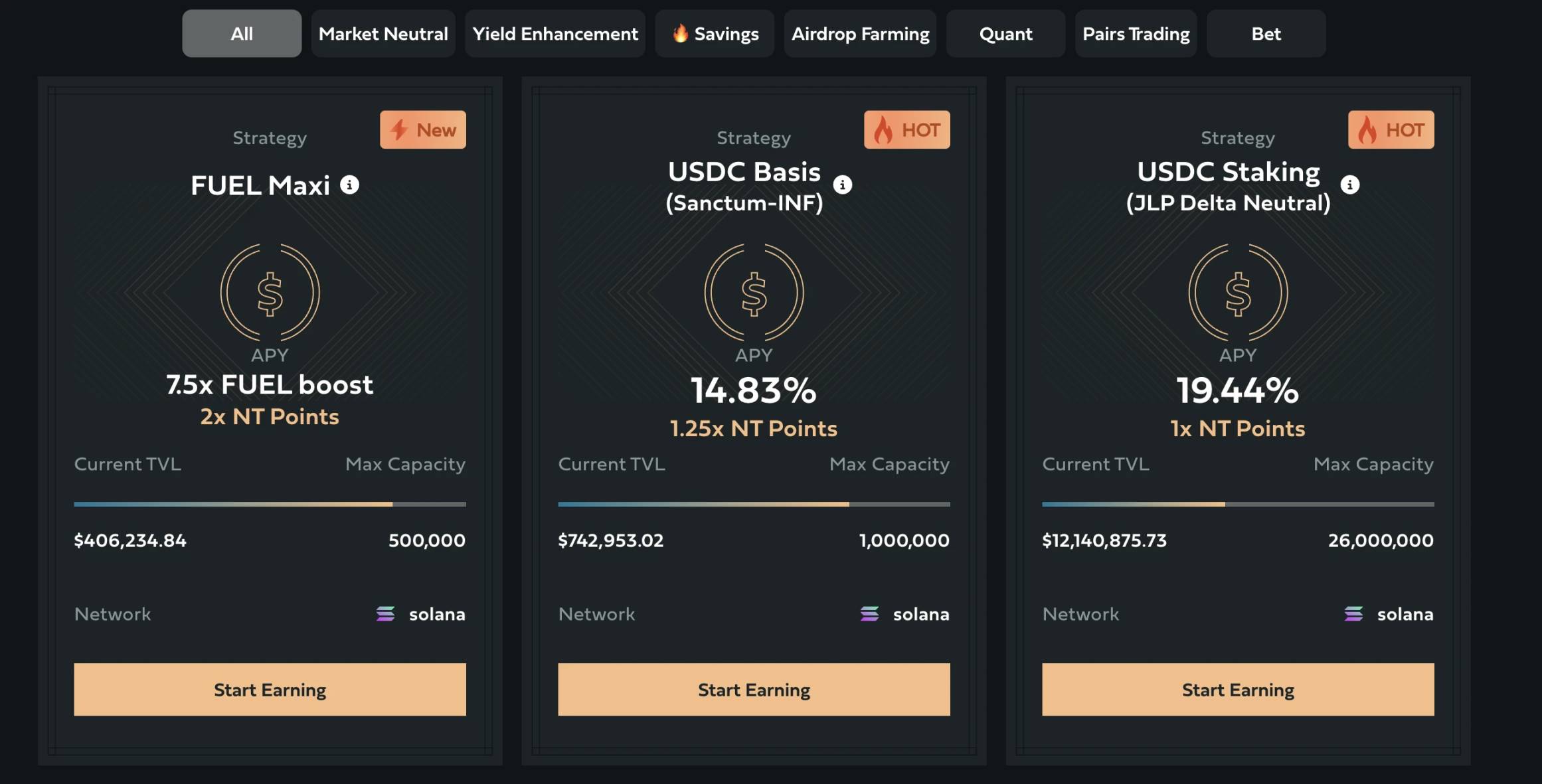

10、Neutral Trade

Led by the former Goldman Sachs team;

Choose a yield strategy and deposit funds to earn 1-2x NT points (airdrops).

11、synatra

Synthetic restaking protocol to exchange SOL for ySOL and earn 31 – 38% APY.

The above is the borrowing and depositing to earn APY protocol shared today, and I recommend focusing on the following items:

-

Neutral Trade, created by quantitative analysts, traders, and experienced Web3 developers at Goldman Sachs, Barclays, and the world's top three hedge funds, is one of the Solana Radar hackathon-winning projects;

-

RateX: The seed round was funded by GSR, Animoca Ventures, and others, and funded by the Solana Foundation, and is also the first prize winner of the Solana 2024 Renaissance Hackathon MCM.

-

Exponent: Announced the closing of a $2.1 million funding round in 2024, led by RockawayX, with multiple project points bonuses for depositing staking tokens;

-

DeFituna: Founder Dhirk previously posted that he is building a V2 version and is also developing an independent product, and the token TGE news will be announced at that time, but DeFituna's token is first and foremost a revenue sharing token, and governance functions will be added in the future. Dhirk also previously revealed a $200 million market manipulation scheme for the M3 M3 platform, involving tokens such as LIBRA, MELANIA (then known as Moty);

-

NX Finance: Partnered with multiple DeFi protocols on Solana, and although the TVL is not high, its points system is expected to be airdropped.

Finally, most of the projects, including the recommended projects, are early-stage projects and have certain risks.

If necessary, several key projects will be selected for detailed description in the future.