I've been on vacation for almost half a month now.

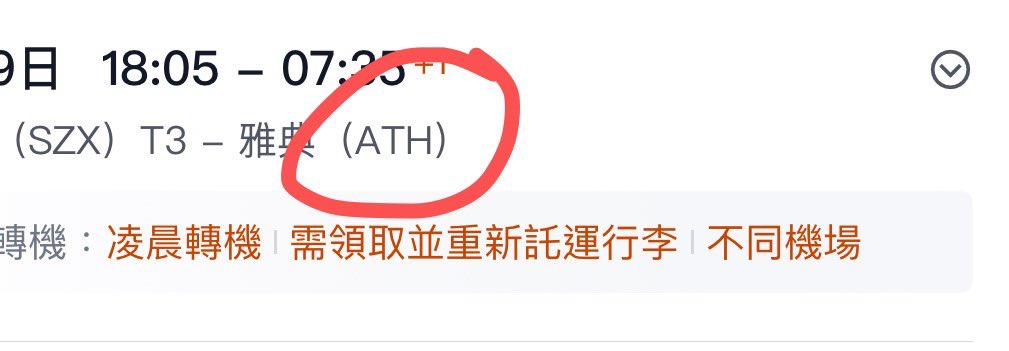

First, I arrived at ATH, then visited @MeteoraAG's lair.

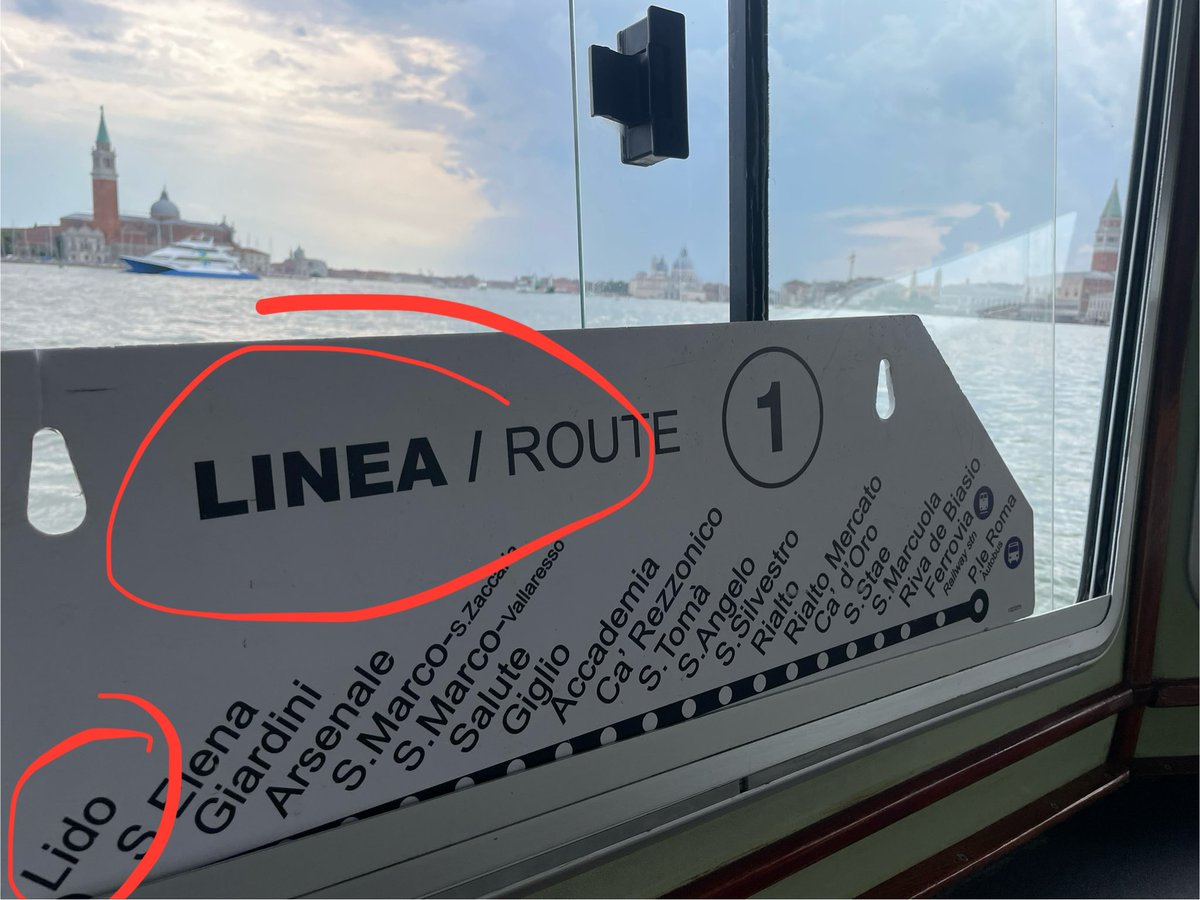

I spent a few days at @LidoFinance.

But every day I was troubled by the $linea that was everywhere.

It's a pity that I didn't have enough time to visit @Delphi_Digital's temple.

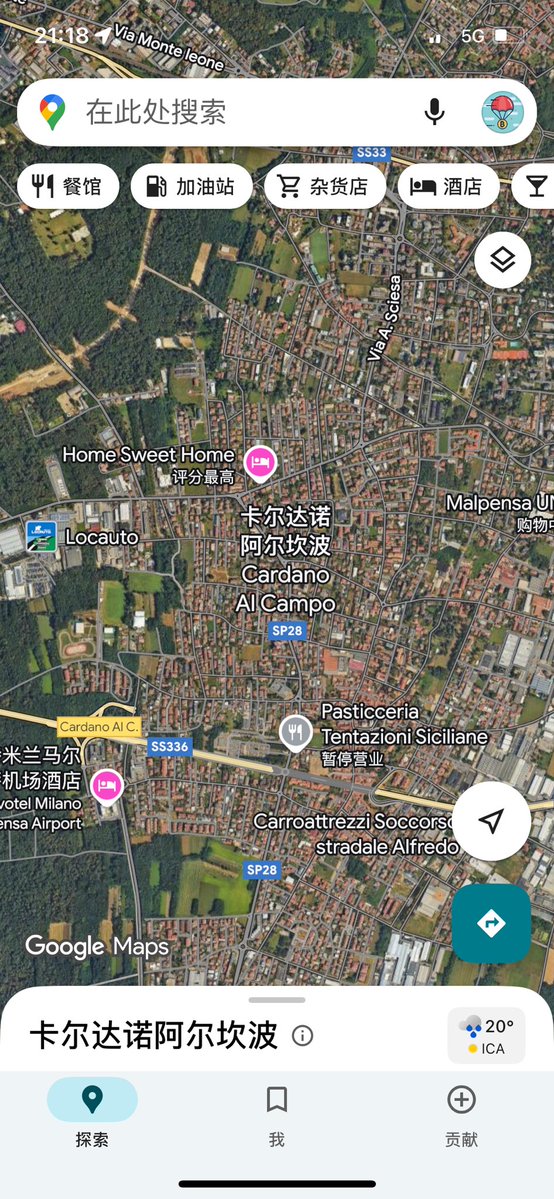

Next, I landed near Milan at @Cardano_CF.

Finally, I continue to have high hopes for lighter.

Lighter AMA Summary — Final Sprint of Private Testing

This is a live X Space AMA (Ask Me Anything) hosted by Lighter, a decentralized perpetual contract trading platform based on Ethereum Layer 2, utilizing custom ZK circuits, aimed at achieving low-cost, low-latency trading.

The host is Lighter CEO Vlad Novakovski (@vnovakovski), assisted by community members @satoshiheist and @hansolar21. The meeting lasted about 1 hour, with approximately 450 live participants, emphasizing transparency, alignment of user interests, and long-term scalability.

🔹 End of Private Testing & Transition to Public Testnet

Private testing is expected to conclude in 3-5 weeks, contingent upon the completion of security audits, API enhancements, front-end optimizations, and bug fixes.

This will mark the end of Season 1 of the points system; Season 2 will launch with the public testnet and will introduce clearer rules to prevent point farming.

A new block explorer (tentatively named "Make Block Explorer Great Again") will be released after Beta to showcase the ZK architecture and verification process.

🔹 Token Generation Event (TGE) and Airdrop

The TGE is expected in Q4 2025 (around December), depending on whether the spot trading functionality is ready, as the token relies on spot infrastructure.

The community airdrop allocation is substantial and completely independent of investors and team pools; VCs will not encroach on user rewards.

Points accumulated during the Beta period (currently around 3.4 million) will significantly count towards the airdrop; the official team is still conducting weekly snapshots.

🔹 Fee Model and Profit Strategy

Retail traders will enjoy zero trading fees permanently (both maker and taker orders are 0), similar to the Robinhood model, to enhance experience and adoption.

Revenue sources: advanced tiered fees for high-frequency traders (HFT) and market makers (MM), with makers at about 0.02 bps, and takers slightly higher.

20 market makers have already been onboarded, with over 100 in the queue; the platform does not provide subsidies and relies purely on profitability to attract users.

🔹 Roadmap and New Features

Short-term (within weeks): Launch of RWA (Real World Assets) and pre-launch perpetual markets, easier to implement than spot trading.

Mid-term (within months): Spot trading, requiring ZK circuit updates, shared collateral, and integration with perpetual matchmakers.

Long-term (by mid-2026): Lending (allowing cross-chain ERC-20 as collateral), options (including 0DTE options), and prediction markets. The goal is to build a complete DeFi stack on Lighter L2, prioritizing seamless integration with existing Ethereum liquidity (like Aave, Curve) rather than rebuilding everything from scratch.

ZK circuits will be open-sourced after audits to ensure transparency and verifiability.

🔹 User Experience and Technical Optimization

Mobile (iOS/Android) is in early planning, aiming for a UX similar to Robinhood; the existing QR code login will be optimized.

The platform monitors P50/P95/P99 latency, with dedicated engineers continuously addressing issues like slow loading.

The system can handle hundreds of millions of transactions daily, proving its scalability; the perpetual engine is the "hardest part" and is fully ready.

🔹 Regulation and Expansion

There is an optimistic outlook on U.S. regulation, expecting positive changes after the new CFTC chair takes office in September-October.

There are no plans to rebuild a complete ecosystem (like Hyperliquid), but rather to focus on seamless integration with Ethereum's $100B+ DeFi liquidity.

🔹 Community and Future Interaction

Multilingual AMAs are planned: Vietnamese (8/21), Korean (8/22), Chinese, Spanish, etc.

Emphasizing community-driven growth, current data includes:

TVL $75M

+150% YTD LLP returns

9,759 traders

Summary

The entire AMA conveyed a strong bullish signal: the team is committed to sustainable development (no subsidies), aligning with community interests, and has clarified the path to becoming Ethereum's preferred ZK trading layer.

This summary is from Grok.

After reading, I can only say one thing: Jeff Yan is already starting to feel scared.

8.01K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.