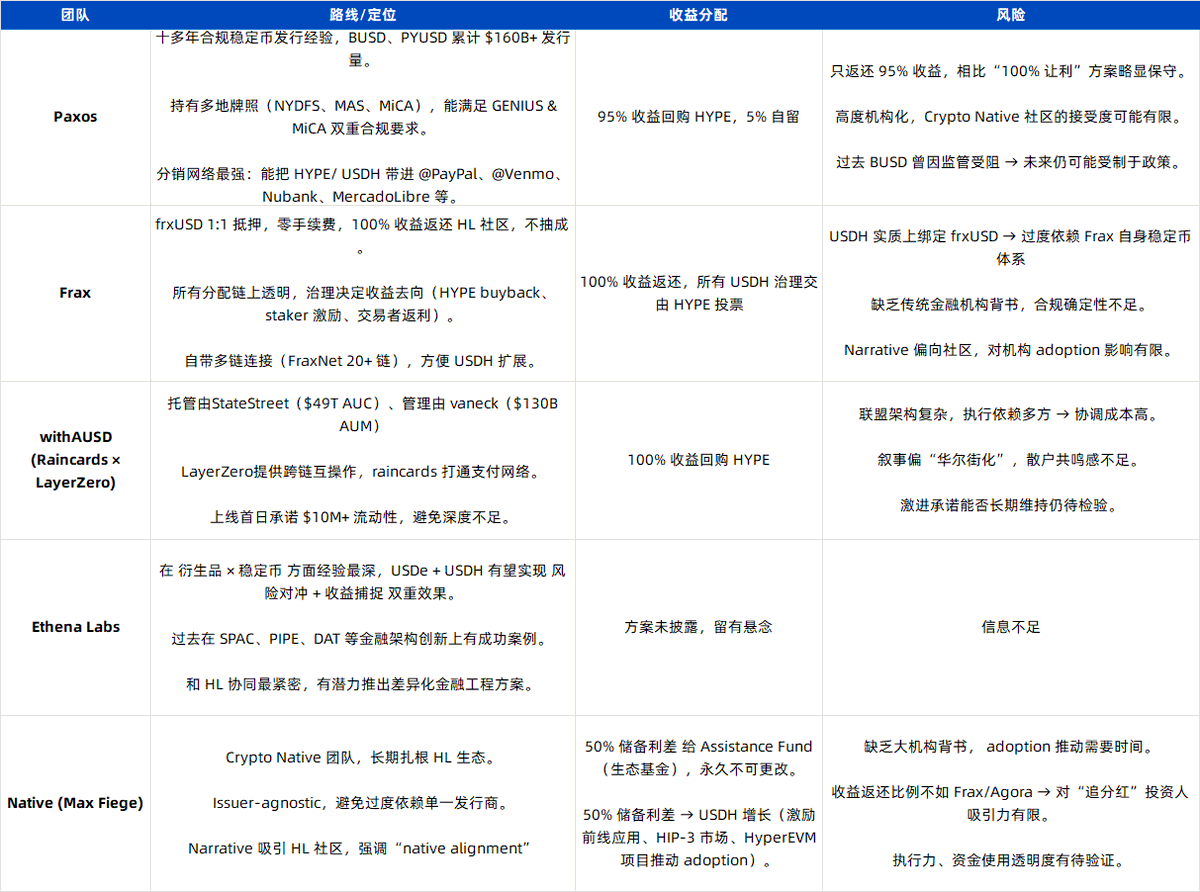

Last Friday, @HyperliquidX dropped a big bomb on Discord: the USDH stablecoin. As we all know, the market has already demystified stablecoins. But! This time it's different. HL is trying to monetize the idle 5.4 billion USDC for buybacks and distribution of $hype. In simple terms, there are two things: 1. Feed the stablecoin interest back to the platform token. There are 5.4 billion USDC lying in the bridge, and the annual interest alone is 360 million dollars. USDH will directly convert this money into HYPE for buybacks and distribution. 2. Reclaim sovereign credit. The USDC from @circle can freeze addresses, and the minting power is not in their hands. The logic of USDH is to firmly pull back the issuance and control rights to HL. This public bidding for USDH is also a stage for top players in the stablecoin space. Currently, there are five: @Paxos: The compliance veteran. Backed by @PayPal / @Venmo / @RobinhoodApp, they promise to use 95% of the profits for HYPE buybacks,...

Show original

25.55K

112

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.