Breaking news: #NVDA #AMD announced that they will pay 15% of the revenue from selling chips to China to the United States in exchange for relaxed export restrictions to China.

This is seen as a "trade agreement like never before" in U.S. history; rather than an agreement, it is more like a "protection fee."

This has also caused some concern for the two companies, with their stock prices dropping in pre-market trading, and it has put pressure on their peers in the tech sector. In the future, if they want to attempt to produce high-end products for the Chinese market, it seems that the "protection fee" will be unavoidable.

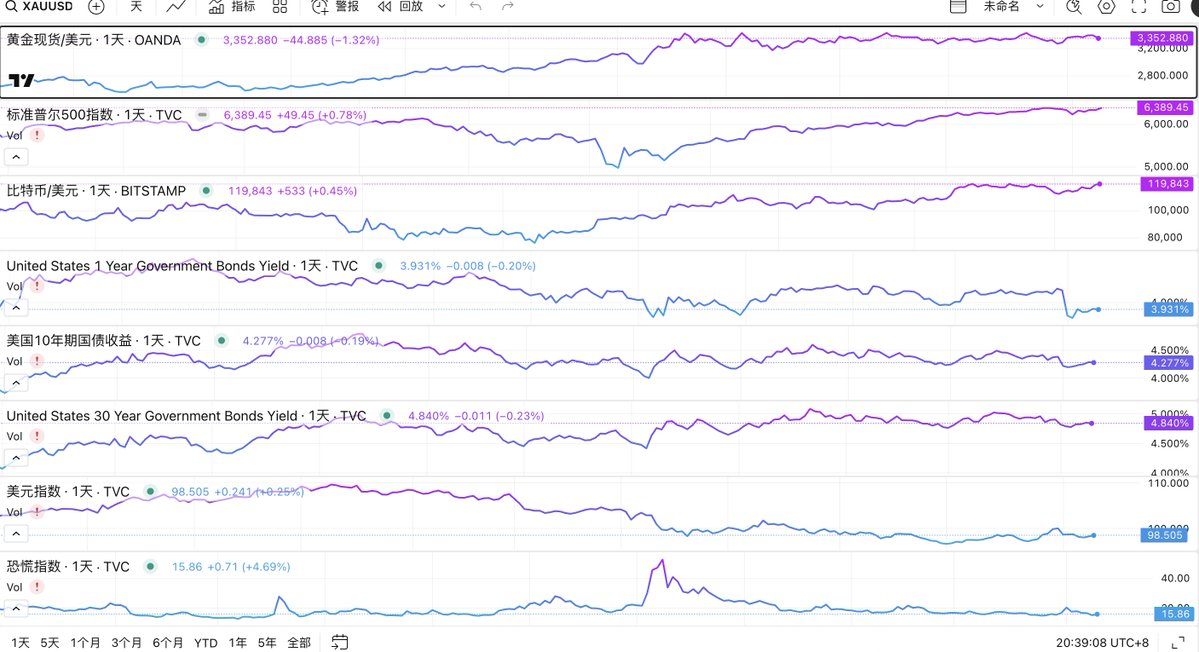

Looking at the pre-market, the global market shows a clear divergence today. In the afternoon, due to Zelensky's "hardline" stance on territory, the risk market remains cautious.

However, in the evening, Wall Street actively boosted U.S. stocks, while the Fed's mouthpiece released expectations of a "moderate" rise in inflation, ensuring that the probability of a rate cut in September remains above 80%, keeping U.S. stocks on the rise.

Nevertheless, although the current expectations are optimistic, the market will still maintain relative caution in the face of tomorrow's key inflation data.

Currently, there are still several key issues in the global market that need close attention:

1. Before August 12, will Trump confirm the 90-day extension of tariffs on China and formally sign the executive order? Otherwise, the U.S.-China tariffs will revert to the high-value trade war model before August 12.

2. Regarding the 39% tariff issue on gold that occurred last week, will the White House provide a prompt explanation this week?

3. Will Zelensky's hardline stance significantly weaken the optimistic expectations for the U.S.-Russia meeting in Alaska this Friday?

Among these three points, the impact of the 90-day suspension of U.S.-China tariffs is the most significant.

6.02K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.