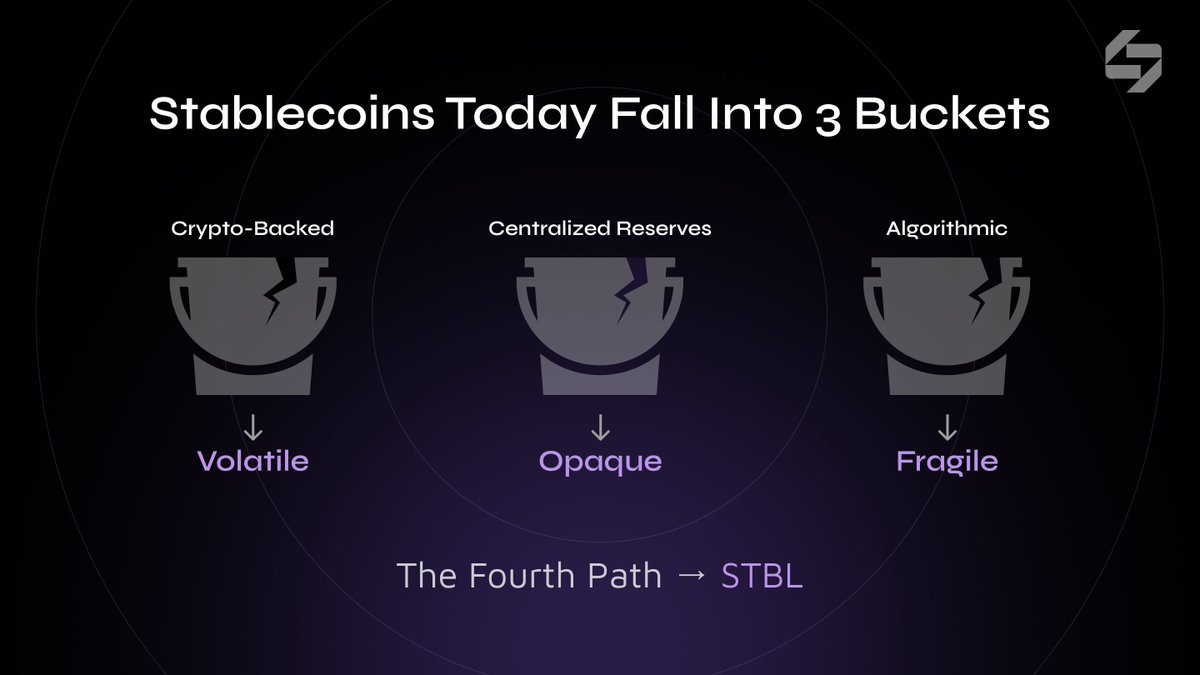

Did you know Reeve Collins, the Co-founder and first CEO of Tether, is back with something new? Check out @stbl_official. Most stablecoins today fall into 3 buckets, and each has issues: i) Crypto-backed → tied to volatile assets, not always stable ii) Centralized reserves → backed by banks/custodians, trust risk iii) Algorithmic → backed by code, breaks under stress That’s where $STBL comes in, the protocol token. (TGE SOON) The idea is pretty simple but very different from what we’ve seen before. When you mint with STBL, you don’t just get a stablecoin. You actually mint two things: 1. USST → stablecoin = instant liquidity 2. YLD → NFT = accrues yield on your locked collateral This way, you can use your stablecoin normally, while your yield still flows to you in the background. No trade-off between using your money or earning on it. What’s backing it? Real on-chain assets like tokenized Treasuries and money market funds from issuers like Ondo (USDY). Basically, tradfi...

16.47K

89

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.