I’m literally frontrunning a teaser of @CallMyBluff_io and @Polymarket prediction market just tripled to 10B.

( $simmi and $emp are gonna benefit biggly)

$simmi $emp betting on the prediction market that no one is betting on yet (it's called frontrunning) @CallMyBluff_io

- Both tokens are close to the bottom

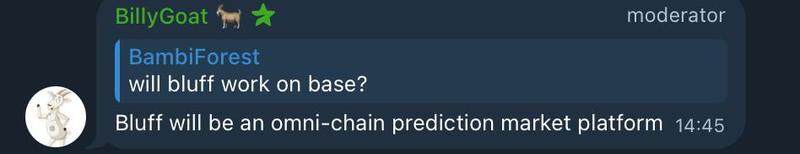

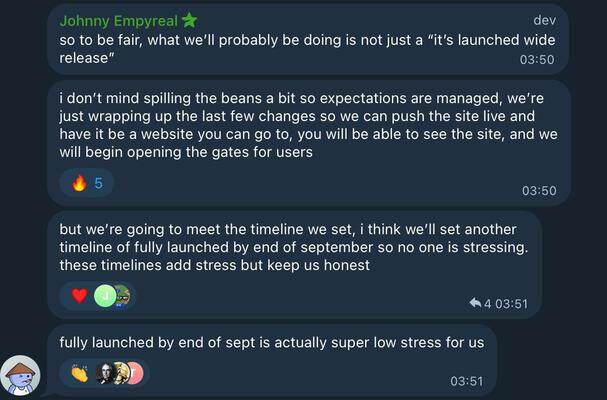

- @EmpyrealSDK started sharing Trailers of @CallMyBluff_io an Omnichain prediction platform (big), probably fully launched EO sep, position with me before release (be as smart as Shark)

- Their last product $T had @ethereumfndn and @arbitrum support proppeling it to 70m in 1 week

- @CallMyBluff_io will create direct value accrual into $simmi and $emp

- $simmi @Simmi_IO will be the MM bot for @CallMyBluff_io

- CT is not positioned (idk why), probably just slow

- All intel in the new whitepaper of $emp which people don't read: (own risk)

- Smart money whales positioning

Let's dive into the value accrual that could be huge.

$SIMMI (the autonomous market maker of @CallMyBluff_io)

Trading and Fee Generation: Simmi captures profits from market-making (e.g., spreads, dynamic pricing based on social sentiment), plus management/performance fees for users leveraging its strategies. Licensing revenue from other projects using its algorithms further accrues value.

Strategy Evolution and P&L: As an AI agent, Simmi learns from outcomes to improve risk-adjusted returns, creating a self-reinforcing loop where better performance attracts more capital and fees. This ties into Bluff's liquidity provision, where Simmi's success generates volume-based fees.

Ecosystem Integration: Fees flow into the Empyreal treasury, indirectly supporting $EMP but also boosting $SIMMI's utility (e.g., strategy marketplace for user investments). Future expansions like multi-market trading or AI collaborations enhance its economic role.

Incentives for Participants: Liquidity providers earn from volume/spreads, while Simmi's transparent reporting builds trust, driving adoption and token demand.

$EMP

Product Revenue Flows: Fees from flagship apps like Bluff (trading/market creation fees) and Simmi (trading profits, management/performance fees, licensing) are "earmarked for $EMP value accrual."

This includes directing portions to the treasury for buybacks, burns, or ecosystem growth, increasing token scarcity and price support.

Infrastructure Usage: Emp_Cloud charges usage-based pricing for agent deployment (e.g., computational resources, premium features) and marketplace revenue from agent templates/skills. As developers adopt the Intelligent Agent Stack (IAS), demand for $EMP rises for governance and access.

Network Effects and Treasury Optimization: Treasury management via Talos automates yield on idle funds (e.g., DeFi deployments for APY), with $T allocations flowing to Empyreal's treasury. This compounds value through "strategic reserves managed by autonomous systems," benefiting $EMP holders via enhanced returns and protocol stability.

Governance and Incentives: Holders participate in decisions, with rewards for liquidity providers and governance participants. The fixed supply ensures that ecosystem expansion (e.g., more agents, users) directly boosts per-token value without dilution.

Overall Flywheel: As AI agents like Simmi and Talos succeed (e.g., generating P&L or optimizing DAOs), they drive adoption, increasing fees that accrue to $EMP—targeting sustainable growth over inflationary models.

I skipped $T here although knowing the chart it could still get fuel on the launch of @CallMyBluff_io I'm just not the biggest fan, and I think $simmi is more forgotten

3.83K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.