"Old trees want to bloom new flowers? A number of old public chains that have disappeared from view are quietly making strides in the popular RWA field."

Today, while researching @Aptos related to RWA, I discovered an interesting fact:

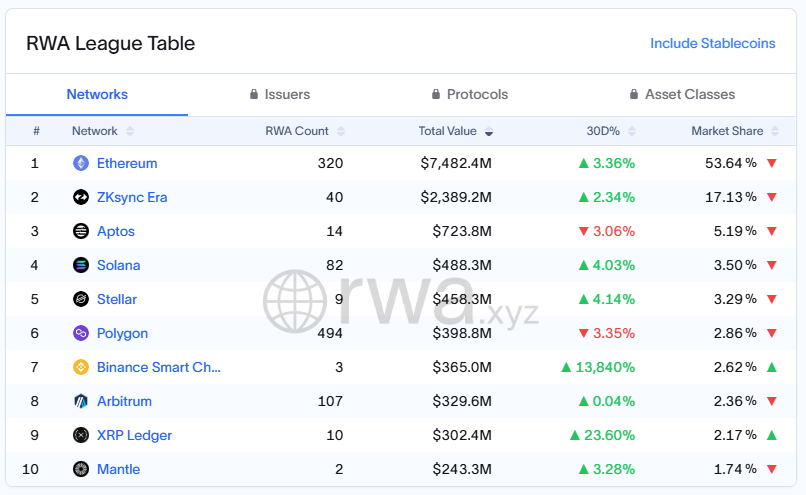

Aptos currently has a total RWA value of 723 million, ranking third in the crypto market. The top two are Ethereum and ZKsync Era.

It's not hard to understand why ETH dominates the RWA market, but how did @zksync, which I haven't paid attention to for a while, achieve nearly $2.4 billion in RWA growth?

To avoid any hint of advertising, let's get straight to the conclusion:

Nearly 90% of the RWA TVL on zkSync comes from just one project, Tradable. Tradable is an asset tokenization platform that allows institutions to label and manage assets while remaining compliant.

RWA assets are closed private placement credit certificates and cannot be used in open DeFi protocols. Although zkSync ranks second in RWA market share, its Defi TVL ranking on Defillama is only 61st. This shows that activity in the RWA field does not intuitively bring trading volume and inject vitality into public chains.

Looking at Aptos in this context:

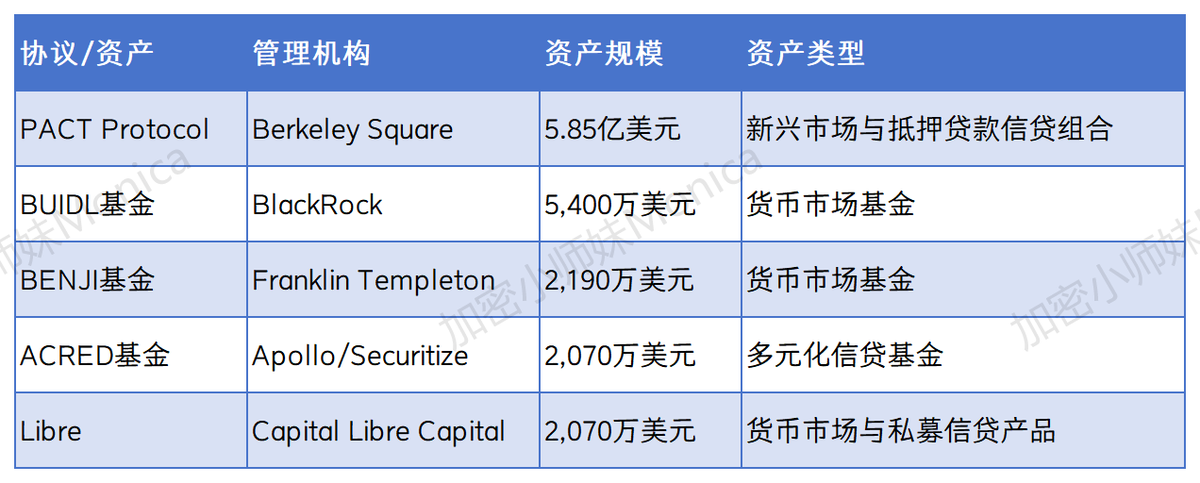

On the Aptos side, it basically supports most mainstream RWA protocols, supporting a total of 22 tokenized products, primarily in the private credit sector. The difference from zkSync is that Aptos supports more large institutional products. Here are a few examples:

If Aptos wants to revitalize its ecosystem through the popularity of RWA, I believe it still needs to enhance the liquidity of RWA assets within a compliant framework and connect traditional finance with the DeFi ecosystem.

I estimate that the next step will involve introducing blue-chip protocols like Aave, which likely considers this aspect. In simple terms: the advantage of compliant RWA issuance is merely becoming a qualified money printer; to make money, it still needs to find a way to become a bank.

#Aptos #zksync #RWA

Show original

17.81K

96

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.