On August 1st, the key market information is poor, so be sure to see it! |Alpha Morning Post

Selected news

1. Coinbase plans to add tokenized stocks, prediction markets, and early-stage token sales services to create an "all-in-one trading platform"

2. The US SEC launched the Project Crypto program to promote the on-chain of financial markets

3. Bitmine, Sharplink Gaming, and The Ether Machine all hold more ETH than the Ethereum Foundation

4.9Moonit, launched in collaboration with GAG, Memeland, and others launched the Meme Currency Market

5. Stable completed a $28 million seed round of financing, co-led by Bitfinex and Hack VC

Project progress

MEET48, a company dedicated to building a new Web3.0 entertainment ecosystem, announced today that its inaugural Web3.0 Global Idol Annual Popularity Finals (WIPA) hosted by it has accumulated over 48.25 million IDOL, accounting for 1.01% of the total token supply, during the one-week countdown phase. Officials expect that the total IDOL consumption will exceed 2% before voting closes at 04:00 UTC on August 2 and the final results are announced at the AsiaWorld-Expo Arena in Hong Kong, setting an unprecedented foundation for participation in this groundbreaking event.

As the world's first project to deeply integrate blockchain mechanisms with idol selection, WIPA brings together popular members from SNH48 GROUP and AI-Agent virtual idol groups launched by MEET48. The finals will select the TOP16 idols, who will not only receive resources such as digital single and MV production, global advertising exposure, overseas tours, and handshake events, but will also be the first to conduct cross-dimensional linkage with AI virtual idols to create a new narrative for Web3 entertainment.

Since MEET48 officially launched the TGE of IDOL tokens on June 11 and completed its launch on platforms such as Binance Alpha, Bitget, Gate, MEXC, and PancakeSwap, a series of warm-up activities around WIPA have quickly attracted the attention of fans around the world.

At the same time, the on-chain performance confirms this phenomenal popularity. According to data from DappRadar, IDOL's trading volume in the past 24 hours reached $27 million, while the MEET48 event Dapp has had 34,000 on-chain unique wallet interactions in the past 7 days, with 29,520 active user wallets, showing extremely high user stickiness and ecological activity. Previously, MEET48 also received support from many institutions and individuals such as YZi Labs, Fosun Group co-founder Liang Xinjun, HashKey Capital, Hash Global, Animoca, etc., and the BNB Chain Foundation announced the purchase of $25,000 worth of IDOL tokens, adding stronger market confidence to the project.

As the final approaches, fans' enthusiasm for voting continues to rise. The final ranking will not only directly determine the business resources and exposure of idols, but also provide a verifiable on-chain fan economy paradigm for the Web3.0 entertainment industry. On August 2, idols and virtual players from all over Asia will appear on the same stage in Hong Kong, and artists such as Super Junior-D&E, Sandara Park, MIYAVI and SNH48's Yuan Yiqi and Xu Jiaqi will also be present to help, with Wu Zongxian as the live host. WIPA is not only a selection competition, but also a landmark event in the integration of blockchain and the entertainment industry, which will witness a milestone moment in the Web3 entertainment fan economy with a closed-loop mechanism of on-chain voting, global participation, and real-world idol resource cashing.

Articles & Threads

1. "When Christie's can buy a house with cryptocurrency, a new milestone in the RWA track"

"Buy land, they don't make land anymore." This is a slogan that was mistaken for Mark Twain in the 20th century and is frequently used in the field of real estate sales. Gravity has strongly endorsed this sentence, if humans cannot travel interstellar, land will be "unable to be issued" like Bitcoin. In 2025, the crypto wave will spread from Silicon Valley to Wall Street and finally affect Washington, and as compliance progresses, it will also quietly change the basic structure of the real estate industry. In early July, Christie's International Real Estate officially established a dedicated department for crypto real estate transactions, becoming the world's first mainstream luxury real estate brokerage brand to support the whole process of "pure digital currency payment for home purchases" in the name of the enterprise. And this is just the beginning, from Silicon Valley entrepreneurs to Dubai developers, from Beverly Hills mansions in Los Angeles to rental apartments in Spain, a number of real estate trading platforms with blockchain technology and digital assets as the core are emerging, forming an emerging "Crypto Real Estate" track.

2. "The 70-fold god market collapsed, can the meme DeFi IMF come back?" 》

From early June to early July this year, $IMF has risen nearly 70x as a MemeFi project on the Ethereum mainnet. While $IMF gradually pulled back 50% after hitting an all-time high of $70 million in market capitalization, yesterday a huge drop that peaked at nearly 85% sent shockwaves through the market. What exactly happened to $IMF to see such a huge drop?

Market data

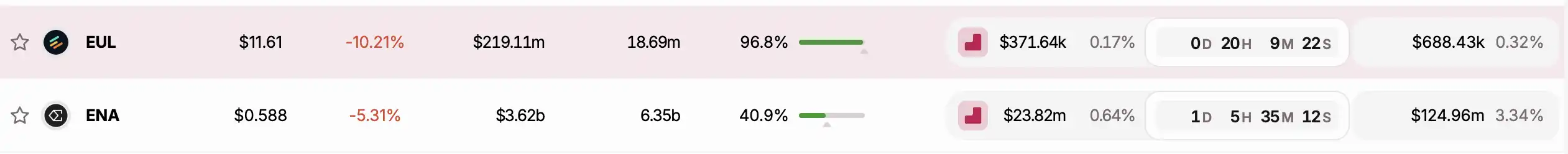

The overall funding popularity of the market (reflected in the funding rate) and token unlocking on a daily basis

Data source: Coinglass, TokenUnlocks

Funding Rate

Token unlocking