$GMX metrics looking like fire.

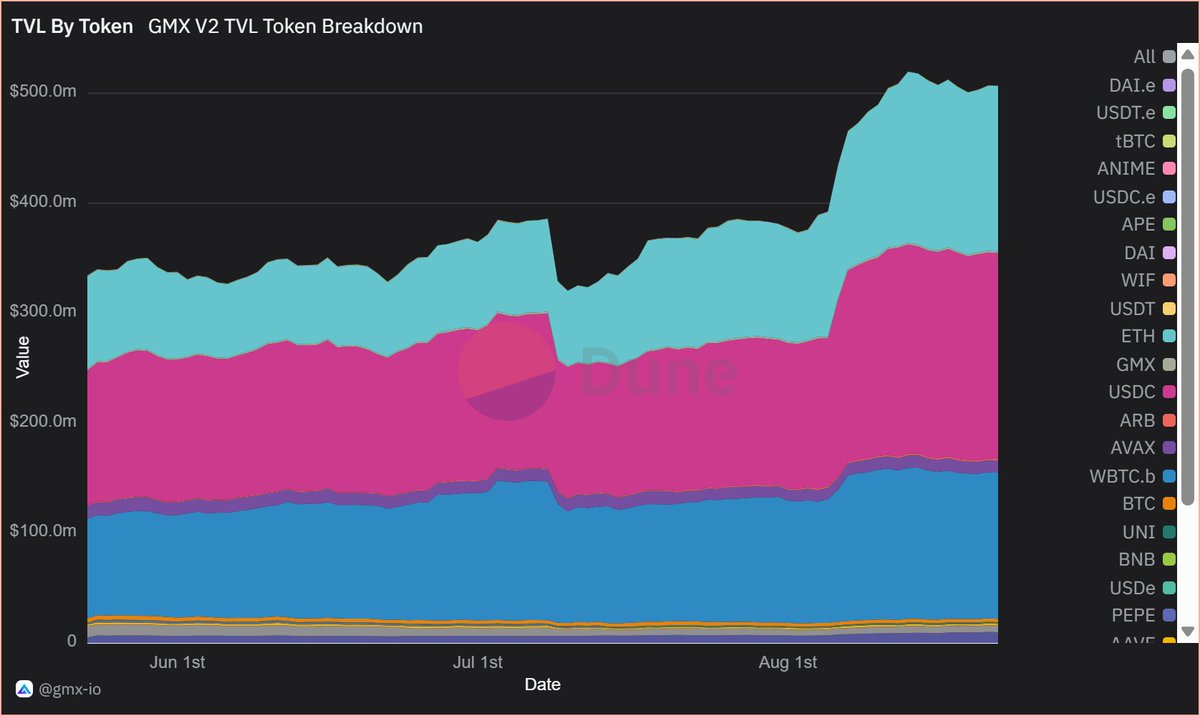

- TVL after the GLP exploit up and to the right.

GLV claimers will not sell, liquidity will stay sticky for the next coming months.

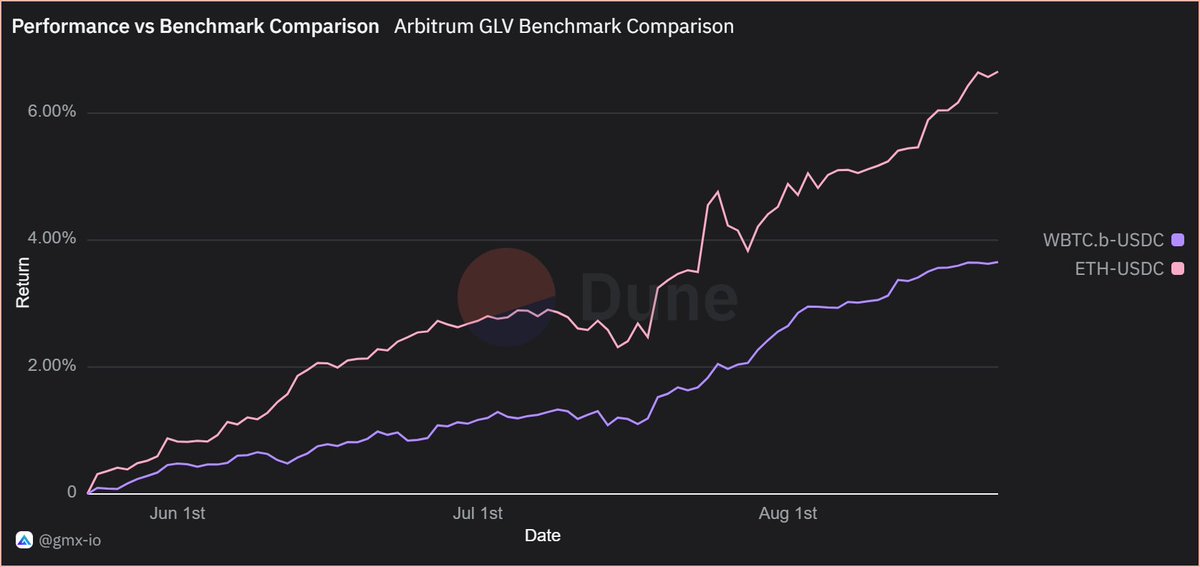

- GLV outperforming their respective GM pools by 6.5% on ETH GLV, and 3.5% on BTC GLV

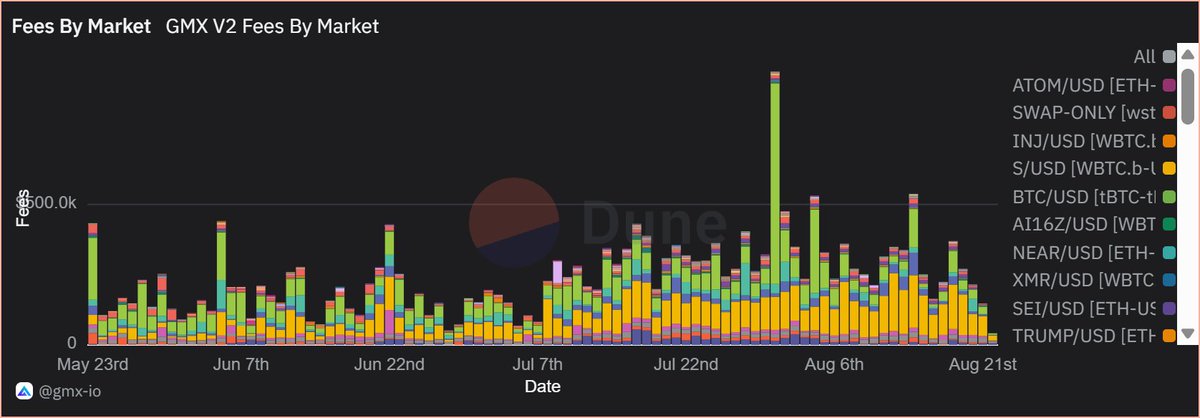

- Fees generated per market is growing slowly, but steadily

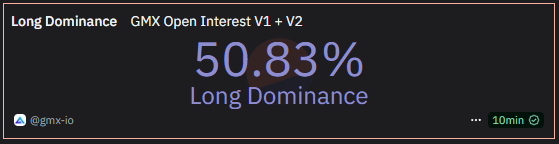

- Pools extremely balanced, PnL since the beginning of GMX V2 looking insane

- GMX treasury grew with $19M by claiming the price impact bucket, GMX treasury now sits at around $40 million dollars, with a token of $150M marketcap 🤣

47.98K

49

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.