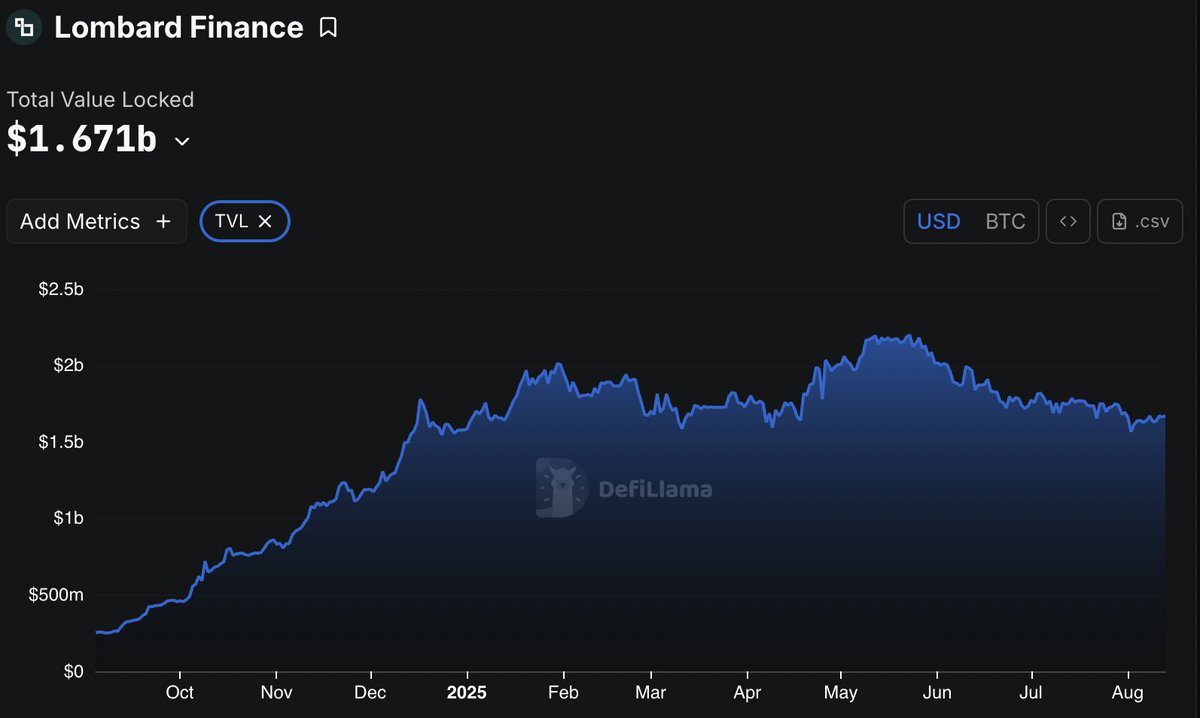

Lombard Finance continues to maintain a TVL above $1.5B, which is impressive performance for such a recently launched protocol.

I believe we'll see increasing demand for Bitcoin on Ethereum in the future. This could be driven by companies using ETH as a treasury asset who are looking to diversify into Bitcoin while staying within the Ethereum DeFi ecosystem. Some TradFi companies using ETH as a strategic reserve have already hinted at their willingness to explore DeFi opportunities.

Key Lombard Finance Metrics (Bitcoin Restaking):

- LBTC Supply: ₿13,465.0294

- Holders: 53,881

- Minters: 53,401

- LBTC Pooled: 2.58%

The strong holder-to-minter ratio (nearly 1:1) suggests healthy distribution and engagement across the user base.

4.03K

10

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.