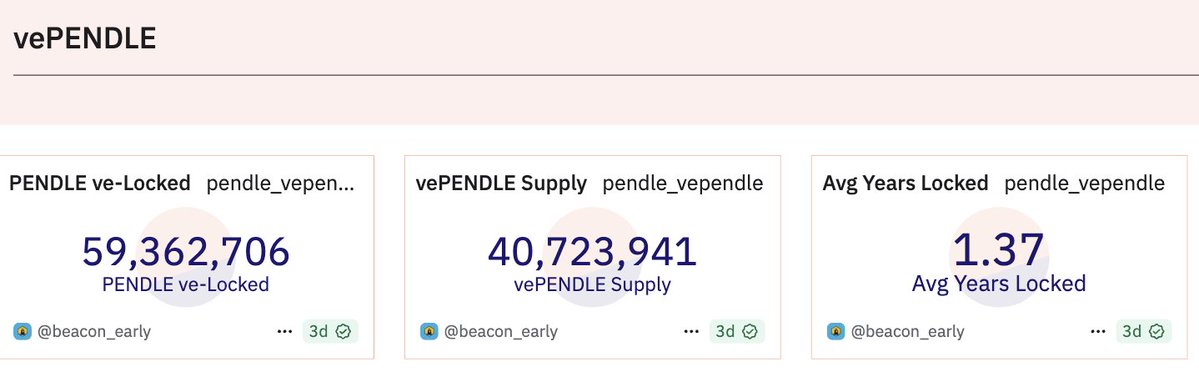

Add on that, most vePENDLE lockers from 2-3y ago are not only up on the tokens they locked, but up massively on the vePENDLE fee distribution if they actively votes every week.

These users have no reason to unlock to sell, rather full max relock and keep voting.

You can learn a lot from @pendle_fi

They brute forced their success.

Now it looks easy but they had to deal with a lot of issues in the past.

- TVL halved after points meta ended

- $PENDLE dropping from $1,7 to $0,05

- Constant outflows of TVL

They always found a way to attract new capital, new partners and create new products. This was only possible because they are close to the community.

Yield Trading is one of the biggest things in TradFi but when Pendle started in 2021 it was not clear if that model would work in crypto. Many people overlooked the opportunity back then since it is difficult to fully grasp the concept of PT/YT and why it’s useful.

Explain your Product

Pendle did a great job creating educational resources which is key if you want to onboard users to a rather complex product.

Once someone is onboarded they stick.

Solve rich people's problems: They pay better

Average User Net Worth > User Numbers

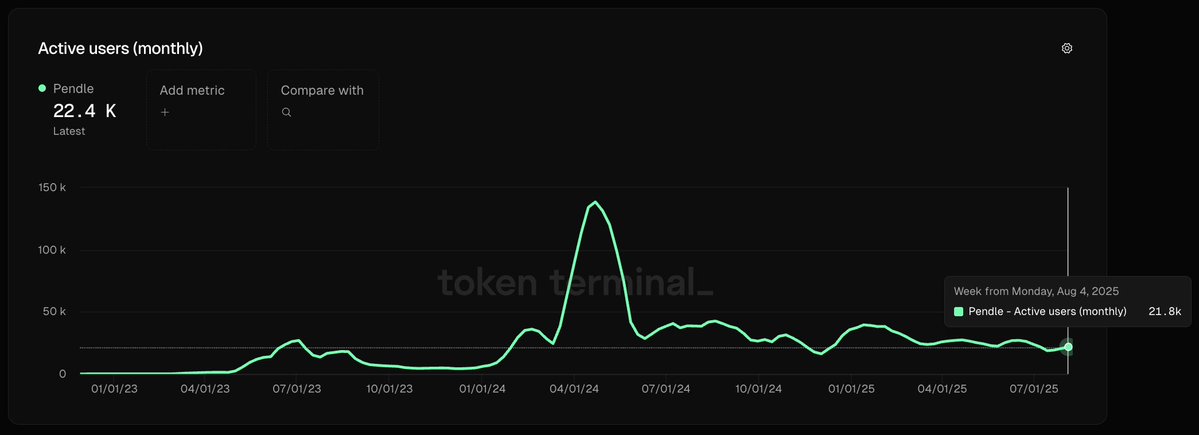

Pendle achieved $7,7 Billion in TVL with 22k monthly active users.

Theory: The average Pendle User deploys $350k.

Reality: 20% of Wallets account for $6,1 Billion TVL

Go where the puck is going

Pendle always had a great sense for what will drive the next liquidity wave. From early partnerships with @LidoFinance and @ether_fi to now @ethena_labs and @kinetiq_xyz. Always think ahead and be prepared.

This is the reason why Pendle has 90% Marketshare in their Niche.

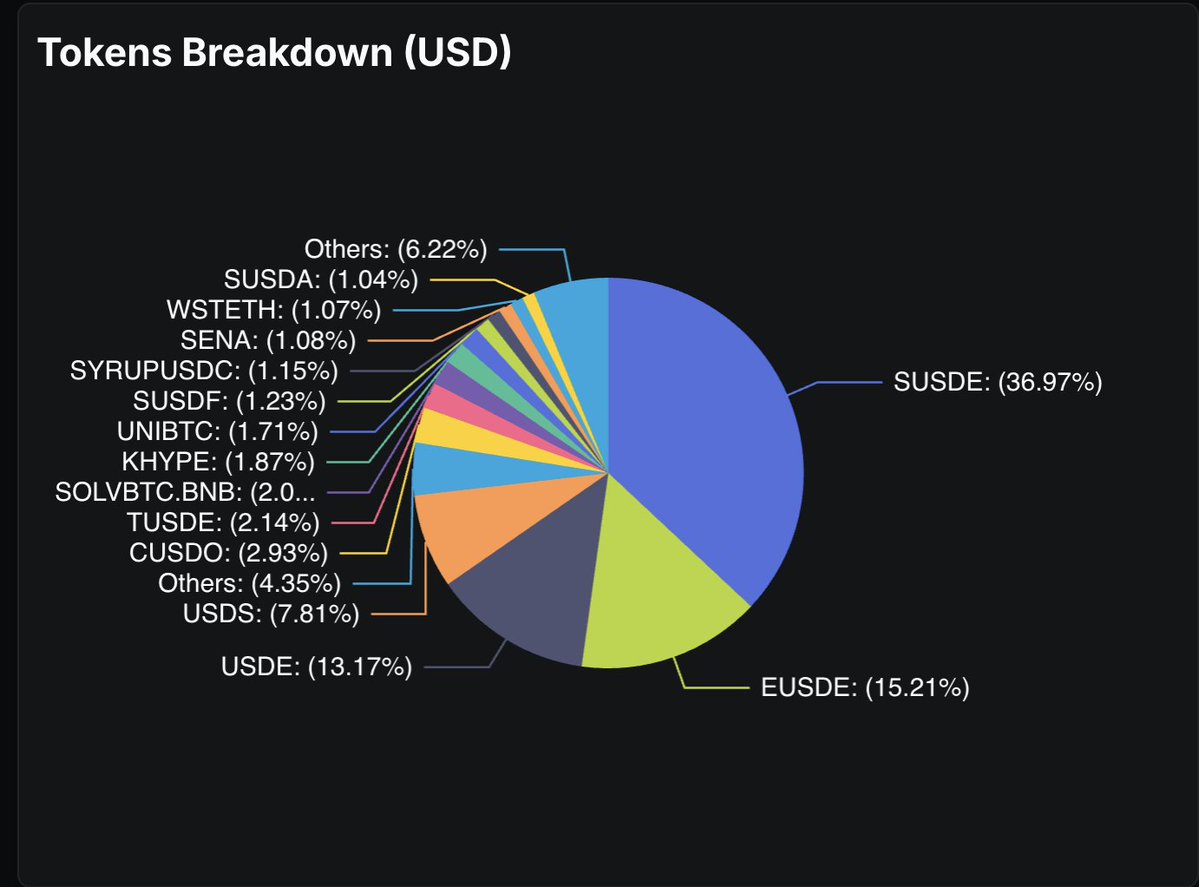

The distribution of Pendles TVL changed a lot over the years. From being 50% in stETH to now being 80% Stablecoins, mostly forms of USDE.

This is big since it reduces the volatility of the TVL.

Don't just focus on TVL growth but find ways to make that TVL stick and less volatile. One of the reasons why I also like @maplefinance so much.

Pendle Token Design

Pendle has a vePENDLE Token design. While this is not ideal for most projects it was crucial for Pendle. The average vePENDLE holder locks their tokens for 1,37 years to earn fees which are paid in $ETH.

Since the $Pendle Token itself is rather useless people are motivated to lock their Pendle for vePendle.

Having Token Holders that can't panic sell when the token is down is crucial for any project.

It also led to : The Pendle Wars of liquid Wrappers.

If you create a situation where people lock vePendle they will find a way to make it more liquid.

@Penpiexyz_io and @Equilibriafi hold about 20 Million vePendle.

Both of their liquid Wrappers depegged so be careful with those.

While I am not the biggest fan of the 2 Token Design it was important for Pendle's success.

Influencers & KOLs

Accounts like @crypto_linn and @defi_mochi played a big role in pushing Pendle and the community. It is important to do partnerships the right way. Look for accounts that align with your vision and focus on the long term outcome.

If your token price goes up you will gain way more attention from real accounts that want to support instead of trying to do a KOL campaign.

Conclusion

> Brute force your way to the top

> Adapt to new circumstances

> Focus on building with and for the community

> Think in years > months

Pendle Chads

@Rightsideonly

@crypto_linn

@tn_pendle

@defi_mochi

@poopmandefi

2.22K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.